Rule 10b5-1 Trading Plan Guidelines: A Survey of the SV150

Wilson Sonsini is pleased to present Rule 10b5-1 Trading Plan Guidelines: A Survey of the SV150. This report summarizes the results of our review of the Rule 10b5-1 trading plan guidelines filed by 75 companies in the Lonergan SV150, which ranks the top 150 companies with headquarters in the Silicon Valley by annual sales. For more information on the methodology used to prepare the Lonergan SV150 and a list of the SV150 companies, please visit the Lonergan Partners website. Please see our companion report, Insider Trading Policies: A Survey of the SV150, for an analysis of certain key elements of insider trading policies filed by the SV150, available here.

BACKGROUND

Rule 10b5-1, adopted by the U.S. Securities and Exchange Commission (SEC) in 2000, includes an affirmative defense for trades made pursuant to a trading plan that was entered into when the person was not aware of material nonpublic information (MNPI). [1] Until 2022, this affirmative defense, outlined in Rule 10b5-1(c), had limited conditions required for persons to avail themselves of the defense. Over time, however, additional conditions were imposed by individual companies, which developed into a set of common practices that companies required as part of approving a Rule 10b5-1 trading plan. [2]

In response to concerns about the rule’s potential for abuse, in 2022, the SEC amended Rule 10b5-1 (the 2022 amendments), introducing new conditions for the affirmative defense under Rule 10b5-1(c). [3] These conditions include a minimum cooling-off period following adoption of the plan, director and officer representations, prohibitions on multiple overlapping plans, limitations on single trade plans, and an expanded good faith requirement. Beyond these enhanced conditions, many companies continue to impose their own additional conditions, such as minimum and maximum terms, limits on trading in company securities outside of the plan, and limits on early termination of the plan, among others. The Rule 10b5-1 conditions as well as the company-imposed conditions are typically documented in written trading plan guidelines.

This report provides an analysis of several key elements of these written trading plan guidelines including cooling-off periods, minimum and maximum terms, trading outside of the trading plan, early terminations, and mandatory use of trading plans.

We would like to thank the team that conducted the research and provided editorial input for this report, including partners Richard Blake, Tamara Brightwell, Shannon Delahaye, Lauren Lichtblau, Jose Macias, and Lisa Stimmell, and practice support lawyer Courtney Mathes.

TRADING PLAN GUIDELINES

Trading plan guidelines vary in form. For example, some companies incorporate their guidelines into their insider trading policies, others attach their guidelines as an exhibit to their insider trading policies, and others have a separate stand-alone set of guidelines. While we believe a majority of companies have trading plan guidelines, some companies may rely on the requirements in Rule 10b5-1 to set the parameters for trading plans, particularly following the 2022 amendments.

As part of the 2022 amendments, public companies are required to file their “insider trading policies and procedures” as exhibits to their Forms 10-K. Because guidelines differ in format, their inclusion in these filings also varies. For this report, we reviewed the publicly filed trading plan guidelines of 75 SV150 companies. Of these 75 companies, 43 companies included their guidelines within their insider trading policy, [4] 27 companies included their guidelines as an exhibit to their insider trading policy, and five companies filed stand-alone guidelines as a separate exhibit to their Form 10-K. [5]

KEY TAKEAWAYS

COOLING-OFF PERIODS

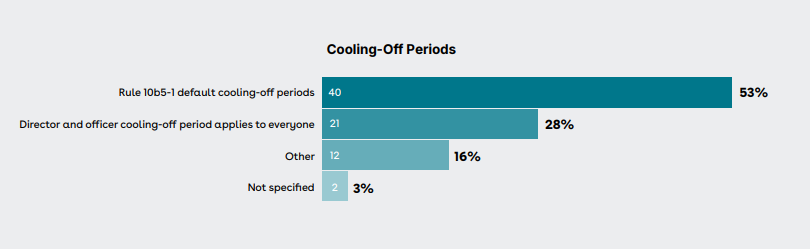

Following the 2022 amendments, Rule 10b5-1 requires a minimum cooling-off period between the date that a trading plan is adopted and when the first trade may occur. For directors and Section 16 officers, the minimum cooling-off period is the later of 90 days or two business days after the release of the company’s financial results in a Form 10-Q or Form 10-K for the fiscal period in which the trading plan was adopted (but not to exceed 120 days). For all other persons, [6] the minimum cooling-off period is 30 days. A majority of the guidelines we reviewed have provided for these minimum cooling-off periods for these respective groups, referred to in the chart below as “Rule 10b5-1 default cooling-off periods.”

In the “Other” category, nine guidelines provide for the director and officer cooling-off period for directors and Section 16 officers but provide for something other than the minimum 30-day cooling-off period for all others. Variations include: the later of 30 days or the opening of the next trading window, the later of 60 days or the opening of the next trading window, and 90 days. Two sets of guidelines provide for the Rule 10b5-1 default cooling-off periods but include additional persons (management or other designated employees) in the director and officer cooling-off period, and one set of guidelines provides for a 120-day cooling-off period for everyone.

COMPANY-IMPOSED REQUIREMENTS

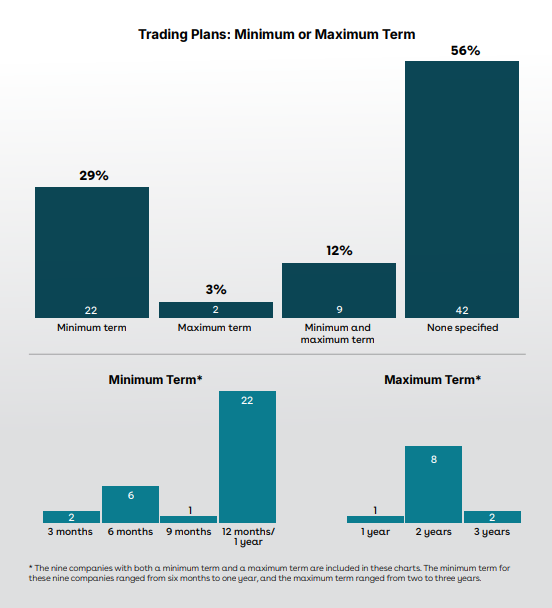

Minimum and Maximum Term of Plans

Some guidelines provide for minimum terms, maximum terms, or both, for trading plans. Having limits on the term of a trading plan allows the insider to re-evaluate and change trading instructions periodically in conjunction with adopting a new 10b5-1 plan or to revert to non-plan trading without having to modify their plan or terminate their plan early.

COMPANY-IMPOSED REQUIREMENTS

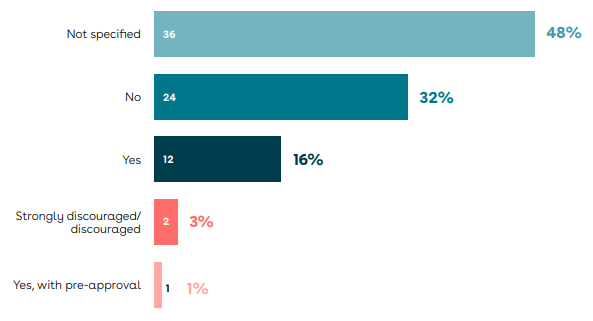

Trading Outside of the Trading Plan

Some guidelines prohibit trading in company securities outside of the trading plan during the term of a trading plan; however, this prohibition is often tempered by continuing to allow dispositions of gifts and other limited exceptions (e.g., exercise of stock options for cash, purchases from the employee stock purchase plan, inheritance) to be completed outside of the trading plan during the term. In these cases, although some limited transactions may be excepted, the guidelines are reflected in the “No” category.

COMPANY-IMPOSED REQUIREMENTS

Restrictions on Early Termination of Trading Plans

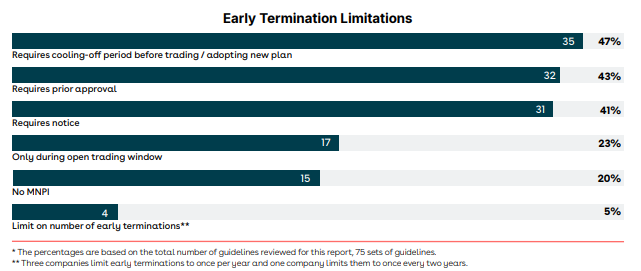

Terminating a trading plan prior to its expiration or completion is generally discouraged absent situations in which market volatility or personal circumstances fundamentally alter the conditions under which the insider adopted the trading plan. While terminations are generally not prohibited, there are a variety of ways that companies attempt to mitigate the potential adverse implication of early terminations. For example, guidelines may require early terminations to occur in an open trading window or when the insider is not aware of MNPI, or require prior approval or notice. In addition, they may limit the frequency of early terminations or require a cooling-off period following termination before the insider may trade in company securities or enter into a new trading plan. The chart below reflects the prevalence of these limitations in the guidelines reviewed. Please note that some guidelines include more than one of these limitations. For example, eight of the guidelines reviewed limit early terminations to open trading windows and at a time when the insider is not aware of MNPI, and only allow early terminations with prior approval.

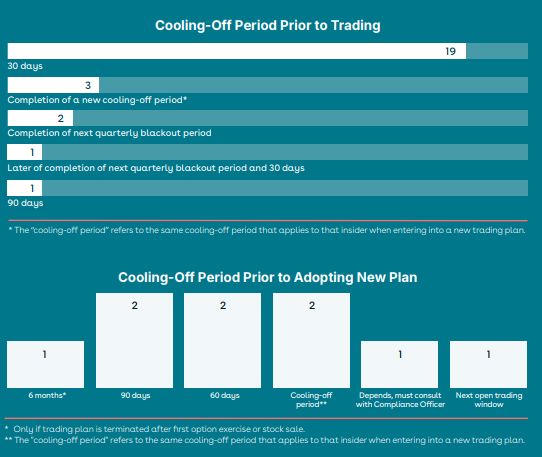

For those guidelines that require a cooling-off period following early termination, 26 guidelines require a cooling-off period prior to any open market trading and nine guidelines require a cooling-off period before the insider may adopt a new trading plan.

MANDATORY USE OF TRADING PLANS

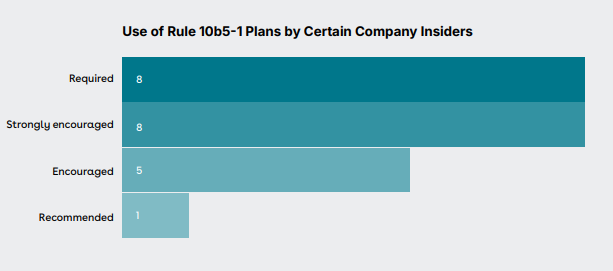

Although not prevalent among the guidelines we reviewed, some companies require their directors, Section 16 officers, and, in some cases, other officers and designated personnel to transact in company securities exclusively through trading plans.

Of the eight companies in the “Required” category, two require directors and Section 16 officers to transact exclusively through trading plans, two require only Section 16 officers (not directors) to use trading plans, and four require directors, Section 16 officers, and other designated members of management to use trading plans. The companies in the “Strongly encouraged,” “Encouraged,” and “Recommended” categories include directors, Section 16 officers, other officers, and other individuals who have regular access to MNPI in the normal course of their duties.

Four of the eight companies in the “Required” category also strongly encourage, encourage, or recommend trading plans for directors (in cases where only Section 16 officers are required to use trading plans) and other designated personnel.

1Selective Disclosure and Insider Trading, Release No. 33-7881 (Aug. 15, 2000).(go back)

2Under most insider trading policies, a Rule 10b5-1 trading plan must be approved by a compliance officer. In addition, many brokers require companies to acknowledge trading plans. Accordingly, companies have developed guidelines for plans to be approved by the company.(go back)

3Insider Trading Arrangements and Related Disclosures, Release Nos. 33-11138; 34-96492 (Dec. 14, 2022).(go back)

4With respect to these 43 companies, it was not clear whether the guidelines within the policy were the sole trading plan guidelines in existence for the company, or whether the company also had stand-alone guidelines. We have assumed, for purposes of this report, that there are not stand-alone guidelines.(go back)

5All percentages provided in this report are based on “n=75” unless otherwise stated.(go back)

6Neither the 2022 amendments nor Rule 10b5-1 include a minimum cooling-off period for transactions by the company.(go back)

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.