Profit Whales 2021 Annual Amazon Ads Report: Quarter Breakdown and Sponsored Products More Than 10% Drop In Ad Sales

A full-service marketing agency for e-commerce brands Profit Whales has released their Annual Amazon 2021 PPC report.

Even though the numbers of Amazon sales are growing quite moderately, the Q3 ad sales grew by 50% ($8.09 billion) compared to the same timespan in 2020. The average CPC (Cost-per-Click) also shows continuous growth rising to 12% in Q3, which means the ad space might become less competitive with bigger players remaining in the picture.

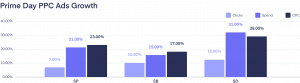

The data presented in the Profit Whales annual Amazon 2021 PPC report comes from internal sources, Amazon PPC statistics during the 2021 calendar and the record-breaking Prime Day event in particular. Throughout the 48 hours it lasted, the sales reached $11.19 billion worldwide, with advertising costs also peaking, mainly Sponsored Display CPC grew by 28%.

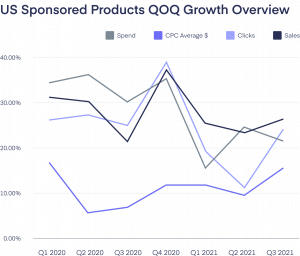

While the statistics for Sponsored Product sales have stayed relatively the same throughout 2021, reaching about 23%, it is a more than 10% drop compared to Q4 results in 2020. Sponsored Brands sales also experienced a major 10% fall at the beginning of 2021, but the level of average CPC growth did not cross the 10% line, as opposed to the SP results.

Still, most sellers continue relying on their Sponsored Products campaigns that take up almost 82% of all ads, while the 2021 trends show that the focus might be shifting towards Sponsored Brands campaigns with Amazon's ongoing encouragement for sellers to engage in Amazon Brand Registry. Sponsored Brands campaigns have taken over 1/10 of all advertising on Amazon.

In 2021, Amazon focused on building a convenient space for brands, with the Ad Console redesign, the Storefronts being used more widely, and Amazon Attribution implementation that made engaging external traffic as important as ever. The Amazon algorithm takes into consideration an unmatched amount of factors compared to previous years. Consequently, sellers, especially the newly engaged ones, should mind the trends and numbers to determine the most profitable areas of advertising and avoid unnecessary ad spending in 2022.

Annual Amazon PPC Report Highlights:

- ACoS is usually the lowest on Saturdays — 13.23%, but the day of the week with the highest CVR is Wednesday — 11.72%

- Sponsored Products Clicks growth on Prime Day shows the lowest result out of all the PPC ad types — only 7%

- The average CPC for Sponsored Brands has dropped lower than 10% from Q1 to Q3 in 2021

- The average CPC for Sponsored Products didn’t change after the Q4 in 2020

Predictions for the direction Amazon takes in 2022 are based on last year’s performance, thus in the Profit Whales Amazon 2021 PPC report, they cover:

- The US Sponsored Products Growth Overview

- The US Sponsored Brands Growth Overview

- Amazon Prime Day PPC Advertising Results

- Spend by Ad Type in 2021

- Average Clickthrough rate vs. Placement

About

Profit Whales is a full-service marketing agency for Amazon brands, a trusted Amazon Ads partner, and a Pinterest partner. They accelerate sales growth using on & off Amazon traffic to give the brands an edge over competitors and diversify the revenue streams while increasing the business evaluation. Their experts deal with Amazon PPC Advertising, Amazon DSP, Social Media Ads, Google Ads, Listing Optimization, and Content Creation.

Dari Bilera

Profit Whales

+1 814-351-9477

email us here

Visit us on social media:

Facebook

LinkedIn

Other

Amazon Updates for Sellers in 2021 - 2022 Strategy and Opportunities

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.