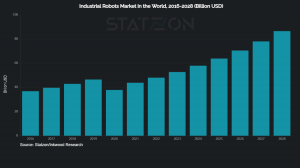

Global Industrial Robot Market Projected to Reach $86.6 bn by 2028

Despite the significant decline of -19% from 2019, the global market for industrial robots is projected to grow with a CAGR of +11% until 2028.

LAHTI, FINLAND, June 17, 2021 /EINPresswire.com/ -- According to Inkwood Research, the global market for industrial robots was valued at around 37.9 billion USD in 2020. In the same year, the sales volume of industrial robots totalled 392,000 units. The market value experienced a significant decrease from the previous year, 2019, measuring a decline of -19%. Despite the sudden decrease, the global industrial robot market is expected to grow in the future with a CAGR of +11%, reaching 86.6 billion USD in 2028.

Industrial robots help manufacturing companies to develop and manufacture products with high accuracy and reliability. They also help reduce product failures and managing the cost of wastage. Some of the challenges in the industry include high initial investment cost, installation, and system engineering & technology. Moreover, cybersecurity threats, strict regulations, and safety issues raise concern within the industry as well.

Key market trends and drivers attributing to growth include:

- Increasing demand for industrial automation

- High cost of energy & human labour

- Shortage of skilled labour

- R&D in the robotics field

- Increasing government support

APAC is the current market leader & Europe is estimated to grow fastest

The trend of outsourcing manufacturing operations to low-cost countries has brought a multitude of discrete manufacturing companies to the Asia-Pacific region. In addition, China and other countries in the Asia-Pacific region remain attractive investment locations to many international robotics companies. However, concern over the safety and working conditions of local labour restricts the use of traditional human labour, leading companies to opt for industrial robots. Europe ranks close to APAC’s leading market position in 2020 and is projected to have the fastest growth 2020-2025.

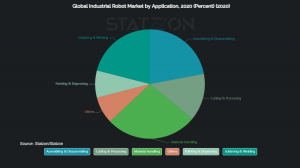

Assembling & disassembling by application and robots by type projected to grow fastest

Material handling holds the largest share (27%) of the industrial robot market in terms of its application. Moreover, the fastest application segments to grow during the forecast period until 2025 are assembling & disassembling, material handling, and soldering & welding. Based on types of industrial robots, articulated robots hold a major share (41%) of the market. However, the collaborative robot segment will be growing fastest during the forecast period.

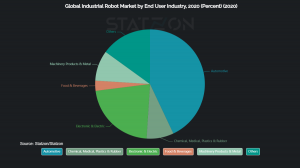

Hardware holds the largest market share by segment, whereas electronic & electric holds the largest share by end user

Based on the segment of industrial robots, the market consists of hardware, software, and services, of which hardware currently holds a 64% share of the market. Moreover, the service segment is projected to grow the fastest. Based on the end-users of industrial robots, the automotive segment holds a major share (43%) of the market. In addition, the electronic & electric segment and the food & beverage segment are expected to grow slightly faster than the rest of the end-user segments.

Denmark has the most companies using industrial robots, while Asia’s robot density is the highest

The manufacturing industry’s average robot density was 113 robots per 10,000 employees in 2019, according to the International Federation of Robotics (IFR). The average density in Asia was 118 robots per 10,000 employees, which is explained by the heavy amount of installations in years past. Europe had an average of 103 robots per 10,000 employees, a figure that was also 103 in the Americas. As reported by Eurostat in 2020, 9% of Denmark’s companies were utilizing industrial robots, making up the highest percentage within the EU.

Top industrial robot companies

Leading market players in industrial robots include: ABB Ltd. (revenue: 2.9 bn USD (2020), a 12.3% decrease from 2019), Denso Corporation (revenue: 47.1 bn USD (2020), a 3.9% decrease from 2019), KUKA AG (revenue: 3.0 bn USD (2020), a 19.4% decrease from 2019), Fanuc Corporation (revenue: 4.6 bn USD (2020), a 20% decrease from 2019), Mitsubishi Heavy Industries, Ltd. (revenue: 40.8 bn USD (2020), a 1.3% decrease from 2019), Yaskawa Electric Corporation (revenue: 3.8 bn USD (2020), a 13.4% decrease from 2019), Nachi-Fujikoshi Corporation (revenue: 1.8 bn USD (2020), a 19.3% decrease from 2019), Kawasaki Heavy Industries Ltd. (revenue: 15 bn USD (2020), a 2.9% increase from 2019), Dürr Systems AG (revenue: 4.0 bn USD (2020), a 15.2% decrease from 2019) and Seiko Epson (revenue: 9.7 bn USD (2020), a 4.2% decrease from 2019).

Learn more about the collaboration at https://statzon.com/insights/global-industrial-robot-market.

Kimmo Kuokkanen

Statzon

+358 50 4713021

statzon@statzon.com

Visit us on social media:

LinkedIn

Facebook

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.