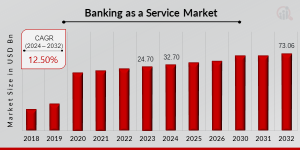

Banking as a Service Market is Expected to Generate USD 73.06 Billion by 2032, Growing at a CAGR of 12.50%

Banking as a Service Market Research Report Information By, Type, Resolution, Distribution Channel, End-User, and Application.

AL, UNITED STATES, January 13, 2025 /EINPresswire.com/ -- The Banking as a Service (BaaS) market is poised for significant growth in the coming years, reflecting the global shift towards digital financial solutions and seamless integration of banking capabilities into various industries. In 2023, the market size was valued at USD 24.70 billion and is projected to expand from USD 32.70 billion in 2024 to an impressive USD 73.06 billion by 2032, at a compound annual growth rate (CAGR) of 12.50% during the forecast period (2024–2032).𝐊𝐞𝐲 𝐃𝐫𝐢𝐯𝐞𝐫𝐬 𝐨𝐟 𝐌𝐚𝐫𝐤𝐞𝐭 𝐆𝐫𝐨𝐰𝐭𝐡

➤ Rising Demand for Embedded Financial Solutions

Businesses across industries are integrating banking services into their platforms to enhance customer experience. From digital wallets to loan offerings, the ability to provide seamless financial solutions is driving the adoption of BaaS platforms.

➤ Technological Advancements in APIs

Advancements in Application Programming Interfaces (APIs) have enabled banks and fintech companies to collaborate efficiently. These APIs facilitate secure and efficient data sharing, enabling businesses to offer services such as payment processing, account management, and credit services directly on their platforms.

➤ Increasing Adoption of Digital Banking

The surge in digital banking adoption, driven by convenience and cost-efficiency, has created a strong demand for BaaS platforms. With consumers increasingly preferring digital-first solutions, banks and fintech companies are leveraging BaaS to deliver personalized and scalable services.

➤ Growth of Fintech Ecosystems

The proliferation of fintech startups and their partnerships with traditional banks has been a significant growth driver. BaaS platforms bridge the gap between legacy systems and innovative financial solutions, enabling agile operations and faster time-to-market.

𝐃𝐨𝐰𝐧𝐥𝐨𝐚𝐝 𝐒𝐚𝐦𝐩𝐥𝐞 𝐏𝐚𝐠𝐞𝐬 https://www.marketresearchfuture.com/sample_request/10717

𝐊𝐞𝐲 𝐂𝐨𝐦𝐩𝐚𝐧𝐢𝐞𝐬 𝐢𝐧 𝐭𝐡𝐞 𝐁𝐚𝐧𝐤𝐢𝐧𝐠 𝐚𝐬 𝐚 𝐒𝐞𝐫𝐯𝐢𝐜𝐞 (𝐁𝐚𝐚𝐒) 𝐦𝐚𝐫𝐤𝐞𝐭

• Twilio Inc. (US)

• Braintree (US)

• BOKU (US)

• Coinbase Inc

• Dwolla (US)

• Zettle (Sweden)

• Fidor Bank (Germany)

• GoCardless (UK)

• Gemalto (Netherlands)

• Intuit (US)

• Square Inc. (US)

• PayPal (US)

• Prosper Inc. (US)

• Solaris Bank (Germany)

• Moven (US)

𝐁𝐫𝐨𝐰𝐬𝐞 𝐈𝐧-𝐝𝐞𝐩𝐭𝐡 𝐌𝐚𝐫𝐤𝐞𝐭 𝐑𝐞𝐬𝐞𝐚𝐫𝐜𝐡 𝐑𝐞𝐩𝐨𝐫𝐭: https://www.marketresearchfuture.com/reports/banking-as-a-service-market-10717

𝐌𝐚𝐫𝐤𝐞𝐭 𝐒𝐞𝐠𝐦𝐞𝐧𝐭𝐚𝐭𝐢𝐨𝐧

To provide a comprehensive view, the BaaS market is segmented by component, end user, and region.

1. By Component

Platform: Includes software solutions enabling BaaS integration.

Services: Encompasses consulting, API management, and operational support.

2. By End User

Banks and Financial Institutions: Leveraging BaaS to enhance digital transformation and streamline operations.

Fintech Companies: Adopting BaaS to scale rapidly and offer innovative solutions.

Non-Banking Organizations: Retailers, e-commerce platforms, and other industries integrating financial services for added value.

3. By Region

North America: Leading market driven by early adoption of technology and a mature fintech ecosystem.

Europe: Growth spurred by open banking regulations and widespread adoption of digital solutions.

Asia-Pacific: The fastest-growing region, fueled by the rapid digitization of economies in countries like China, India, and Southeast Asia.

Rest of the World (RoW): Gradual growth in Latin America, the Middle East, and Africa as financial inclusion initiatives expand.

𝐏𝐫𝐨𝐜𝐮𝐫𝐞 𝐂𝐨𝐦𝐩𝐥𝐞𝐭𝐞 𝐑𝐞𝐬𝐞𝐚𝐫𝐜𝐡 𝐑𝐞𝐩𝐨𝐫𝐭 𝐍𝐨𝐰: https://www.marketresearchfuture.com/checkout?currency=one_user-USD&report_id=10717

The Banking as a Service market is set to revolutionize the financial landscape, enabling businesses to embed banking solutions into their ecosystems seamlessly. The growth trajectory is supported by increasing digitalization, evolving customer expectations, and the collaborative efforts of banks and fintech companies. As businesses across industries leverage the potential of BaaS, the market is expected to play a pivotal role in shaping the future of financial services worldwide.

Related Report –

Peer Analysis Market

Private Equity Market

𝐀𝐛𝐨𝐮𝐭 𝐌𝐚𝐫𝐤𝐞𝐭 𝐑𝐞𝐬𝐞𝐚𝐫𝐜𝐡 𝐅𝐮𝐭𝐮𝐫𝐞

At Market Research Future (MRFR), we enable our customers to unravel the complexity of various industries through our Cooked Research Report (CRR), Half-Cooked Research Reports (HCRR), Raw Research Reports (3R), Continuous-Feed Research (CFR), and Market Research Consulting Services. The MRFR team have a supreme objective to provide the optimum quality market research and intelligence services for our clients. Our market research studies by Components, Application, Logistics and market players for global, regional, and country level market segments enable our clients to see more, know more, and do more, which help to answer all their most important questions.

Sagar kadam

WantStats Research And Media Pvt. Ltd.

+1 855-661-4441

email us here

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.