Nada Partners with IRA Platform Rocket Dollar

Nada is announcing a new strategic partnership with Rocket Dollar, the fastest growing self-directed IRA platform for investing in alternative assets.

DALLAS, TX, USA, November 17, 2022 /EINPresswire.com/ -- Nada, a real investment fintech company, is announcing a new strategic partnership with Rocket Dollar, the fastest-growing self-directed IRA platform for investing in alternative assets. Enjoying the tax advantages of IRA accounts, Rocket Dollar allows account holders to invest in alternative assets outside of stocks and bonds such as real estate, private equity, startups, cryptocurrency, and more.According to Sundance Brennan, VP of Revenue, “The ability to hold alternative real estate investments, like Cityfunds by Nada, in a self-directed IRA gives financial control back to those that deserve it most. The Rocket Dollar and Nada partnership allow investors to prioritize based on their own specific circumstances on a platform that is both easy to access and reliable to use. We couldn’t be happier with the presentation and availability on the Rocket Dollar portal.”

“Rocket Dollar was founded in 2018 based upon the belief that retirement is changing, and so is the way people want to invest for their retirement. Account holders are free to invest in any asset class allowed by the IRS, including Real Estate, which can be a fantastic hedge against inflation. Diversification is a key goal for many of our account holders and investing in assets that have a low correlation with stocks and bonds provides the level of portfolio diversification they seek." says Thomas Young, Co-founder and VP of Marketing of Rocket Dollar about adding Real Estate assets in a self-directed IRA.

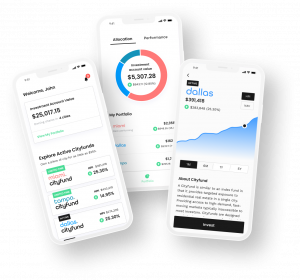

In the three years since its founding, Nada has delivered financial solutions that have powerful benefits for both real estate investors and homeowners. The company is transforming the way people invest in real estate by providing access to opportunities that were previously only available to accredited investors. For the first time ever, retail investors can buy and sell shares of a top city, for as little as $250, on the platform by investing in Nada’s “Cityfunds” investment product. This product is an index-like real estate fund providing targeted exposure to a single city’s home equity market. Homeowners can access their home equity to spend on the Nada debit card without the encumbrances associated with adding new debt. With the combination of these solutions, everyone can start building real estate wealth on the Nada platform starting with opening a free account.

About Nada

Nada is unlocking the $27 trillion home equity market for retail investors and homeowners. Its platform makes it possible for any investor to buy & sell fractions of a top city’s real estate market and for homeowners to unlock home equity, without taking on debt, to spend on a debit card. Fractionalizing homeownership and leveling the playing field for retail investors with the first banking and investing platform built for real estate. Nada is backed by LiveOak Venture Partners, Revolution’s Rise of the Rest Seed Fund, Capital Factory Ventures, 7BC Venture Capital, and Sweater Ventures.

About Rocket Dollar

Rocket Dollar provides self-directed retirement accounts to individuals who want to use their retirement savings to invest in any alternative asset allowed by the IRS such as real estate, crypto, startups, lending, and more, without losing any IRA tax benefits. With customers in all 50 states, Rocket Dollar’s platform makes investing fast, simple, and safe.

Poorvi Mody

www.nada.co

Marketing@nada.co

Visit us on social media:

Facebook

Twitter

LinkedIn

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.