Solar Market Price Corrections Forecasted for 2022 as 175+ GW of New Polysilicon Capacity Expected to Come Online

Q4 2021 module and cell capacity expansions were smaller than expected as many suppliers took old equipment offline and GCL exited cell production entirely.

DENVER, COLORADO, UNITED STATES, February 25, 2022 /EINPresswire.com/ -- Clean Energy Associates (CEA), a leading solar and storage supply technical advisory, released its Q4 2021 PV Supplier Market Intelligence Program Report (SMIP). The subscription-only report, authored by CEA’s Market Intelligence team, includes proprietary insights gathered from 1-on-1 interviews with technical leaders at many of the world’s leading solar suppliers.CEA’s Q4 2021 SMIP report analyzes the progress of capacity expansions catering to large wafer modules and other power-boosting module technologies. In addition to analyzing significant polysilicon expansions expected to come online in 2022 the Q4 SMIP report also reviews the potential impact of China’s energy control policies that may continue to create energy supply constraints in 2022.

Over 500,000 Tonnes of New Polysilicon Capacity to Come Online Over 2022 Leading to Price Corrections in Solar Market

With the rapid removal of most energy control restrictions in China in Q4 2021, many polysilicon makers are now rushing to ramp up new capacities to take advantage of high polysilicon prices while supplies remain constricted. The first tranche of polysilicon expansions, which started in late 2020, are starting to come online. Many will finish ramping up to full production in early to mid-2022, releasing a significant amount of new polysilicon into the market. Despite many follow-up expansions still in construction, both new and established suppliers are continuing to announce new polysilicon production capacities.

Production Line Updates Led to Slowdown in Module Capacity Expansions; GCL Exited Cell Production

Based on exclusive 1-to-1 interviews with module suppliers covered in CEA’s Supplier Market Intelligence Program, fourth-quarter module and cell capacity expansions were smaller than expected, as many suppliers took old equipment offline and GCL exited cell production entirely. Some expansions did not materialize by the end of 2021 due to a challenging global manufacturing environment and trade tensions with the United States.

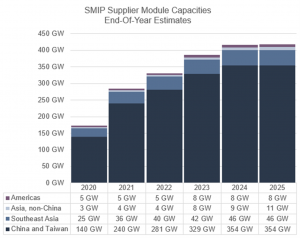

With a more robust outlook projected, ingot, wafer, cell, and module capacities will continue to increase over the next two years, with around 45 GW of additional module capacity slated to come online by the end of 2022 followed by over 55 GW of new module capacity in 2023.

TOPCon and HJT Cell Capacity Updates Announced by New PV Supplier Entrants

In addition to many suppliers reaching PERC cell efficiencies of 23.0% or higher, several established players and new entrants have announced TOPCon and HJT cell capacities. While many new entrants are suspected of not bringing these production lines online at the scale or timeline previously announced, many interviewed suppliers have made progress in implementing these upgrades. Most suppliers are expected to convert existing PERC lines to TOPCon within the next few years to break past PERC’s commercial efficiency threshold of about 23.7%.

European Suppliers Announce Sizeable Capacities, But the Largest Expansions are Currently Only in Planning Stages

Europe has a strategic interest in rehoming PV manufacturing capacity from ingot to module production due to high logistics costs, volatile energy commodity prices, and political interest in decoupling supply chains from China. Ingot, wafer, and cell production capacities will see the largest relative increase over the next few years, with ingot and wafer capacities potentially growing tenfold to over 20 GW by the end of 2025. Cell capacities currently total approximately 2.5 GW, and these capacities could grow to over 30 GW over the next four years based on current supplier expansion plans.

European module capacity is expected to increase from 11 GW in 2021 to over 45 GW by the end of 2025. Many timelines for announced expansions are not definitive and are based on general industry timelines. Many expansions depend on government funding and policy support and could change based on the benefits extended to solar manufacturing.

China’s 2022 Dual Control Policy Clarified: New Renewable Generation Unlikely to be Curtailed

In 2021, the Chinese government announced “Dual Control” policies on energy consumption and energy intensity. Energy generation control measures in Q3 and early Q4 2021 led to intermittent energy shortages and price increase of all main PV module inputs. China’s central party is planning to make Dual Control policies less disruptive in 2022 by making the policy’s objectives clearer. Consumption of energy from new renewable generation capacities may not face generation restrictions and will not be counted in provincial energy targets.

In addition to diving deeper on the topics listed here, the complete Q4 SMIP report covers policy updates related to the PV industry, reliability concerns for new products, detailed module and raw material capacity information, and up-to-date operational data for the largest solar suppliers.

The complete report, authored by CEA’s Market Intelligence team, is available for purchase and includes insights gathered from 1-on-1 interviews with the technical leaders at many of the industry’s leading suppliers.

About Clean Energy Associates

CLEAN ENERGY ASSOCIATES (www.cleanenergyassociates.com) provides technical due diligence and engineering services for solar PV and energy storage clients around the globe who are financial institutions, project developers, EPCs, IPPs, and PV power plant owners.

CEA’s global team serves the solar PV and energy storage industries through expertise in PV modules, racking, inverters, transformers, and energy storage systems. Since 2008, CEA has reduced Buyers' risks and improved returns on investments via technical assurance and engineering services.

Loretta Prencipe

Clean Energy Associates

+1 202-658-9024

pr@cea3.com

Visit us on social media:

Twitter

LinkedIn

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.