China's Shift to Parity Could Cause Price Shock for some Renewable Energy Power Producers

On January 1, China's newly installed wind & solar PV electricity generation will see the end of subsidies as the country enters the era of grid price parity

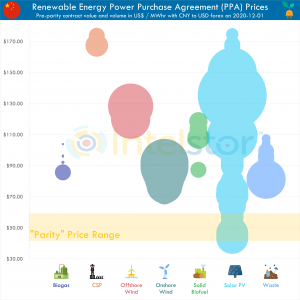

HOUSTON, TX, USA, January 5, 2021 /EINPresswire.com/ -- On January 1, 2021, China's newly installed wind and solar PV electricity generation will see the end of subsidies as the country enters the era of grid price parity, i.e. prices are now equivalent to the wholesale market price for coal power generation.IntelStor has analyzed the past 7 years of renewable energy power purchase agreements (PPAs) to identify where the winners and losers of this policy shift will end up.

China's capacity weighted average wholesale market price for coal generation is approximately 336 Yuan/MWhr (US$51.92/MWhr). In most countries today, a US$52 PPA for wind energy or solar PV would be readily achievable given the current state of technology development and current levels of project CapEx. Nevertheless, China's power producers may see a material impact if they were used to prices which are well above the new price range.

More than 80% of the solar PV capacity contracted in the past 7 years has seen a price range well above the current "parity" era average price range of between US$43/MWhr and US$61/MWhr. On the other hand, some solar PV producers will inevitably make some money if their previous capital efficient endeavors saw them able to procure PPAs below the current wholesale market price.

Onshore wind energy producers may feel the biggest impact from this, as 100% of their recent capacity was above the current parity price range. However, most onshore wind energy companies have luxuriated themselves with Chinese PPAs in the US$72/MWhr to US$98/MWhr for many years, and when compared to some global markets, those prices are 3 - 5X the current cost.

Offshore wind energy in China still enjoys a subsidy for the rest of 2021, at which point that one evaporates too. Other renewable energy sources will still receive their subsidies for the foreseeable future, at least until the technology is proven through capacity additions which drive down levelized cost of electricity, or the technology is not able to compete in a subsidy free regime and new deployments cease.

With China's established "3060" climate target, in which they expect peak CO2 emissions be reached by 2030 and they have pledged to be carbon neutral by 2060, another 700GW of renewable energy will need to be added to their power generation mix by 2030 alone to begin to see those targets achieved.

As such, the domestic photovoltaic industry has proposed to increase their annual capacity additions to 70 - 90GW by the end of the forthcoming "14th Five-Year Plan" period (i.e. by early 2026), and the wind power industry has followed suit with a goal of not less than 50GW annually (including both onshore and offshore).

With further scale being reached in renewable energy capacity additions, and the days of luxury PPA prices coming to an end, the transition period may be difficult for some power producers, but there is still plenty of money to be made with new deployment.

Contact us today to get a demonstration of IntelStor and see how you can get market intelligence which allows you to win.

Philip Totaro

IntelStor

+1 8329150010

email us here

Visit us on social media:

Facebook

Twitter

LinkedIn

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.