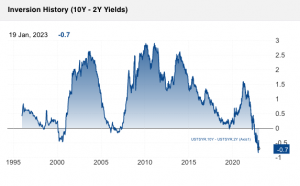

Yield Curve inverts more than the last four recessions

NEW YORK, US, January 20, 2023 /EINPresswire.com/ -- The 10Y - 2Y US treasury yields, Powell's most mentioned indicator, now stands at -0.7%. This makes the curve more inverted than it has been in the past four recessions.

The bond king, Jeffrey Gundlach, who observes ten-year minus three-month yields for investing, recently stated, "We haven't seen the threes-tens this inverted really since the early 80s."

The Yield Curve is a chart of interest rates (yields) demanded by the market for US govt issued bonds. The short-term end of the curve shows the interest rates (yields) the US govt. has to pay to the investors for one-month to two-year debt. Similarly, the long-term end shows the yields for 10-year to 30-year debt.

Why do economists and investors follow the yield curve?

Yield Curve is a summary of investor's view on the markets. Typically, any capital intensive business needs to fund its projects on short-term loans. However, the projects start providing revenues in long-term. So, short-term end of the yield curve is reference to the cost of businesses and long-term refers to the reward.

This risk-reward is calculated as the difference between the long-term and short-term yields. One such indicator, the 10-year yields minus the 2-year yields, is used by market watchers to measure this risk-reward.

A positive value for this means that rewards of investing in long-term projects are greater than risks. This encourages business to make big capital investments to grow their businesses. On the other hand, a negative value means that risks are more than the reward or the "yield curve is inverted". This puts brakes on any long-term capital investments by the companies. Historically, this had led to recessions. Today, the curve is more inverted than ever in history, except the Volker era.

Rishi

Grufity.com

contact@grufity.com

Visit us on social media:

Twitter

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.