60% of consumers planning to get a new car say affordability is impacting their purchase decision – GfK

47% of those affected plan to postpone buying for over 1 year

NEW YORK, NY, UNITED STATES, March 16, 2023 /EINPresswire.com/ -- With the average price of a new car approaching $50,000 – and many buyers still paying MSRP or above – affordability remains top of mind for millions of car shoppers. In fact, new research from GfK AutoMobility® shows that 60% of US auto “intenders” – those planning to buy or lease a new vehicle – say that affordability is already affecting their decision.Click here to view our webinar on trends in the auto market

Nearly half (47%) of affected intenders – and 29% of those who plan buy in the next 12 months – report that they will postpone their purchase by over 1 year. (See Chart 1.) Other common coping strategies – more prevalent among near-term intenders – include cutting expenses in other areas, switching to a lower-cost vehicle, and looking for longer-term financing.

Over 8 in 10 (83%) of those affected by this affordability crisis are planning to purchase a Non-Luxury vehicle, and 53% are specifically planning to buy a Non-Luxury SUV. GfK AutoMobility® data also show that Non-Lux SUVs account for 42% of overall industry demand – and fully half (50%) of Non-Lux SUV intenders impacted by affordability say they plan to postpone their purchase at least a year; that is double the proportion for all intenders.

Lower-income consumers are also much more likely to have affordability concerns – 71% of those who say high prices are impacting their vehicle decisions live in households earning less than $100,000 a year, while just 13% are in homes earning $150,000 or more. (See Chart 2.) GfK also found that, since January 2020, the largest drop in vehicle demand has been among middle-income buyers (those earning $50,000 to $100,000 a year), especially those married with children.

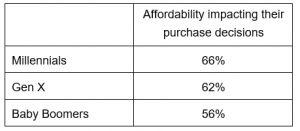

GfK also found that money worries are having a big impact on near-term Millennial auto intenders – with two-thirds (66%) reporting that affordability is impacting their car purchase decision. (See Table 1. ) Almost four in 10 (37%) affected near-term Millennials say they would cut expenses in other areas to afford a new vehicle, while 31% said they would switch to a lower-cost model, and 29% plan to look for longer-term financing.

“At a time when many consumers are worrying about money on a daily basis, auto makers and dealers have raised prices and all but eliminated promotions,” said Julie Kenar, SVP,Consulting, of GfK AutoMobility. “The question is: Who can still afford a new vehicle – and how will they make the finances work? Our new analysis shows that coping strategies differ dramatically depending on income, generation, time of intention, and other factors. To help more Americans find ways to afford a new car, manufacturers and sellers need to understand fully the challenges consumers face – and the purchase strategies they plan to employ.”

GfK AutoMobility® is the leading Auto Intenders Brand and Attitude Insights research in the US. Since 1982, GfK’s Automotive Purchase Funnel has been the bedrock for analysis and insights throughout the automotive industry. The funnel consistently tracks performance throughout each stage of the purchase process, determines competitive strengths and weaknesses, assesses consumer responses to marketing actions, and provides you with overall guidance and diagnostics for managing marketing actions.

David Stanton

GfK

+ 19088759844

email us here

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.