MarketNsight Predicts 10 Years to Reach Normal Atlanta New Home Inventory

MarketWatch Atlanta highlights historically low inventory

“Lumber prices could go to zero and that would not fix the current housing shortage,” Hunt said. “We need 92,000 more homes in Atlanta over the next year to meet housing demand. Between lot shortages, development timelines, exclusionary zoning issues and a myriad of other factors, it will take years to start to meet this demand.”

Strong consumer confidence and demand for homes is fueling back-to-back years of double-digit increases in pending new home sales and resale home sales. March through May of 2021, new home pending sales are up 7% and resale is up 37% over last year. Material pricing concerns are causing home builders in the lower price points to throttle back. There simply aren’t as many homes coming to market in the $200,000 to $300,000 price range.

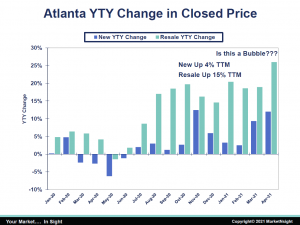

“Builders at these price points don’t have the margins to absorb the increased building supply costs,” Hunt said. “So, the question remains: is there a housing bubble?

“The year-over-year price change for new homes is only up 4%. Resale is crazy, out of control and not sustainable. It has gone up 15% in the last 12 months. This is what caused the downturn in 2008 and 15% is worrisome. It looks like a bubble in the short run, but don’t panic yet.”

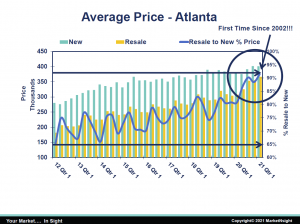

According to Hunt, Atlanta is in the middle of a 20-year housing cycle, and 2002 was our last normal year in housing. For years we had 4.5% annual home appreciation. New was only 10% above resale and this trend held for 10 years. Atlanta would pull 50,000 new home permits a year and new homes were 40% new home market share.

After the 2008 housing collapse, Atlanta finally found the bottom in 2011. That year, builders pulled only 6,000 permits, new home market share was 11% and there was a 65% new to resale price spread. Today, the gap between new and resale is back to the “normal” 10% spread.

“We are right where we should be,” Hunt said. “We have reached a peak and with only a 10% differential, we should be selling tons of new homes but we aren’t because of zoning, lack of land, lack of developed lots and a plethora of other reasons.”

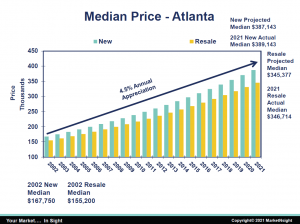

Looking at where the market was 20 years ago and applying 4.5% appreciation to where the market is today is very interesting:

• In 2002 the median price of a new home was $167,750 and the resale median price was $155,200.

With 4.5% appreciation from then until now:

• 2021 projected median new home price is $387,143 and the projected resale price is $345,377.

So, what does the actual look like?

• 2021 actual new home median price is $389,143 and the actual resale median is $346,714.

As it relates to permits, MarketNsight data shows permits up 40% over last year but, according to Hunt, this will moderate, and we will end the year up between 15 and 20%. What is driving the permit trend and why is the housing shortage going to last for years?

• Demand pressures. The millennials have only recently started buying.

• Shortages and red tape. Lack of construction workers, lack of lots, lack of new home communities, zoning challenges, regulations, etc.

• End of forbearance is not going to have an impact. The shortage of homes is too massive.

• No relief from resale.

Historically, a normal supply of homes in Atlanta is six months, but Atlanta is experiencing a record low home supply along with inventory deficits. At present, there is less than one month of home inventory supply, and MarketNsight sees the same trends across its 35-city footprint. In Birmingham, Alabama there is less than one month of supply and in Charleston, there is only half a month of supply.

“What is needed to reach equilibrium is staggering,” Hunt said. “In Atlanta, the number is 46,000 homes at current absorption rate, and this is a 6-month number. If you annualize it, we need 92,000 homes.”

MarketNsight is focused on helping its customers make smart decisions as it relates to purchasing land and pricing product. Its groundbreaking Feasibility Matrix provides a one-stop-shop for gauging new home community feasibility by providing ranking reports, lot and raw land sales data, regression analysis and mortgage data.

Visit https://bit.ly/3guRdor for supplemental graphs and information. To learn more or to schedule a demonstration, visit www.MarketNsight.com.

About MarketNsight:

MarketNsight currently serves 35+ cities in seven states – Alabama, Florida, Georgia, North Carolina, South Carolina, Tennessee, Texas and Virginia. Look for the addition of more cities soon!

To schedule a demonstration of the MarketNsight Feasibility Matrix® or Mortgage Matrix®, call 770-419-9891 or email info@MarketNsight.com. For information about MarketNsight and Hunt's upcoming speaking engagements, visit www.MarketNsight.com.

Mandy Holm

Denim Marketing

+1 770-383-3360

email us here

Visit us on social media:

Facebook

Twitter

LinkedIn

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.