The volume of investments in Swiss InsurTech companies remains stable in 2021

COVID-19 has moderate impact on investments in Swiss InsurTech. Global funding in InsurTech reaches new record high with $7.4 bln raised in first half of 2021

Link to the report: www.aginganalytics.com/insurtech-switzerland

Link to the Interactive IT Platform: https://mindmaps.aginganalytics.com/Swiss%20InsurTech

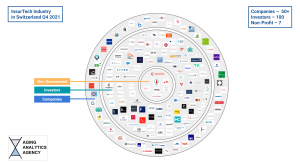

The report presents economic and financial data, technological trends and key Swiss players in InsurTech, a market where innovations are implemented to improve efficiency in the insurance industry. The analysis comprises over 50 Swiss InsurTech companies, 100 investors and 7 NGOs.

Companies investing in Swiss InsurTech are mainly general insurers, service providers (i.e. actuarial, underwriting, data mining and analysis, etc...) and auto insurers. Chubb, AXA Group, Zurich Insurance Group, Swiss RE and Vaudoise Assurances are the top 5 publicly traded companies involved in the development of InsurTech in Switzerland.

The majority of investments in Swiss InsurTech come from Europe (65%) and North America (24%). However, only 38% of insurers have invested in InsurTech since 2010.

The report has also highlighted a geographical divide in the Swiss InsurTech market with 59% of Swiss InsurTech companies based in canton Zurich, 30% in Zug, Basel and Bern cantons and only 8% in the south of the country.

Emma Brodina, Director of Analytics at Aging Analytics Agency, says: “ Switzerland is a financial Hub with one of the largest shares of gross value added produced by the insurance sector, constituting more than 40% of the financial sector. The combination of developed and well-established classic insurance sector and innovative technology solutions creates promising development prospects”.

COVID-19 had a moderate impact on the Swiss InsurTech market.

“The global pandemic has pushed insurers to invest in and implement InsurTech solutions, focusing on business areas such as customer service, accelerating virtual interactions in sales and claims, and reducing operational costs to remain competitive. The development of new technologies such as artificial intelligence, machine learning, blockchain and cloud computing is enabling real-time tracking and monitoring of insurance customers as well the creation of personalised and customised insurance policies”, comments Brodina.

On a global level:

- the InsurTech market was estimated at $9.4 billion in 2020 and it is projected to reach $159 billion by 2030 with a CAGR of 32.7% (source: Allied Market Research);

- global funding in InsurTech has reached a new record with $7.4 billion raised just in the first half of 2021, compared to $7.1 billion raised for the whole of 2020;

- so called “mega-rounds” or funding rounds of over $100 million are already up to 15 deals in 2021;

- North America remains the leading region for the amount of investments in InsurTech with over 70% of total investments, followed by Asia (14%).

Notes to editors:

Aging Analytics Agency is the world’s premier provider of industry analytics on the topics of Longevity, Precision Preventive Medicine and Economics of Aging, and the convergence of technologies such as AI, Blockchain, Digital Health and their impact on the healthcare industry. The company provides strategic consulting services in fields relating to Longevity, and currently serves as the primary source of analytics and data for the UK All-Party Parliamentary Group for Longevity. Aging Analytics Agency is the only analytics company focused exclusively on the topics of Aging, Geroscience and Longevity. Founded in 2013, with headquarters in London, UK and branches in Europe, US and Canada, it began producing in-depth reports on Longevity long before it emerged as an industry.

Deep Knowledge Group is an international consortium of commercial and non-profit organizations focused on the synergetic convergence of DeepTech and Frontier Technologies (AI, Longevity, MedTech, FinTech, GovTech), applying progressive data-driven Invest-Tech solutions with a long-term strategic focus on AI in Healthcare, Longevity and Precision Health, and aiming to achieve positive impact through the support of progressive technologies for the benefit of humanity via scientific research, investment, entrepreneurship, analytics and philanthropy.

InsurTech, a combination of the words “insurance” and “technology”, refers to the use of technology innovations designed to develop new business models in insurance to improve efficiency and service.

Roberto Napolitano

Deep Knowledge Group

+44 7706138432

rn@dkv.global

Visit us on social media:

Facebook

Twitter

LinkedIn

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.