Paper Paperboard Wood Recycling - Top Global Industry Trends in 2026

The United States is forecasted to achieve a CAGR of 3.4% from 2025 to 2035, with growth led by packaging, printing, and construction industries.

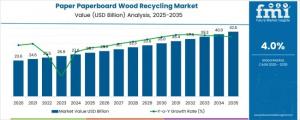

NEWARK, DE, UNITED STATES, November 24, 2025 /EINPresswire.com/ -- The global Paper, Paperboard, and Wood Recycling Market is entering a decade of steady and strategic growth, driven by rising sustainable material demand, regulatory reforms, and expanding recycling infrastructure across key regions. According to recent industry estimates, the market will increase from USD 28.7 billion in 2025 to USD 42.5 billion by 2035, reflecting a measured but dependable CAGR of 4.0%.

Annual growth trends reveal incremental yet consistent expansion. The market adds USD 1.2 billion between 2025 and 2026, gradually rising to USD 1.6 billion between 2034 and 2035, underscoring the stable pace of adoption across industries. From 2025 to 2030 alone, the market grows by USD 6.3 billion, while the 2030–2035 period contributes a further USD 7.5 billion, driven by technological improvements and growing participation in emerging economies.

Explore Opportunities – Get Your Sample of Our Industry Overview Now!

https://www.futuremarketinsights.com/reports/sample/rep-gb-23377

A Market Steadily Strengthening Its Global Footprint

The Paper Paperboard Wood Recycling Market represents approximately:

• 2.8% of the global waste management and recycling market

• 3.5% of the pulp & paper manufacturing industry

• 2.6% of the wood products and timber industry

• 3.1% of circular economy and material recovery systems

• 2.9% of the packaging materials sector

These contributions reflect the increasing reliance on recovered fibers and reclaimed wood as industries shift toward circularity, resource efficiency, and carbon footprint reduction.

Growing regulatory pressure, particularly around extended producer responsibility (EPR), landfill diversion, and recycled-content mandates, continues to shape market development. Companies are investing in advanced sorting, de-inking, pulping, and wood treatment technologies to enhance material quality and expand application potential.

Key Insights and Market Takeaways

• 2025 Market Value: USD 28.7 billion

• 2035 Forecast Value: USD 42.5 billion

• Forecast Growth Rate: 4.0% CAGR

• Leading Grade Segment (2025): Corrugated & kraft grade (33%)

• Top Growth Regions: North America, Asia-Pacific, Europe

• Notable Players: Hadfield Wood Recyclers, American Paper Recycling Corp, Carolina Fibre Corporation, Evergreen Paper Recycling, Hanna Paper Recycling, Huron Paper Stock

Corrugated & Kraft Grade Leads with 33% Market Share

With the rise of global e-commerce and logistics, corrugated and kraft grades remain the backbone of the recycling value chain. Their high fiber yield, easy recoverability, and strong resale value make them the most sought-after recycled paper category. Investments in automation—from baling to compression systems—are improving throughput and lowering processing costs for recyclers.

Packaging Emerges as the Largest Application Segment (29% in 2025)

Sustainable packaging commitments from FMCG companies, retailers, and global brands are stimulating demand for recycled paperboard. With increasing mandates that restrict plastic usage and require minimum recycled content, recycled paperboard is becoming a preferred material across:

• Consumer packaged goods

• Food service packaging

• Shipping and transport cartons

• Industrial packaging applications

Standardized formats and high-volume demand make packaging the ideal sector for large-scale recycling integration.

Market Growth Drivers and Key Restraints

Key Drivers

• Regulations promoting landfill diversion and reuse

• Rising material costs for virgin pulp and timber

• Adoption of circular economy frameworks

• Technological advancements in fiber recovery and contamination control

• Growth in packaging, construction, and logistics sectors

Key Restraints

• Inefficient collection in developing markets

• Contamination in mixed waste streams

• Price volatility of recovered materials

• Infrastructure limitations in wood waste recovery

Despite these challenges, advancements in automated sorting and waste segregation continue to elevate recovery rates globally.

Country-Level Growth Analysis

China – CAGR 5.4%

China remains the world’s largest market, driven by strong packaging demand and advanced recycling facilities. Companies like Nine Dragons Paper and Lee & Man Paper are investing in high-efficiency pulping and sorting technologies.

• Recovered paper utilization rose by 4% in 2024

• Wood fiber recovery increased by 3%

India – CAGR 5.0%

India’s market expansion is powered by FMCG-driven packaging demand, urban construction growth, and government-led waste segregation programs.

• Paperboard recycling in FMCG rose 4% in 2024

• Automated sorting installations increased 3% YoY

Germany – CAGR 4.6%

Germany’s technologically advanced recycling infrastructure supports high-purity material recovery and strong circular economy performance.

• Recycled content in premium packaging up 3%

• Engineered wood output increased 3% YoY

United Kingdom – CAGR 3.8%

The UK’s focus on sustainable construction and corporate packaging mandates continues to strengthen the recycling ecosystem.

• Biomass fuel from recovered wood grew 2% YoY

• E-commerce packaging recovery increased 2%

United States – CAGR 3.4%

The U.S. market benefits from strong participation by large recyclers like WestRock, International Paper, and Georgia-Pacific.

• Food-grade recycled paperboard production up 3%

• Composite materials from wood waste increased 2% YoY

Subscribe for Year-Round Insights → Stay ahead with quarterly and annual data updates – https://www.futuremarketinsights.com/checkout/23377

Competitive Landscape

Global and regional recyclers are expanding their recovery capabilities to meet rising industrial demand. Key strategies include:

• Establishing long-term contracts with municipalities and manufacturing companies

• Investing in shredding, sorting, and de-inking systems

• Expanding recovery facilities and biomass processing capabilities

• Strengthening export partnerships for high-value recovered fibers

Industry leaders such as Hadfield Wood Recyclers, American Paper Recycling Corp, Carolina Fibre Corporation, Evergreen Paper Recycling, and Huron Paper Stock continue to drive innovation and capacity expansion.

Recent Market Developments

• February 2025: Sweden’s PaperShell unveiled a pioneering process that transforms paper into engineered wood stronger than conventional timber—now being tested for EV components and furniture.

• October 2024: Veolia commissioned the Spreyton Materials Recovery Facility in Tasmania, equipped with AI-powered sorting systems that double regional recycling capacity to 20,000 tonnes annually.

Why FMI: https://www.futuremarketinsights.com/why-fmi

Have a Look at Related Research Reports on the Packaging Domain:

Perfume Filling Machine Market https://www.futuremarketinsights.com/reports/perfume-filling-machine-market

Pan Liner Market https://www.futuremarketinsights.com/reports/pan-liner-market

Nitrogen Flushing Machine Market https://www.futuremarketinsights.com/reports/nitrogen-flushing-machine-market

Aerogel Film Market https://www.futuremarketinsights.com/reports/aerogel-film-market

About Future Market Insights (FMI)

Future Market Insights, Inc. (FMI) is an ESOMAR-certified, ISO 9001:2015 market research and consulting organization, trusted by Fortune 500 clients and global enterprises. With operations in the U.S., UK, India, and Dubai, FMI provides data-backed insights and strategic intelligence across 30+ industries and 1200 markets worldwide.

Sudip Saha

Future Market Insights Inc.

+1 347-918-3531

email us here

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.