Mintec report on the price and trade impact of the Brexit deal on EU and UK commodity markets

The analysis focuses on key food commodity categories, delving into the main challenges facing importers and exporters on both sides.

BOURNE END, BUCKINGHAMSHIRE, UNITED KINGDOM, February 18, 2021 /EINPresswire.com/ -- Price and trade impact of the Brexit deal on EU and UK commodity markets

This report provides a category update on commodity price movements since the Brexit deal between the UK and EU on 24th December 2020. It shows that the agreement has had a muted price impact on most categories to date.

Click here to read the full report for free.

https://www.mintecglobal.com/top-stories/price-and-trade-impact-of-the-brexit-deal-on-eu-and-uk-commodity-markets

The EU-UK Trade and Cooperation Agreement (TCA) permits trade to continue across the English Channel without duties or taxes, to maintain the competitive position of EU exports to the UK and vice versa. This analysis focuses on key commodity categories, delving into the main challenges facing importers and exporters on both sides.

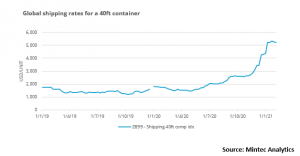

A consistent theme in the immediate post-Brexit era centres around customs and border delays, due to increased stringency regarding origin labelling and health certification, particularly for outbound UK shipments to mainland Europe. Additional documentation is now required for phytosanitary checks, as well as registration for VAT in both areas. Consequently, demand for customs brokers and freight forwarders has increased significantly, according to market participants. However, in the seven weeks to 10th February 2021, there's been minimal Brexit-related price impacts on the fruit and vegetable, dairy, oilseeds,softs, nut and dried fruits market categories. So far, these commodities' prices appear to have been influenced by more traditional fundamental drivers - supply, demand, and weather issues. The impact of COVID-19 and more recently, soaring shipping rates due to a shortage of containers and congestion at ports, have also been key drivers of commodity prices. The global shipping rate for a 40ft container skyrocketed by 133% and reached USD 5,191/UNIT, in the three months to 10th February 2021.

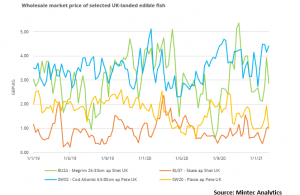

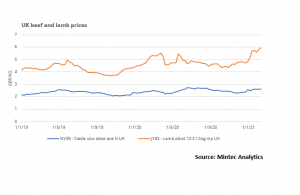

With its unique conditions and perishable nature of the produce, the fish category continues to pose significant challenges for UK exporters. The impact of logistical bottlenecks has been particularly severe for the fish market, reflected in the price increases at the UK's key wholesale auctions. The meat category (UK beef and lamb) has faced similar admin-based price increases, with the export of all animal products and live animals requiring Export Health Certificates (EHC) and the need to pass through Border Inspection Posts (BIP).

It becomes tougher to differentiate between the direct Brexit price impacts in the other categories (grains and packaging )when considering the global pandemic's overlapping effects and various meteorological factors. However, Mintec expects that the 'Brexit' related price impacts should become increasingly evident in the coming months.

Analysis by Category

1. Fish & Seafood

2. Meat & Poultry

3. Fruit and vegetable

4. Dairy

5. Oilseeds and Vegetable Oils

6. Grains

7. Nuts

8. Packaging

9. Concluding remarks

Click here to read the full report for free.

https://www.mintecglobal.com/top-stories/price-and-trade-impact-of-the-brexit-deal-on-eu-and-uk-commodity-markets

About Mintec

Mintec enables the world's largest food brands to implement more efficient and sustainable procurement strategies through its SaaS platform. Mintec Analytics, delivers market prices and analysis for more than 14,000 food ingredients and associated commodity materials. Our data and tools empower our customers to understand supplier prices better, analyse their spend in greater detail and negotiate more confidently with suppliers. Ensuring they are best placed to reduce costs, manage risk and increase their efficiency, helping them to maximise their margins.

David Bateman

Mintec

+447970668470 ext.

email us here

Data-driven insight into food commodity prices

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.