New ENERGY STAR Multifamily Online On-Demand Course with Latest EPA Information

The Inflation Reduction Act includes substantial tax incentives for ENERGY STAR certified buildings inspected and certified by highly trained HERS* raters.

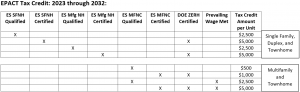

How lucrative are the tax incentives for buildings that qualify for ENERGY STAR certification? The tax incentives are in tiers that pay considerably more if the workers on the building project are paid prevailing wage. In fact, if you were to build the most efficient apartment complex that meets the DOE Zero Energy Ready Home (DOE ZERH) program and also pay your workers the prevailing wage you would get $5,000 per apartment unit in tax incentives. A 20 unit apartment complex that met the DOE ZERH requirements and built using prevailing wage workers would get a $100,000 tax incentive! (20 X $5,000 = $100,000) A handy chart listing the building types and tax incentive amounts is attached along with information explaining this chart.

Note that in order to get a building certified as ENERGY STAR and to obtain the appropriate tax incentive you need to enlist the help of a certified home energy rater, not an energy auditor. There is some confusion as to the difference between an energy auditor and an energy rater so here is an article that can help clear this up.

*HERS - Home Energy Rating Systems

*RESNET - Residential Energy Services Network

Ken Riead

EnergySmart Institute

+1 816-224-5550

contact@energysmartinstitute.com

Visit us on social media:

Facebook

Twitter

LinkedIn

Award Winning Video named "Do you need a HERS rating?"

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.