Checkrun by AP Technology Provides Control, Security, and Modernized Check Payment Choices for QuickBooks Online Users

Checkrun Features Three Check Printing Options, a Mobile Approval App for Signing and Deposit, Automated Positive Pay, and More

Checkrun integrates seamlessly with QuickBooks Online, enabling real-time, two-way synchronization that automatically records every payment detail.”

LAS VEGAS, NV, UNITED STATES, October 28, 2024 /EINPresswire.com/ -- Checkrun by AP Technology is transforming how QuickBooks Online users manage and issue payments, delivering more choice, control, speed, security, and efficiency with every transaction. Checkrun by AP Technology is currently being demonstrated at the Intuit Connect 2024 show in Las Vegas, running today through Wednesday.— Richard Love, CEO, AP Technology

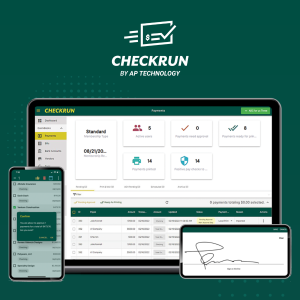

Designed specifically for QuickBooks Online users, Checkrun offers a range of innovative features that includes a mobile approval app for on-the-go convenience, configurable workflows, and three options for printing modernized checks.

Checkrun’s advanced payment management and secure issuance features are ideal for ProAdvisors, accountants, and accounts payable professionals seeking to streamline their payment processes. Checkrun users can manage multiple accounts from a single sign-on, making it easier than ever to handle payments for different business entities or clients. This feature is especially valuable for ProAdvisors and accounts payable professionals who need to manage diverse financial operations without the hassle of switching between platforms or sign-ins.

Checkrun is already being utilized across a wide variety of industries, from law firms specializing in personal injury, trusts, and real estate transactions, to non-profits, automotive enterprises, and property management offices. For businesses in these sectors, security, efficiency, and payment flexibility are paramount. If you are using QuickBooks Online, a demo and free trial will help your business decide if Checkrun is the right fit for you.

In a world of digital payments, checks remain a vital option for many businesses—and Checkrun is making them an even stronger payment option. This cloud-based solution comes with modernized security features, remote printing capabilities, and payee choice on how and when to be paid, enhancing the traditional check payment process.

Checkrun gives users three convenient options for printing payments, providing flexibility based on business needs:

1. In-Office Printing: Users can print checks from their office, maintaining complete control over the check issuance process.

2. Remote Printing: For businesses with remote teams or multiple office locations, checks can be printed securely from anywhere, allowing for operational continuity regardless of location.

3. Print and Mail Service: Checkrun can print and mail checks on behalf of the user, eliminating the need for in-house printing and mailing tasks, saving time, resources, and money.

Checkrun payment control also means payment flexibility. Payables can be scheduled at any time and in partial payments, giving businesses the ability to optimize cash flow and align payment schedules with internal preferences.

“Checkrun integrates seamlessly with QuickBooks Online, enabling real-time, two-way synchronization that automatically records every payment detail,” said Richard Love, CEO at Checkrun parent company, AP Technology. “With this integration, electronic remittance advice is sent to vendors, and businesses gain full access to digital audit trails, ensuring complete transparency for all transactions.”

One of Checkrun’s most popular features is its mobile app, which allows users to authorize, sign, and manage payments from any mobile device, from any location. This eliminates the need to track down approvers or to rush back to the office to sign and issue checks, giving businesses the flexibility to manage their payments on-the-go.

Checkrun provides fully configurable workflows, enabling businesses to set-up unique security and approval processes that align with their specific operational needs. Whether it’s multiple approval layers or specific role-based permissions, Checkrun allows for tailored security measures and use cases.

Security remains an important payment priority, and Checkrun helps protect businesses from check fraud through automated Positive Pay, a widely trusted solution recommended by banks. This advanced protection ensures every payment is verified before being processed.

With Checkrun, businesses maintain full control over their payments without the need for pre-funding accounts. This provides businesses with greater financial flexibility and control over their cash flow. For more information on Checkrun by AP Technology or to start a free trial, visit Checkrun.com.

About AP Technology

AP Technology is a Carlsbad, California-based company founded in 1989 that creates business payment issuance software for banks, insurance companies, law firms, government offices, and businesses of all sizes and all payment volumes. Annually, AP Technology customers process more than $140 billion in payments through the Company’s suite of payment solutions that includes: APSecure, SecureCheck, SecurePay Advantage, ezSigner Direct, and Checkrun. AP Technology is a trusted payment partner, providing next-generation security, efficiency, speed, mobility, remote printing and payment automation to payment disbursement processes. For more information on AP Technology products, please visit: https://www.aptechnology.com/

END ###

Greg Wilfahrt

AP Technology

+1 800-652-2877

email us here

Visit us on social media:

Facebook

X

LinkedIn

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.