Reinsurance Market To Scale Revenues By Offering Bundled Products And Services

The Business Research Company’s Reinsurance Global Market Report 2022 – Market Size, Trends, And Global Forecast 2022-2026

LONDON, GREATER LONDON, UK, March 25, 2022 /EINPresswire.com/ -- Reinsurers across the globe are offering bundled products and services to enhance their revenues. This change is a result of diverse choices, attractive prices, and broader coverage offered by reinsurers to gain additional market share and cut down costs. This approach has helped the global reinsurance market to close business deals at a group level, thereby reducing the need for reinsurance at different levels. For instance, reinsurance companies Generali and Allianz have adopted a bundled approach, enabling them to get better oversight of the global market and cut down the cost of offering reinsurance services.

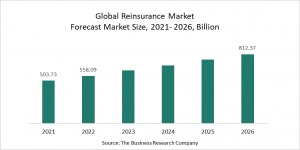

The global reinsurance market size is expected to grow from $503.73 billion in 2021 to $558.09 billion in 2022 at a compound annual growth rate (CAGR) of 10.8%. The global reinsurance market share is then expected to grow to $812.37 billion in 2026 at a CAGR of 9.8%.

Read more on the Global Reinsurance Market Report

https://www.thebusinessresearchcompany.com/report/reinsurance-global-market-report

Reinsurance providers are integrating their processes with blockchain technology to reduce costs, increase efficiency, transparency, security associated with client data and other financial transactions shaping the reinsurance market outlook. Blockchain is a distributed decentralized ledger and is a shared database (can be saved, owned, updated at different levels), not managed by a central authority, comprising secure transactions, authenticated and verifiable. It reduces processing time and transactions costs, improves compliance, avoids re-entries, claims leakages, and frauds, minimizes time to settle losses, and ensures cryptographic security. For instance, blockchain technology could save costs of reinsurance companies by more than $5 billion globally.

Western Europe was the largest region in the global reinsurance market in 2021. The Asia Pacific was the second largest region in the reinsurance global market. The regions covered in the reinsurance market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, and Africa.

Major players covered in the global reinsurance industry are Munich Re, SWISS Re, Hannover Re, Talanx, SCOR SE, Berkshire Hathaway Inc., China Reinsurance (Group) Corp, Lloyd’s of London, Axa Group, Reinsurance Group of America Inc.

TBRC’s reinsurance global market report is segmented by type into property and casualty reinsurance, life and health reinsurance, by distribution channel into direct writing, broker, by mode into online, offline, by organization location into domestic, international.

Reinsurance Global Market Report 2022 – By Type (Property And Casualty Reinsurance, Life And Health Reinsurance), By Distribution Channel (Direct Writing, Broker), By Mode (Online, Offline), By Organization Location (Domestic, International) – Market Size, Trends, And Global Forecast 2022-2026 is one of a series of new reports from The Business Research Company that provides a reinsurance market overview, forecast reinsurance market size and growth for the whole market, reinsurance market segments, geographies, reinsurance market trends, reinsurance market drivers, restraints, leading competitors’ revenues, profiles, and market shares.

Request for a Sample of the Global Reinsurance Market Report:

https://www.thebusinessresearchcompany.com/sample.aspx?id=3528&type=smp

Not what you were looking for? Here is a list of similar reports by The Business Research Company:

Insurance Brokers Market Report 2022 – By Type (Life Insurance, General Insurance, Health Insurance), By Mode (Offline, Online), By End User (Corporate, Individual) – Market Size, Trends, And Global Forecast 2022-2026

https://www.thebusinessresearchcompany.com/report/insurance-brokers-global-market-report

Insurance Agencies Market Report 2022 – By Insurance (Life Insurance, Property And Casualty Insurance, Health And Medical Insurance), By Mode (Online, Offline), By End User (Corporate, Individual) – Market Size, Trends, And Global Forecast 2022-2026

https://www.thebusinessresearchcompany.com/report/insurance-agencies-global-market-report

Insurance, Reinsurance And Insurance Brokerage Global Market Report 2022 – By Type (Insurance, Insurance Brokers And Agents, Reinsurance), By Mode (Online, Offline), By End User (Corporate, Individual) – Market Size, Trends, And Global Forecast 2022-2026

https://www.thebusinessresearchcompany.com/report/insurance-reinsurance-and-insurance-brokerage-global-market-report

About The Business Research Company?

The Business Research Company is a market research and intelligence firm that excels in company, market, and consumer research. It has over 200 research professionals at its offices in India, the UK and the US, as well a network of trained researchers globally. It has specialist consultants in a wide range of industries including manufacturing, healthcare, financial services and technology.

Read more about us at https://www.thebusinessresearchcompany.com/about-the-business-research-company.aspx

Call us now for personal assistance with your purchase:

Europe: +44 207 1930 708

Asia: +91 88972 63534

Americas: +1 315 623 0293

Email: info@tbrc.info

Check out our:

LinkedIn: https://bit.ly/3b7850r

Twitter: https://bit.ly/3b1rmjS

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ

Blog: http://blog.tbrc.info/

Oliver Guirdham

The Business Research Company

+44 20 7193 0708

info@tbrc.info

Visit us on social media:

Facebook

Twitter

LinkedIn

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.