NielsenIQ Releases New Report Focusing on Inflation's Impact on Small and Medium Brands

NielsenIQ previews a new framework to help small and medium brands scale growth in its latest global study.

“Inflation has supercharged the importance of every investment and strategic effort made by smaller brands. As the cost of products rise, so does the cost of missing the mark with consumers’ expectations,” says Dzung Nguyen, APAC, Small and Medium Business Leader, NielsenIQ. The good news for small & medium-sized businesses is that despite many SMB’s being largely “unfamiliar” in terms of notoriety according to our recent study, consumers are considering a wider variety of brands when deciding what to buy.”

Large corporations have leverage against inflation and supply chain problems that smaller enterprises often struggle to weather, making the balancing act for small and medium-sized businesses a crucial, but potentially rewarding effort at this specific point in time. The analysis also highlighted consumer preferences in APAC region:

· Three out of five (59%) consumers in APAC prefer to buy locally made products from small businesses in their area versus the global average of 56% consumers

· 58% try to support small brands where possible, but are finding it harder to find them on the shelf

· 52% feel that small brands are more authentic and trustworthy than big brands

· 88% of APAC consumers felt that functional reasons like availability, quality and value for money are of utmost importance when making their purchasing decisions

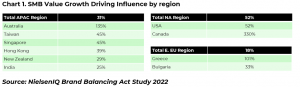

Further, as compared to North America which leads SMB value growth by 52%, APAC region follows at 31% driven by highest growth driving influence compared to other tiered groups. See Chat 1. indicating that SMB’s are contributing more to FMCG market growth than larger companies

The Brand Balancing Act study provides a perspective on how inflationary pressures are impacting small and medium brands and strategies they can use to showcase their value and remain aligned to the core values sought by consumers.

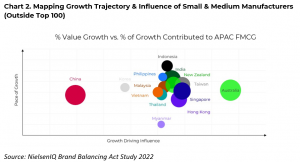

A deep dive into APAC region shows that despite the slowed pace of growth, SMB’s deliver more than fair share (31%) of FMCG growth in most cases. Indonesia drives the pace of growth, while Australia’s small manufacturers are contributing the most to local FMCG growth. Reference Chart 2.

“It is highly likely that inflationary pressures will stick around for some more time, consumers will be spending cautiously, therefore FMCG companies must work with specific strategies depending upon the different level of cautiousness of each cohort. At the same time, smaller brands could succeed if they can scale and find the right levers, based on the right consumer data, to innovate in meaningful ways,” concludes Nguyen.

Download full report here.

Jackie Helliker

Trippant

+61 412 405 761

email us here

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.