The Inflation Reduction Act (IRA) of 2022 and How It Will Affect Business

President Biden signed the Inflation Reduction Act of 2022. Find out how this legislation will affect your business in the coming years.

The Inflation Reduction Act Of 2022 Seeks To Reduce The Federal Deficit (And Tame Inflation)

The Inflation Reduction Act of 2022 (IRA) began its tortured journey through Congress first as the Green New Deal and later the Build Back Better Act – a massive spending proposal that flamed out multiple times after Democratic Senators Manchin (WV) and Sinema (AZ) pulled their support due to concerns over inflation and increased deficits.

But as the midterm elections approach, a last-minute budget reconciliation deal was consummated.

Unlike its predecessors, the scaled-down IRA reduces the Federal deficit significantly – a requirement for budget reconciliation bills that bypass the filibuster.

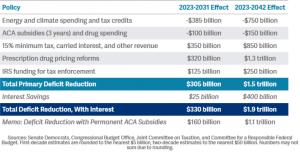

According to the bi-partisan Committee for a Responsible Federal Budget, the Inflation Reduction Act would trim the deficit by $330 billion between 2023 and 2031, and over a longer timeframe, would save $1.9 trillion (between 2023 and 2042).

The IRA accomplishes this through a combination of $900 billion in new spending, $2.4 trillion in offset savings, and $400 billion in interest savings.

The bill’s proponents claim that significantly reducing the Federal deficit over time will help reduce inflation, although most of the savings come in the period between 2031 and 2042.

Carbon Pricing Is Out, Tax Credit Incentives To Avert Climate Change Are In

After reducing the deficit (and hopefully helping to tame inflation over the long term), the second major thrust of the IRA is to reduce US greenhouse gas emissions through targeted tax credits, hopefully helping us meet our international commitments at the Paris Climate Accords, which seeks to limit global warming to below 2 degrees Celsius.

The introduction of the IRA’s tax credit incentives marks a major strategic shift away from carbon pricing and cap-and-trade policies that have long been considered by Congress (and many economists) for decades as the preferred “free market” approach to reducing greenhouse gas emissions.

What’s the projected cost? The new tax incentives intended to help speed up the transition to a cleaner green economy will cost $369 billion.

But will it deliver the goods?

According to the Rhodium Group, the IRA should lower emissions by 32 – 42% by 2030 (compared to a 2005 baseline).

Researchers at Princeton point out that this is significantly lower than our current trajectory of 24-27% reductions by 2030 – albeit not as good as the House’s failed Build Back Better Act which would have theoretically cut emissions by 46%.

Tax Incentives For Clean Energy Production, Including Wind, Solar, And Energy Storage Development

Transforming our nation’s energy sector to become a cleaner, more environmentally friendly system is a tall order.

And it’s hard to discern an overall strategy just by looking at the different provisions and tax credits within the new law, including $44 billion for production tax credits for promoting wind, solar, battery storage, and hydrogen technologies.

However, we like the way that the Rhodium Group has analyzed the situation, an approach they call the “4 Rs” of transitioning to clean electric generation:

· Reinvigorate Creating New Clean Electricity Production Capacity

The IRA includes significant investment tax credits (ITCs) and production tax credits (PTCs) for adding new clean energy capacity to the grid.

The IRA also extends the tax credits for wind and solar projects for another 10 years.

Green hydrogen production (via clean energy sources) will earn a new $3/kg tax credit.

Finally, a new 30% investment tax credit will apply to stand-alone energy storage projects, a critical component necessary to ensure solar and wind-powered grids are capable of providing power at night.

· Retain Existing Nuclear Capacity

The IRA offers $30 billion in production tax credits (PTCs) to encourage existing zero-carbon nuclear plants not to shut down.

· Retire Carbon-Emitting Electric Plants

The IRA encourages the retirement of fossil-fuel-based production capacity through changes to USDA (for rural electric co-ops) and DOE loan programs.

· Retrofit Carbon-Emitting Electric Plants

The IRA supports retrofitting existing electric generation plants powered by fossil fuels through Q45 carbon capture tax credits. The IRA ups the value of these carbon credits, which will range from $85/ton to bury C02, to $60/ton for using C02 industrially (such as in advanced oil recovery e.g. fracking), to $180/ton for capturing C02 directly from the air.

The IRA also includes provisions to resume offshore oil and glass leases in the Gulf of Mexico to provide energy in the short term. However, methane leaks from oil and gas facilities will be subject to a hefty tax to reduce greenhouse gas emissions from wellheads, pipelines, and other sources of leaks – despite industry claims that existing regulations are sufficient.

A Mix Of Industry And Consumer-Facing Tax Credits For Electric Vehicles (EVs) And Energy Savings At Home

The Inflation Reduction Act also has a series of tax incentives designed to encourage industry to shift the production of batteries, EV components, and solar equipment to North America. As we’ll see, some of these tax credits apply to industry directly while others are consumer-facing.

Read more...

Julia Solodovnikova

Formaspace

+1 800-251-1505

email us here

Visit us on social media:

Facebook

Twitter

LinkedIn

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.