Circle Power Renewables Offers Contracts to Officials to Guarantee New Property Tax Revenue

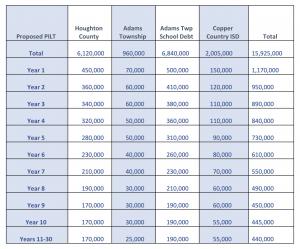

Payment In Lieu of Taxes (PILT) guarantees entities would receive $15.9 million in property tax revenue even if future rules decreased the project’s tax burden.

Circle Power Renewables CEO Jordan Roberts had this to say about offering up the contracts, which would guarantee the revenue to these entities:

“We heard real concerns from residents that we at Circle Power would try to lower our tax bill after Scotia Wind is permitted. However, when we said the project would result in at least $15.9 million in new property tax revenue, we meant it. Host communities deserve to know they can count on our commitment, which is why we are offering this contractual, legally-binding guarantee.”

In putting together the draft PILT agreements, Circle Power Renewables turned to tax attorney Jack Van Coevering of Foster Swift. Van Coevering has represented many Michigan communities in defending property tax litigation, often after the taxpayer received tax incentives from the local government unit. He has been an outspoken advocate against the practice of companies using tax appeals, often without merit, to force local units to accept a lower valuation simply to avoid the cost of litigation. Van Coevering has long represented the City of Escanaba in its fight to defend against a “Dark Store” appeal.

“Tax appeals harm a local unit’s ability to maintain a stable budget and keep millage rates at acceptable levels,” said Van Coevering. “Financial uncertainty and the prospect of expensive litigation and costly refunds are significant threats to local units.” Van Coevering continued, “Entering a separately enforceable contract with businesses provides certainty apart from the many changes that may arise in tax law. It lends substance to the company’s promise of local goodwill. Working with Houghton County and Adams Township entities, Circle Power Renewables is acting in good faith and is willing to guarantee that this revenue will materialize. This allows local entities to budget appropriately and plan for the future.”

The proposed payment structure provides each entity with a minimum annual guarantee based on the Scotia Wind project’s estimated value. As is normal with property taxes, payments would gradually decrease on an annual basis based on a standard depreciation formula.

For more information, visit www.scotiawindfarm.com.

Matt Peterson

Wonderstruct

matt@wonderstruct.co

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.