Wind Energy O&M Costs Continue to Escalate

Since 2010, the average cost of a maintenance contract has increased 20.9%, driven by higher than expected maintenance costs for ageing assets

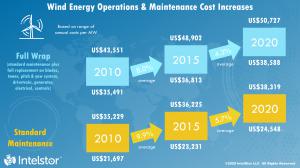

The capacity weighted average cost of standard maintenance has increased from $28,746.21 per installed MW for projects which went COD in 2010 to $34,213.38 per installed MW for projects which IntelStor expects will be COD in 2020. Similarly, the capacity weighted average cost of full wrap maintenance contracts has increased from $39,049.14 per installed MW for projects which went COD in 2010 to $44,455.09 per installed MW for projects which IntelStor expects will be COD in 2020.

The high end of the range of standard maintenance costs is now more expensive than the low end of the range for a full wrap agreement for wind energy projects which went COD just five years ago. IntelStor is predicting that by 2025, the high end of the range for standard maintenance contracts will exceed the cost of the most expensive full wrap agreements for projects which went COD in 2010. Full wrap agreement costs could see another 3 – 5% increase at a minimum in the next five years as well.

There are two key drivers of these increasing operations and maintenance costs. The first is wind turbine OEMs are still using a lower turbine price as leverage in their commercial negotiations to obtain more favorable rates on their long-term service contracts. Declining wind turbine prices are resulting in wind turbine OEMs sacrificing margin on turbine supply contracts in order to sign more expensive full wrap contracts in an effort to claw back their margin. While this strategy implies a risk to the OEMs, with operational performance of the asset at 98 – 99% availability with minimal major corrective repairs should allow them to take a net positive return over the lifetime of the project.

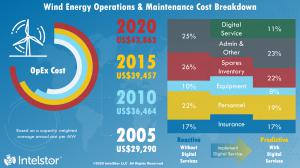

The second driver for escalating O&M costs are that technologies like data analytics are not yet seeing a material impact on overall cost. The opportunity to reduce OpEx cost is almost completely missed at this stage due to a cost shift from reactive maintenance practices to predictive maintenance practices powered by data analytics.

Money which would have otherwise been saved on administrative costs, a reduction in the inventory of spare parts, as well as the time in service for equipment and personnel is instead being spent on the digital service being provided to implement that reactive to predictive maintenance transition. As a result, there is no net OpEx cost reduction at this stage, only a cost shift towards the digitally enhanced services.

As costs have escalated over time, the cost distribution has not changed, and the industry faces a challenge to ensure that spares inventory and personnel costs can be reduced as a result of the implementation of digital services.

One way in which asset owners can offset some these costs is through a royalty income stream from data licensing. Digital service companies, who can bring significant benefit to asset owners by evaluating their historical SCADA, CMS and other operational and performance data in order to improve performance and extend asset life.

These data focused digital service companies can analyze the operational history of the wind turbines and develop predictive models of component faults and failures so that more proactive action can be taken.

The knowledge these data analytics companies create serves a primary purpose to diagnose an operational or maintenance issue, but also the indirect market intelligence value of knowing when certain components might fail or the makes and models of turbines which frequently have incorrect pitch and yaw settings.

This market intelligence value of data can be monetized, and asset owners could generate significant royalty income from the licensing of this data, which would partially offset the growing cost of maintenance.

Proactive asset owners, OEMs, or insurance brokers with reams of asset reliability and performance data who out-license or cross-license their data could collectively see a total royalty income upwards of US$845 million in recognized commercial value for the data they own or control in the United States market alone.

This underscores the need for a data and digital content exchange to facilitate such licensing transactions. In the past, asset owners, OEMs or independent service providers had no commercial incentive to share their data with other companies. This resulted in most companies stockpiling a significant amount of SCADA, CMS and other data while being highly reluctant to share it for fear of liability exposure on warranty claims.

However, most companies would likely share more of their data if they were offered a royalty for licensing it, instead of just giving it away to a data pool in order to get access to other commercial data which they might not fully utilize.

The market is there for asset owners to achieve cheaper long term service contracts through commercializing a portion of their asset performance and reliability data. They need to seek the right partnerships with data analytics companies who can add value to them.

Philip Totaro

IntelStor

+1 213-465-0080

email us here

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.