GMSacha Inchi beverage could be the next Silk

GMSacha Inchi beverage could be the next Silk because it is the only beverage with Omega 3,6,9, and a complete vegan protein with all 9 essential amino acids

QED Connect (OTCMKTS:QEDN)

MEDELLIN, ANTIOQUIA, COLOMBIA, August 25, 2022 /EINPresswire.com/ -- Press Release

FOR IMMEDIATE RELEASE

August 25, 2022

GMSacha Inchi beverage could be the next Silk

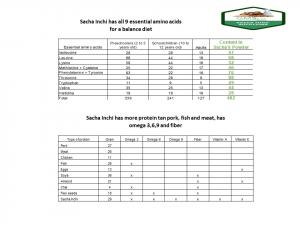

MEDELLIN, Colombia- QED Connect (OTC: QEDN) with its subsidiary GMS (Green Mind Solution SAS) registered in Medellin Colombia has developed the only process in the world to convert 100 % of Sacha Inchi seed into powder and then into a beverage. GMSacha Inchi has developed the only beverage in the world with Omega 3,6,9 and a complete vegan protein with all 9 amino acids.

“The plant-based beverages market size was estimated to be valued at USD 11.16 billion in 2018 and is projected to reach USD 19.67 billion by 2023, at a CAGR of 12.0% during the forecast period. Plant-based beverages provide consumers with options that are low in cholesterol and calories. The growth of the plant-based beverages market is attributed to the shift in preference toward vegan diets among consumers at a global level. Apart from this, major food companies such as Danone (US) have been showing interest in plant-based beverages; this is expected to give the market a boost.”

https://www.marketsandmarkets.com/Market-Reports/plant-based-beverage-market-34414144.html?gclid=Cj0KCQjwgO2XBhCaARIsANrW2X2Q76eAB5dzAmDnzkMSWxW4v-aAMGhf5KJpPkioJUumzYVYiSLOiBMaAmXSEALw_wcB

In 2002 WhiteWaves created the brand, Silk. In 2002 WhiteWave was bought by Dean Foods for over $300 Million. In 2010 Silk introduced the Silk Pure Almond the first non-soy-based product. In 2013 WhiteWave Food separated from Dean Foods and became a publicly trades company. In July 2016 Danone purchased WhiteWave Food for $10.4 billion USD.

Making Almond milk is relatively easy, and most grocery stores are making their own almond milk brand. On the other hand, Sacha Inchi is a very difficult seed that has very bad taste, therefore the technology that GMSacha Inchi has is the only one in the world.

GMSacha Inchi has a higher nutritional value than any almond beverage on the market because has Omega 3,6,9, and a complete vegan protein with all 9 amino acids, this is the reason GMSacha Inchi beverage could become the next Silk.

GMSacha Inchi has contracts with over 255 farmers to purchase all their production of Sacha Inchi. GMSacha Inchi has the capacity to produce over 7,500,000 liters per year for 2023 and 2024. GMSacha Inchi is already planning to double its capacity every year starting in 2025.

GMSacha Inchi has been approved to sell to Carulla and Grupo Exito in Colombia www.grupoexito.com

QED Connect has submitted a RFP to a major grocery store in the USA to sell GMSacha Inchi beverages in 2022 and 2023.

QED Connect (GMSacha Inchi ) has been accepted to the plant base program of Range me and we have confirmed a private meeting from October 11 to 13 with the following companies: Associated Food Stores, Blue Marble Brands, Brightfield Group, Chex Finer Foods, Food Bazar Supermarket, Kehe Distribution just to name a few.

QED Connect with GMS has also developed GMSacha Inchi snack, GMSacha Inchi powder, GMSacha Inchi pet food, and GMSacha Inchi infusion that will be in the USA markets in late 2022 o 2023.

A “safe harbor” for forward-looking statements is provided by the Private Securities Litigation Reform Act of 1995 (Reform Act of 1995). The Reform Act of 1995 was adopted to encourage such forward-looking statements without the threat of litigation, provided those statements are identified as forward-looking and are accompanied by meaningful cautionary statements identifying important factors that could cause the actual results to differ materially from those projected in the statement. Forward-looking statements have been and will be made in written documents and oral presentations of QED Connect (GMS) and its subsidiaries. Such statements are based on management’s beliefs, as well as assumptions made by and information currently available to management. When used in this filing, the words “believe”, “anticipate”, “endeavor”, “estimate”, “expect”, “objective”, “projection”, “forecast”, “goal” and similar expressions are intended to identify forward-looking statements. In addition to any assumptions and other factors referred to specifically in connection with such forward-looking statements, factors that could cause QED Connect (GMS) and its subsidiaries’ actual results to differ materially from those contemplated in any forward-looking statements include, among others, the following:

•Factors affecting utility operations such as unusual weather conditions; catastrophic weather-related damage; unusual maintenance or repairs; unanticipated changes to fossil fuel costs; unanticipated changes to gas supply costs, or availability due to higher demand, shortages, transportation problems or other developments; environmental or pipeline incidents; transmission or distribution incidents; unanticipated changes to electric energy supply costs, or availability due to demand, shortages, transmission problems or other developments; or electric transmission or gas pipeline system constraints.

•Increased competition in the energy environment including effects of industry restructuring and unbundling.

•Regulatory factors such as unanticipated changes in rate-setting policies or procedures, recovery of investments and costs made under traditional regulation, and the frequency and timing of rate increases.

•Financial or regulatory accounting principles or policies imposed by the Financial Accounting Standards Board; the Securities and Exchange Commission; the Federal Energy Regulatory Commission; state public utility commissions; state entities that regulate electric and natural gas transmission and distribution, natural gas gathering and processing, electric power supply; and similar entities with regulatory oversight.

•Economic conditions including the effects of an economic downturn, inflation rates, commodity prices, and monetary fluctuations.

•Changing market conditions and a variety of other factors associated with physical energy and financial trading activities including, but not limited to, price, basis, credit, liquidity, volatility, capacity, interest rate, and warranty risks.

•The performance of projects undertaken by the Company’s nonregulated businesses and the success of efforts to invest in and develop new opportunities, including but not limited to, the realization of Section 29 income tax credits and the Company’s coal mining, gas marketing, and broadband strategies.

•Direct or indirect effects on our business, financial condition or liquidity resulting from a change in our credit rating, changes in interest rates, and/or changes in market perceptions of the utility industry and other energy-related industries.

•Employee or contractor workforce factors including changes in key executives, collective bargaining agreements with union employees, or work stoppages.

•Legal and regulatory delays

Nanny Katharina Bahnsen

GMS Semilla Saludable

+1 7753918601

email us here

Visit us on social media:

Facebook

Twitter

LinkedIn

GMSacha Inchi at Gulfood one of the top brands

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.