A Closer Look: Insights into the Rapidly Evolving Clinical Diagnostics Market in Canada

Canada's Clinical Diagnostics market size is set to reach USD 4.9 Bn by 2030 - thanks to increased awareness around diseases and Government's initiatives

Majority of Canada's population is concentrated in the areas close to the US-Canada border, primarily in its 4 largest provinces - Ontario, Quebec, British Columbia, and Alberta - which together account for 86.5% of the country's population. With about 18% of Canadians residing in rural or remote communities, health care delivery can often be difficult in areas beyond the densely populated US-Canada border corridor due to the requirement for far flung primary care facilities and frequent medical transport to specialized centers. In the face of these challenges, many clinical diagnostic companies - thanks to emerging technologies and significant investment in the space - are coming up with innovative solutions that have the potential to improve patient outcomes and reduce healthcare costs.

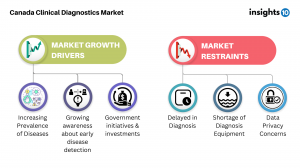

Insights10’s comprehensive report titled ‘Canada Clinical Diagnostics Market Analysis’ explores factors that drive and restrict the market growth, to enable the stakeholders to capitalize on prevailing market opportunities. Canada Clinical Diagnostics market size stood at around 3.9 Bn in 2022 and is projected to reach 4.9 Bn by 2030, exhibiting a CAGR of 3.1% during the forecast period. Among the top factors driving the growth of Canada’s Clinical Diagnostics market are rising prevalence of chronic and infectious diseases, as well as cancer. In 2020, 4% of Canadians reported having received a COPD diagnosis from a medical professional, while the death rate from cirrhosis and chronic liver disease was 7.2 per 100,000 Canadians. Chronic diseases and infectious diseases further add to the factors pushing the market’s growth. With around 233,900 new cancer cases and 85,100 cancer deaths in Canada in 2022, cancer continues to be the leading cause of death in Canada and is responsible for 28.2% of all deaths. Moreover, around 2.4 out of every 100,000 Canadians died in 2020 as a result of unspecified infectious and parasitic diseases and their consequences.

Growing awareness about early disease detection of diseases is another, albeit positive, factor contributing to the growth of the Clinical Diagnostics market. Increasing awareness about the diseases, importance of early disease detection and the benefits of starting treatment in the early stages of the disease is driving the growth in this region.

The demand for healthcare is being driven by the government's healthcare initiatives and investments. The Ontario government is investing over $20 million in operating funds to support the addition of 27 new MRI devices in hospitals across the province. This investment, combined with the $4.5 billion Canada Health Transfer top-up provided since the start of the pandemic, will help alleviate the immediate pressures caused by the pandemic on the healthcare system. These funds will address backlogs in operations, medical procedures, and diagnostics. As a result of this investment, some small and remote community hospitals will now have their first MRI machine, making it easier for residents to access diagnostic imaging.

While several factors play-in to boost the growth in this market, there are co-existing restraints that are potential threats to the market’s growth. Shortage of diagnostic equipment, as well as the aging of existing equipment are some long-prevailing issues. Moreover, with increasing technology data privacy and security are a restraint to the growth of the Canadian clinical diagnostics market, as the storage and use of sensitive patient information is a major concern.

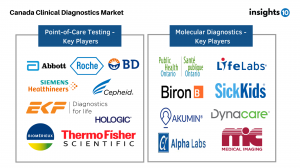

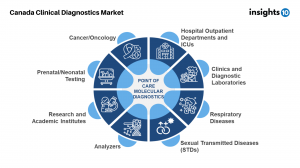

Insights10’s report on the Canadian Clinical Diagnostics market also presents a comprehensive breakdown of the most commonly ordered diagnostic tests in Canada as well as the split of the test numbers across 3 categories - community, inpatient and emergency. Point of care testing market in Canada stood at USD 2 Bn in 2021 is anticipated to at a CAGR of 7.8% between 2023-2030. Dominated by key players like Roche, Abbott, BD and Siemens Healthineers, with Abbott being the leading provider of POC Diagnostics solutions in Canada, use of POCT in healthcare has increased recently, and this development is anticipated to continue in the near future. Canadian states and territories are looking for ways to implement POCT in the delivery of healthcare in a way that is appropriate and efficient in view of this expansion. However, there are some unaddressed issues around quality, and reliability of POCT as well as the effects of POCT adoption on the healthcare system that still persist in the system.

On the regulatory front, the Canada Health Act of 1984 established national standards for hospital, diagnostic, and physician services that are medically required. Standards Council of Canada (SCC) is a crown organization created in 1970 as a result of an Act passed by Parliament with the goal of encouraging and advancing voluntary standardization in Canada. SCC offers an internationally recognized accreditation program for medical testing laboratories across Canada. The program is provided in conjunction with the Bureau de normalization du Québec (BNQ) for laboratories located in Quebec. SCC accreditation enables medical testing facilities to confidently provide services and draw in new clients.

Canada Health Infoway is an independent, not for profit organization funded by the federal government. It collaborates with governments, healthcare institutions, medical professionals, and patients to digitize healthcare in order to promote faster, easier, and more secure information sharing. It provides Pan Canadian Standards to support the safe and secure exchange of healthcare data (such as prescription drugs, test results, and diagnostic imaging) throughout the continuum of care, clinical decision support (such as alerts and reminders), data analytics, population health management (such as screening, public health) and more. Infoway is a significant part of interoperability between healthcare systems, workflows and solutions.

In future view of the Canadian healthcare, AI-based software programs integrated into the healthcare system will make it possible to examine vast amounts of patient data and previous therapies to identify what is optimal for a patient. AI-Based softwares, coupled with advancement in Big Data & Analysis, Cloud Computing, Healthcare IoT (IoMT) would aid in addressing critical challenges in Healthcare delivery. AI can be used for facilitating diverse tasks including assessing sample pictures, comparing patient data to existing datasets, mining and interpreting information from big databases, and forecasting patient outcomes.

Some contemporary healthcare issues, however, still threaten the system as drug resistant infections continue to be a worldwide health crisis. Technologies like platforms with American Association for Clinical Chemistry (AACC) features could reduce the inappropriate use of antibiotics that fuels the emergence of drug resistant bacterial strains by enabling quick and accurate responses to serious diseases.

Insights10’s reports provide such in-depth analyses of the market with current trends and future estimations to bring out the most promising investment pockets. Data and insights with similar coverage are available for several other countries, spanning across all major regions of the world. Here is a glimpse of the Clinical Diagnostics market sizes (2022) and growth rates (2022-2030F) of some of the countries covered in our reports:

1. North America

● Canada: USD 5.923 Bn, 6.10% CAGR

Report title: Canada Clinical Diagnostics Market Analysis

● US: USD 31.097 Bn, 4.10% CAGR

Report title: US Clinical Diagnostics Market Analysis

2. Asia-pacific

● China: USD 5.952 Bn, 7.60% CAGR

Report title: China Clinical Diagnostics Market Analysis

● India: USD 1.346 Bn, 9.10% CAGR

Report title: India Clinical Diagnostics Market Analysis

● Japan: USD 4.602 Bn, 6.60% CAGR

Report title: Japan Clinical Diagnostics Market Analysis

● South Korea: USD 1.082 Bn, 7.10% CAGR

Report title: South Korea Clinical Diagnostics Market Analysis

● Hong Kong: USD 119 Mn 7.10%

Report title: Hong Kong Clinical Diagnostics Market Analysis

● Australia: USD 888 Mn, 7.60% CAGR

Report title: Australia Clinical Diagnostics Market Analysis

3. Europe

● UK: USD 1.925 Bn, 4.10% CAGR

Report title: UK Clinical Diagnostics Market Analysis

● Germany: USD 2.710 Bn, 4.30% CAGR

Report title: Germany Clinical Diagnostics Market Analysis

● France: USD 2.036 Bn, 5.10% CAGR

Report title: France Clinical Diagnostics Market Analysis

● Italy: USD 1.777 Bn, 5.60% CAGR

Report title: Italy Clinical Diagnostics Market Analysis

4. MENA

● UAE: USD 370 Mn, 7.10% CAGR

Report title: UAE Clinical Diagnostics Market Analysis

● Saudi Arabia: USD 1.259 Bn, 7.60% CAGR

Report title: Saudi Arabia Clinical Diagnostics Market Analysis

● Turkey: USD 592 Mn, 6.60% CAGR

Report title: Turkey Clinical Diagnostics Market Analysis

● Egypt: USD 207 Mn, 7.60% CAGR

Report title: Egypt Clinical Diagnostics Market Analysis

5. LATAM

● Brazil: USD 1.851 Bn, 7.10% CAGR

Report title: Brazil Clinical Diagnostics Market Analysis

Country-wise and region-wise reports in the Insights10 repository bring out critical market insights, and having considered the qualitative and quantitative industry variables, empower stakeholders with a comprehensive understanding of the industry outlook.

About Insights10

Insights10 is a healthcare-focused market research platform with an objective of supporting data-driven decisions and delivering actionable insights for healthcare and life science organizations. Insights10 platform provides syndicated and customized research reports in healthcare and allied industries such as pharmaceuticals, diseases/therapies, medical devices, digital health, healthcare services, OTC and nutraceuticals, etc. Insights10 currently provides 30,000+ different reports on different topics at a global as well as country specific level, making it one of the largest collections of syndicated research reports in the Life sciences and Healthcare sector available across the world.

Purav Gandhi

Healthark Wellness Solutions LLP

+91 91600 01292

email us here

Visit us on social media:

Facebook

Twitter

LinkedIn

Instagram

YouTube

Other

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.