Global Demand for Energy Storage Expected to Exceed 100 GWh in 2025

China Dominates Global Battery Cell Manufacturing, Housing 75% of Capacity, According to Clean Energy Associates’ Latest Market Intelligence Report

DENVER, COLORADO, UNITED STATES, March 9, 2022 /EINPresswire.com/ -- Driven by growth in renewable energy deployments, combined with high energy costs from natural disasters, and increasing concerns around energy security, global demand for energy storage is expected to surpass 100 GWh in 2025 according to the latest market intelligence report issued by Clean Energy Associates (CEA), a leading solar and energy storage technical advisory.China, Europe, and North America are the top regions for energy storage system (ESS) cell manufacturing. China dominates a key aspect of the market, housing 75% of the global battery cell manufacturing capacity, according to CEA’s H2 2021 Energy Storage System (ESS) Supplier Market Intelligence Program report (SMIP). More than 250 battery cell factories are in operation, under construction, or planned in China. As European market influencers look to reduce reliance on Asian supply chains, battery manufacturers such as SKI Innovation, CATL, and BYD have all announced plans to expand their presence in Europe.

Increasing Material Supply Constraints May Hurt ESS Deployment Growth

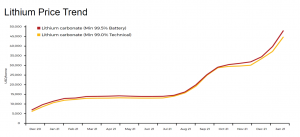

Despite rapid growth in battery cell manufacturing capacities, battery availability may not keep pace with new factory expansion due to material supply constraints and high mineral prices. ESS prices started to rise at the end of 2021 due to supply chain bottlenecks, stopping a longstanding general trend of year-on-year price declines for lithium-ion storage. However, even in a high price environment, demand from large-scale renewable projects is expected to sustain ESS purchasing and lead to strong base growth in ESS deployment despite the higher-than-expected prices. China and the United States are still expected to represent more than half of the global ESS market over the next five years.

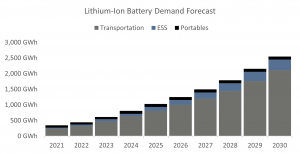

EVs to Dominate Battery Demand and Deployment

Carbon neutrality targets in both Europe and the United States are significant drivers in the demand for lithium-ion batteries in both transportation and stationary storage sectors. Through this decade, energy storage systems will account for 10% of annual lithium-ion battery deployments and electric vehicle (EV) fleets will account for 90%. Accelerating demand from the EV sector is expected to maintain upward price movement for most battery materials in 2022.

With EV makers aiming to develop higher energy density batteries to reduce upfront costs while increasing EV range, the ESS sector will experience strong spillover effects from EV technology advancements. On the supply side, battery manufacturers continue to focus on expanding their capacities to capture the ever-increasing demand and maintain their market share in both the EV and ESS sectors. However, despite impressive nameplate capacities and aggressive expansion plans, manufacturing capacity online and ramped for production from qualified and bankable cell suppliers remains a large barrier for downstream battery cell buyers. Rapid supplier expansion is also causing prices of various minerals such as lithium, cobalt, and graphite to increase, and more manufacturers look to procure a still limited pool of mineral resources.

Lithium-iron-phosphate Continues to Gain Market Share Due to Costs and Safety Advantages

The lithium-iron-phosphate (LFP) cell chemistry continues to gain market share as it provides automakers with a lower cost alternative to the NCM (nickel-cobalt-manganese) and NCA (nickel-cobalt-aluminum) chemistries. LFP accounted for around 52% of total battery installations (both EV and ESS) in China in 2021. The combination of LFP’s safety advantages and lower costs, even as all raw material prices increase, make it a favorable solution for entry-level EV models and stationary energy storage applications.

Suppliers are also focusing on the development of cost-competitive long-duration energy storage (LDES) technologies as renewable energy sources account for a growing share of utility portfolios. Suppliers are also expected to double down safety features following renewed fire concerns and ever increasing LFP energy densities. Flow batteries, solid-state batteries, and sodium-ion batteries are also discussed in this report as alternatives to traditional lithium-ion battery technologies.

The complete ESS SMIP report, authored by CEA’s Energy Storage and Market Intelligence teams, includes in-depth analysis and insights gathered from 1-on-1 interviews with technical leaders at dozens of the industry’s leading manufacturers. The H2 2021 ESS SMIP report covers global energy storage market trends, technology trends, price analysis and forecasting, supplier overviews, and more.

Loretta Prencipe

Clean Energy Associates

+1 202-658-9024

email us here

Visit us on social media:

Twitter

LinkedIn

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.