Cognerium Launches AI-Powered Digital Banking Platform for Credit Unions and Banks

Our goal is to level the playing field for credit unions and small-medium banks so they can compete with the large banks.”

BOCA RATON, FLORIDA, UNITED STATES, July 11, 2022 /EINPresswire.com/ -- Cognerium, a fintech startup that provides an artificial intelligence (AI) powered digital banking solution, has announced the launch of its software platform specifically for credit unions and small-medium banks.— Cognerium CEO, Assad M. Shaik

This new product will help these financial institutions quickly digitize their operations and launch new financial products to keep up with the changing needs of their customers.

"In an age of digital transformation, small-medium banks and credit unions are being left behind because they lack the resources to keep up with the large banks," said Cognerium CEO, Assad M. Shaik. "With Cognerium, they can quickly digitize their operations and launch new financial products, as well as provide banking services to new market segments such as the cryptocurrency market."

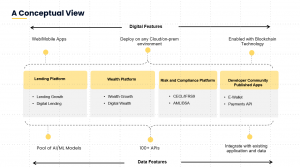

Cognerium’s digital banking platform includes features such as digital lending, wealth management, and anti-money laundering. The company says this product is a complete solution for banks and credit unions to stay competitive in a rapidly changing marketplace. Below is a quick overview of Cognerium’s digital banking platform:

• Digital Lending: From loan origination and disbursement to loan management, Cognerium offers a seamless, end-to-end digital lending solution. It transforms the lending process for both borrowers and lenders, making it faster, easier, and more transparent.

• Lending Growth - Our innovative CRM is powered by artificial intelligence to empower the sales and marketing team to grow the lending portfolio across both secured and unsecured loan types. It helps banks and credit unions increase loan growth, cross-sell products, and improve customer retention.

• Digital Wealth - Our Mobile-First Robo Advisor App helps banks and credit unions offer their customers a personalized, automated, and intelligent investing experience. With our app, your customers can easily manage their finances on the go and make informed investment decisions.

• Wealth Growth - A complete platform tailored to address the needs of wealth management business starting from business planning, marketing, sales and client retention and management.

• Anti-Money Laundering - Real-time analytics to screen high volume transactions for money laundering, powered with Machine learning models to detect hidden patterns.

• CECL - Our AI-driven current expected credit losses (CECL) solution is a highly scalable and fault-tolerant platform that helps banks meet the CECL compliance requirements and address credit impairment concerns.

"Our goal is to level the playing field for credit unions and small-medium banks so they can compete with the large banks," said CEO's Assad. "With our platform, they can offer their customers the same digital banking experience without having to make a large investment."

Cognerium’s digital banking platform is available now. For more information, visit cognerium.com or contact info@cognerium.com.

Assad M. Shaik

Cognerium

contact@cognerium.com

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.