ABFC releases annual ‘Biofuels in Canada’ 2022 report with expanded scope, 2021 data

New report assesses Clean Fuel Regulations impact, fuel and carbon tax penalties on biofuels, and abatement costs

The report is commissioned annually by Advanced Biofuels Canada and independently authored by Navius Research, a leading energy and environment quantitative market analysis firm. It evaluates Canadian renewable and low carbon fuel policies and their impact on fuel consumption, greenhouse gas (GHG) emissions reduction, and consumer costs. The 2021 report quantified the impact of electrification and co-processing, and this year’s report provides new detail on how carbon tax implementation and fuel tax application is impeding biofuels’ contributions to climate action.

“With every annual update, this report’s message rings more clear: advanced biofuels’ GHG reductions will only grow and become more critical to Canada’s climate goals,” stated ABFC President Ian Thomson. “And amidst turmoil in global energy markets, billions of litres that supplement tight fossil fuel markets are saving Canadians billions of dollars every year. A surge in new capital spending and job creation to build world-scale advanced biofuel production facilities will also add to our energy security by reducing reliance on imported gasoline, diesel, and jet fuel - bringing even more jobs back to Canada.”

The annual report calculates the volumes of renewable and petroleum transportation fuels consumed in each Canadian province, and characterizes these calculations by fuel type, feedstock, and carbon intensity (CI). Clean fuels profiled include ethanol, biodiesel, and hydrogenation-derived renewable diesel (HDRD); bio-based feedstocks co-processed with crude oil in a conventional refinery are also analyzed. Electrification's impact on fuel markets is also assessed.

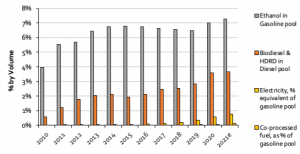

The report’s highlights for the past decade (2010-2020) include:

• Ethanol use declined in 2020 by 11% below 2019 as a result of the pandemic, but less than gasoline’s decline. Biomass-based diesel use increased 13% from 2019 to 2020

• Despite a reduction in overall biofuel consumption in 2020 relative to 2019, annual greenhouse gas (GHG) emissions reductions improved slightly to ~5.9 MtCO2e/yr based on biofuels progressively lower carbon intensity

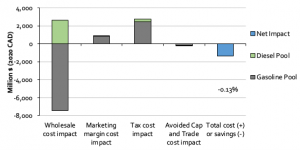

• Biofuels saved the typical gasoline consumer 0.4% in annual fuel costs, whereas they cost a typical diesel consumer an additional 0.7%.

• Biofuel consumption in Canada has reduced consumer fuel costs by $1.3 billion.

• Volumetric taxation of biofuels and the improper application of carbon taxes on biofuels have generated surplus tax revenues to governments of $3.26 billion. Fair taxation of biofuels would have reduced consumer fuel costs by $231 million in 2019.

• In 2020, the national blending rate for ethanol in gasoline was 7.0% (2019: 6.5%), and biodiesel and HDRD blends totaled 3.6% (2019: 2.9%) in diesel fuels.

“The report highlights the dysfunction of federal and provincial carbon tax regimes. When very low carbon biofuels in BC are charged a higher carbon tax than gasoline and diesel, that sends exactly the wrong signal to fuel users. Navius estimates that by 2030, this penalty on biofuels would take $1.4 billion from Canadians every year, at absolutely no benefit to climate action. There is no technical obstacle to correcting the carbon tax on biofuels; political will is needed.”

This year’s analysis studies the extent to which current renewable fuel consumption would satisfy the requirements of the upcoming Clean Fuel Regulations and includes estimated results for 2021. Amongst improvements to this edition, volumes and GHG impact of renewable co-processed fuels are based on British Columbia government data, and the estimate of octane’s value has been refined. Tax rates used in the cost impact calculations now change by fiscal year rather than calendar year.

The full report and data tables are available at: https://advancedbiofuels.ca/biofuels-in-canada-2022

Advanced Biofuels Canada/ Biocarburants avancés Canada is the national voice for producers, distributors, and technology developers of advanced biofuels and renewable synthetic fuels. Our members are global leaders in commercial production of these functional, scalable fuels, with over 24 billion litres of installed annual capacity worldwide. Our members include Canada’s leading advanced biofuels producers and technology innovators which are actively developing new clean liquid fuels production and distribution assets and operations in Canada. For information on Advanced Biofuels Canada and our members, visit: www.advancedbiofuels.ca.

Ian Thomson

Advanced Biofuels Canada

+1 604-947-0040

email us here

Visit us on social media:

Twitter

LinkedIn

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.