Q-o-Q Surge in Term Insurance Prices Emphasises the Importance of Early Purchase

PolicyX.com's term insurance price index reveals a 3.63% increase in term insurance prices over the quarter.

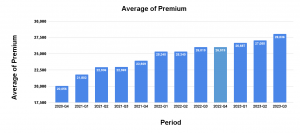

GURUGRAM, HARYANA, INDIA, November 30, 2023 /EINPresswire.com/ -- According to the latest Term Insurance Price Index report provided by PolicyX.com, revealing a notable 3.63% increase in Quarter 3, 2023, as compared to Quarter 2, 2023. This data underscores the growing significance of acquiring term insurance at an earlier age to lock the prices.The quarter-to-quarter rise highlights the dynamic nature of the insurance landscape, emphasising the need for individuals to consider securing term insurance without delay. Beyond the quarterly statistics, a closer examination reveals a concerning increase of 40% from the start of the index in Q4-2020, signalling a sustained upward trend in term insurance premiums.

Key Highlights from the Latest Term Insurance Price Index:

1) Term Insurance Premium Averages:- In the latest Quarter 3, 2023 Term Insurance Price Index, PolicyX.com shows key insights into premium trends for a sum assured of INR 50 Lakh

- Non-Smokers (25-Year-Olds) (50 lac cover)

- Female: Average premium of INR 6,265

- Male: Average premium of INR 7,012

- Smokers (25-Year-Olds) (50 lac cover):

- Female: Average premium of INR 10,317

- Male: Average premium of INR 11,563

The above figures highlight the influence of individual factors like smoking habits and gender on term insurance premiums. Smokers pay on an average upto 70% higher than non-smokers highlighting the fact that smokers are at significant risk of early death.

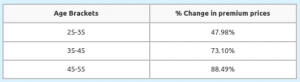

2) Impact of Age on Term Insurance Premiums:- Critical insights into the correlation between age and term insurance premiums. The below data underscores the significant impact of delaying the purchase of a term policy by a decade according to the latest Quarter 3 2023 Report

Premium Variation with Age:-

- 25-Year-Old: Delaying by 10 years could result in an average premium increase of 47.98%.

- 35-Year-Old: For a 35-year-old, the delay of 10 years could lead to a 73.10% higher average premium.

- 45-Year-Old: Individuals aged 45 may face an 88.49% increase in average premium by postponing the purchase by a decade.

These findings emphasize the financial repercussions of procrastination when it comes to securing a term insurance policy. This variation was observed across sum assured and across companies.

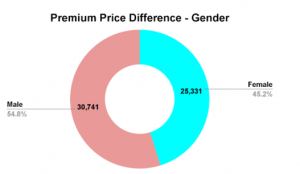

3) Gender-Based Premium Variations:- The latest findings indicate a 21.36% premium difference based on gender. Actuarial insights highlight that, on average, males pay higher premiums than females, emphasizing the importance of informed gender-based risk assessment in premium structures. Please refer to the pie chart which shows Gender premium variations

4) Impact of Habits on Term Insurance Premiums:-

The data reveals a substantial impact of smoking on term insurance premiums, distinguishing it from health insurance. In the context of habits, both male and female smokers experience a noteworthy difference in premium rates when compared to their non-smoking counterparts.

Premium Variation by Gender:

- Male Smokers: Pay a premium 68.29% higher than non-smoking individuals for a 1 crore cover.

- Female Smokers: Exhibit a comparable increase in premiums, reflecting a similar trend.

About PolicyX.com Term Insurance Price Index:

The prices and charts displayed above are based on the average premium prices of the top 5 life insurance companies in India in terms of their GWP. The companies considered in our analyses are Kotak Life Insurance, HDFC Life, ICICI Prudential, Max Life, and Bajaj Allianz Life.

The prices represent the average annual premium payable (as of the quarter ended December 2023) against a sample profile based on age, gender, and smoking status. In addition, the analyses also factor in the sum assured and the policy type (Term Insurance) for a comprehensive evaluation. It is important to note that the insurer's individual rate may vary depending on age, gender, health profile, sum assured & coverage type.

PolicyX.com started India's first insurance price index to track insurance premium prices in India to enable customers, industry participants, distributors to assess the price movements across quarters. The index is released every quarter.

About PolicyX.com

PolicyX.com is an IRDA approved insurance comparison portal helping consumers compare, choose, and buy policies online. The company was founded with an aim to provide consumers with expert guidance in selecting health & life insurance plans from top insurance companies in India.

PolicyX.com today is a highly reputable organization providing trustworthy advice to millions of Indians every year with its team of 300+. More than 8.2 million visitors used PolicyX.com for their insurance decisions in the financial year 2023.

Priya Singh

Gurgaon

Priya Singh

PolicyX.com

email us here

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.