EJL Wireless Research Reports Global Macrocell TRx Shipments Up 24% in 2017

Massive MIMO driving radio transceiver market towards 500 million units by 2022; Outlook bullish for 2018 with 113% growth due to 5G NR deployments

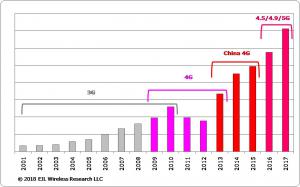

SALEM, NH, UNITED STATES, April 19, 2018 /EINPresswire.com/ -- Shipments of macrocell radio transceivers (TRx) for remote radio units (RRU) and massive MIMO antenna radio systems (MM-ARS) supporting 2G, 3G, 4G, 4,5G, 4,9G, and 5G NR were up 24% in 2017, according to the latest report from EJL Wireless Research titled “Global Macrocell Radio Transceiver (TRx) Market Analysis and Forecast, 2018-2022 14th Edition.” “The TRx report is the third in our mobile radio access network (RAN) series of market research reports and complements the recently published RRU and digital baseband unit (BBU) reports,” says founder and President, Earl Lum. EJL Wireless Research is forecasting that the macrocell TRx market will more than double in shipments in 2018 due to initial 5G NR massive MIMO deployments, offsetting a 28% decline in LTE TRx demand.

Regarding market share for the mobile radio access network (RAN) wireless equipment suppliers, EJL Wireless Research believes that the recently reinstated U.S. Department of Commerce Export Ban on ZTE Corporation may significantly alter the market share within the industry and would be potentially beneficial for Ericsson, Huawei, and Nokia in China, the EMEA region and across Asia Pacific.

“We were correct in our prior forecast estimate for total TRx shipments for 2017 with a 6% delta when compared with the actual estimates for each equipment vendor. This gives us more confidence that our forecast model and research methodology is working,” says Lum.

“Our current outlook for 2018 is moderately conservative based upon timing of 5G NR in the U.S. and NB-IoT upgrades in China. We forecast that microwave/mmwave TRx shipments for 5G NR will capture 49% of total TRx shipments in 2018 and will exceed 200 million units annually by 2022,” says Lum.

About EJL Wireless Research

EJL Wireless Research provides proprietary, accurate and cutting-edge market analysis and consulting services on the wireless technology ecosystem. The firm's wireless infrastructure research focuses on vertical elements of the wireless ecosystem including telecommunication standards evolution, global and regional regulatory issues, spectrum availability, mobile operators, and mobile infrastructure equipment vendors. In addition, the firm provides analysis across horizontal technology suppliers including RF semiconductor materials, RF semiconductor/components, and RF subsystems. Our goal is to provide our clients with critical market analysis and information.

EJL Wireless Research believes it has a corporate responsibility, both local and international, in giving back to the community. Please visit our website for more information about the charitable organizations it supports at: http://www.ejlwireless.com/corporate_responsibility.html.

EJL Wireless Research is managed by Earl Lum. Mr. Lum has more than 25 years of experience within the wireless industry including 8 years as an Equity Research Analyst on Wall Street. The company is headquartered in Salem, NH. For more information about EJL Wireless Research, please visit the company’s website at www.ejlwireless.com.

EARL LUM

EJL Wireless Research LLC

6504302221

email us here