DIAGNOS Inc. Increasingly In-play with Two Major Catalysts, Clinical Trials have Begun at Major Health Provider in USA

DIAGNOS Inc. TSX-V: ADK OTCQB: DGNOF clinical trials on Stroke Predictor have begun, and worlds largest eyecare company is in negotiations for platform access.

DIAGNOS Inc. (TSX:ADK)

NEW YORK, NY, UNITED STATES, December 15, 2021 /EINPresswire.com/ -- DIAGNOS Inc. (TSX-V: ADK) (OTCQB: DGNOF) (Frankfurt: 4D4) is the subject of a Market Equities Research Group Market Bulletin, full copy with chart may be viewed at https://marketequitiesresearch.com/marketbulletin-diagnos-advisory-dec-2021.htm online.

DIAGNOS Inc. pioneered ‘Computer Assisted Retinal Analysis' (CARA) technology, a technology that appears in the process of advancing forward in terms of institutional adoption within the medical community. DIAGNOS helps solve two important problems that plague patients across a spectrum of deleterious medical conditions; the of lack of early detection and poor monitoring of condition. DIAGNOS’ CARA platform automatically analyses the retina (located at the back of the eye) using machine learning / artificial intelligence (AI) technology to identify damage caused by diabetes and cardiovascular issues. The retina uniquely contains microscopic blood vessels whose image can be non-invasively captured by a standard optometrist’s fundus camera (a microscope with a camera on it) and prepped by DIAGNOS’ CARA platform for auto-detection of pathology and lesion classification, providing medical experts an early indicator of trouble (e.g. diabetic retinopathy which can lead to blindness, hypertensive retinopathy, tortuosity indicative of excessive stress) or conversely progress/repair underway (e.g. medications working). CARA is a new technology whose time has come, with DIAGNOS at the fore having commercially advanced the diabetic retinopathy application of CARA for the last 7 years. Matters are now heating-up in a major way in terms of adoption and the institutional awakening that investors in DIAGNOS Inc. (and the technology it pioneered) had hoped for appears to be at hand.

TWO MAJOR CATALYSTS UNDERWAY, each individually with company-maker potential:

Catalyst #1) DIAGNOS' Stroke Predictor CARA platform application begins clinical trials on Dec. 6, 2021 with CommonSpirit Health Research Institute, the 2nd largest health service provider in the USA (~137 hospitals and >1,000 clinics, in 21 states).

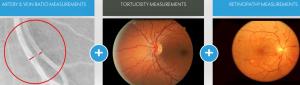

See Figure 1. (Located in Market Bulletin) CARA (Computer Assisted Retinal Analysis) Artery Vein (AV) Ratio analysis in action and retinal images -- DIAGNOS' cardiovascular retinal imaging looks at micro circulation, the small little vessels. There is a direct relationship between cardiovascular issues and the retina. DIAGNOS' algos focus on the artery-to-vein ratio (AVR), classifying the patterns of blood vessels, and how swollen (or not) they are. DIAGNOS' new cardiovascular applications will be marketed as an add-on to its now proven and accepted CARA. No retinal imaging competitor can offer anything in the cardiovascular realm, DIAGNOS is uniquely positioned in the market.

Catalyst #2) ~EUR$80B market cap. Essilor Luxottica (symbol EL on Euronex – the world’s largest eyecare company with ~15,000 locations and >EUR$16B/annum in revenues) has a MoU signed and is actively in negotiations with DIAGNOS on three transaction points; 1) Deployment/access to DIAGNOS’ existing CARA platform, 2) development of DIAGNOS technology into Essilor’s line of fundus camera, 3) access to future applications of CARA as they rollout (see product pipeline below).

DIAGNOS has a high-margin software-as-a-service (SaaS) business model (it only costs DIAGNOS ~4 cents to process what it charges its client ~C$5 - $10, and the client marks-up the service for its benefit from there). DIAGNOS does not sell the software, it protects its proprietary code and database, the software resides in its servers, and everywhere the CARA platform solution is set up it functions as a service. All images world-wide are sent via secure feed to its high security facility in Montreal for processing and quick turn-around.

Shares of ADK.V are poised for upside revaluation to better reflect the developing increased upside revenue generation potential with serious catalysts increasingly in-play on two fronts. The stock market is a discounting mechanism whereby future revenue prospects are forward discounted, reflected in the present share price. The fact the largest eyecare company in the world has vetted and chose DIAGNOS Inc. and its technology speaks volumes. Eyecare centers appear to now be transitioning into ‘Point of Care’ wellness centers with DIAGNOS’ proven technology as a centerpiece. On the cardiovascular front, as the clinical trial progresses and results affirm what DIAGNOS already knows, look for pharma, insurance, and the medical investment complex to pay-up to integrate AI-driven retinal analysis solutions as primary care go-to-service for insight into the health of a patient.

Low outstanding share count: ADK.V only has 69.12 million shares outstanding and there are very little warrants left.

Tight Share Structure: Insiders & family office own ~40% of the outstanding shares.

Sound Financials: DIAGNOS has no debt, money in the bank, an untapped C$2 million government credit line if needed, has a high-margin SaaS model, is expected to be cash flow positive (based on solid contracts already in hand) in the coming fiscal year, has numerous new business prospects in discussion now, and is expected to see rapid revenue growth.

Near-term (12 month) target price: DIAGNOS Inc. received its first institutional coverage from the independent investment bank / advisory / equity research firm Echelon Capital Markets, its current rating is 'Top Pick', 'Speculative BUY' with a near-term (12 month) target price per common share of DIAGNOS of $1.55 Canadian (or in US dollars: USD$1.23 or in Euros: €1.09). The Analysts latest update report may be viewed at https://sectornewswire.com/echelonADK10282021.pdf online. A related follow-up interview with the Analyst regarding his 'Top Pick' ranking may be viewed at https://www.youtube.com/watch?v=vnb_EJTyv6c [running time 30 min.]. NOTE: The analyst share price target is based on the DIAGNOS’ CARA Platform that is currently in use alone and does not include progress on the Stroke Predictor application that is now the subject of clinical trials, needless to say a much higher share price target is justified if success in the clinical trials is demonstrated.

The Bottom Line: .... SEE Market Bulletin for full 'Bottom Line' opinion commentary and rational for near to mid-term >10x share price appreciation potential at https://marketequitiesresearch.com/marketbulletin-diagnos-advisory-dec-2021.htm online.

Content herein is for information purposes only, is not financial advice, and not solicitations to buy or sell any of the securities mentioned.

Fredrick William

Market Equities Research Group

8666209945

email us here

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.