Bad news and loss of value for Portuguese Banks

The net sentiment score (NSS) analysis showed that 8 out of the 13 banks used for the study have negative net sentiment score.

The opinions were “unsolicited” in the sense that no one asked anyone a question; the only source DMR used was online sentiment as expressed on Twitter, Facebook, blogs, forums, videos, reviews and the news.

DMR gathered 25,758 unique posts about 13 Portuguese banks from all these sources from September 1st, 2020, to August 31st, 2021.

The study focused on share of voice, net sentiment score (NSS) and the sharing of negative sentiment.

These data showed that Novo Banco has the highest share of voice at 54% followed by Millennium BCP with 40% and Santander with 18%.

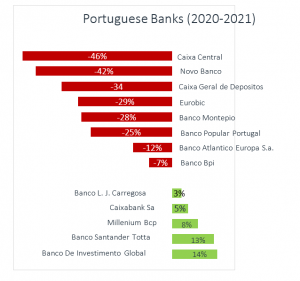

The net sentiment score (NSS) analysis showed that 8 out of the 13 banks used for the study have negative net sentiment score.

The net sentiment score is a DMR proprietary, and trademarked score which indicates the overall sentiment situation for a brand by combining positive, negative and neutral sentiment.

Caixa Central has the worst NSS at -46% followed by Novo Banco with -42%.

The reason for this lies mainly in the customer experience – a whopping 16,881 posts - and Novo Banco fares the worst of all banks with 51% share of negative sentiment, considerably more than Millennium BCP (24%) which is ranked 2nd. The 3rd highest share of negative CX was for Santander.

Michalis Michael the CEO of DMR said: ”Our studies of the banking sector aimed to show causal link between social intelligence and performance. The data from the global banking study shows extremely high correlation of sentiment expressed in news and social media with the banks’ stock price.”

Next step is to establish whether social intelligence metrics have a direct correlation with bottom line performance of the banks. Should that be the case sentiment could become a leading indicator of how a bank might perform in the future.

Michalis Michael

DMR

2037954715 ext.

email us here

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.