California Mandates Companies Have A Retirement Plan: There Is A Plan With Bitcoin

Californian companies looking to create a 401k plan for their employees now have options that include direct exposure to Bitcoin

Bitcoin is now an option in 401k plans”

NEWPORT BEACH, CALIFORNIA, USA, June 29, 2022 /EINPresswire.com/ -- By June 30, 2022, all California employers with five or more employees must comply and have a retirement program in place otherwise face a penalty. There are two basic options and one unique option. An employer can have their payroll provider implement a vanilla plan or register with CalSavers. The 3rd option is a retirement plan that uses diversified funds and incorporates Bitcoin.— DAIM

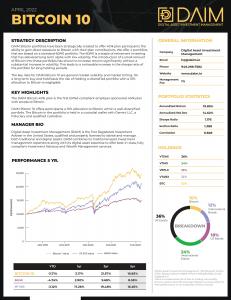

DAIM is an industry leading crypto advisor that offers 401k plans on a pre and post tax basis. Our plans give participants exposure to Bitcoin, bought on exchange through Gemini. DAIM offers 4 portfolios based on a traditional 60/40 stock/bond allocation. Participants can invest in a traditional portfolio or choose an option that has 1%, 5%, or 10% allocation to pure Bitcoin.

Click on the image to see the factsheet for the portfolio with a 10% allocation to Bitcoin.

Contact DAIM at hq@DAIM.io or 888-600-4522 to learn more. www.daim.io/corporations

California law requires that employers doing business in California that do not offer a 401(k) plan must register under the CalSavers Retirement Program (the “CalSavers Program” or “Program”) and provide employee census information in order for CalSavers to automatically enroll eligible employees in a retirement savings program. The deadline is June 30th. As an employer you may face a $250 fine per employee if noncompliance extends beyond 90 days and an additional $500 fine per employee if noncompliance extends beyond 180 days.

CalSavers contributions are made automatically from your paycheck on an after-tax basis. The CalSavers Plan is a Roth IRA and subject to income limitations. If your AGI is above the threshold you may not qualify.

Public Relations

DAIM

+1 888-600-4522

email us here

Visit us on social media:

Twitter

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.