White Metal Approaches Resource Milestone at Copper-Silver Project in Namibia and Advancing Tower Stock Gold Project, ON

White Metal Resources Corp. WHM.V presents exceptional opportunity with exposure to Gold, Copper, and Silver on two fronts, plus holds portfolio of other assets

White Metal Resources Corp. (TSX:WHM)

NEW YORK, NY, UNITED STATES, May 25, 2021 /EINPresswire.com/ -- White Metal Resources Corp. (TSX-V: WHM) (US Listing: TNMLF) (Frankfurt: CGK1) is a Canadian-based junior explorer mining company that has graduated from a pure project-generator model to now advancing two major projects; 1) its recently optioned Tower Stock Gold Project in Ontario, and 2) its 95%-owned Okohongo Copper-Silver Project in Namibia, in addition to holding an array of other projects.

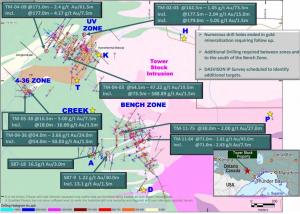

Recent highlights from Tower Stock Gold Project, Ontario: 3D-IP Geophysical Survey Provides Multiple Targets for Phase 2 Drill Program, Bench Zone Strike Potential Extended to 2.1 km, Plans for Additional Phase 1 Drilling, and New 'Ellen' Gold Zone Discovery of 82.5 Metres of 1.7 g/t Gold (Including 45 Metres of 3.0 g/t Gold). Located in the Shebandowan Greenstone Belt ~40km west-northwest of the port city of Thunder Bay, Ontario, Canada. The project hosts an extensive syenite-associated disseminated gold system, a type similar to deposits in the Kirkland Lake and Malartic gold camps, and the Young-Davidson Mine (Alamos Gold). The project has a historical resource on the UV & Bench zones which has seen historical drilling from the likes of Inco, Noranda, Avalon, and finally ValGold -- previous work over the last 30 years has only scratched the surface (~200 m depths) in select areas along the contact region with the intrusive complex, and many holes ended in target gold mineralization. White Metal's geological team is taking an approach that looks at the big picture multi-million ounce gold potential of the syenite intrusive rock using a modern systematic approach and with an improved understanding.

See the following two most recent news releases regarding the Tower Stock Gold Project:

https://www.whitemetalres.com/2021/may-13-2021-white-metal-3d-ip-geophysical-survey-correlates-with-new-ellen-zone-gold-discovery-and-provides-multiple-targets-for-phase-2-drilling-program-at-tower-stock-gold-project-ontario

&

https://www.whitemetalres.com/2021/may-11-2021-white-metal-expands-bench-zone-extends-strike-potential-to-21-km-and-plans-for-additional-drilling-at-the-tower-stock-gold-project-ontario

Recent highlights from Tarnis Copper-Silver Project: White Metal Reports 23.0 Metres of 2.31% Cu, 46.3 g/t Ag Including 4.0 Metres of 4.74% Cu, 65.1 g/t Ag from Final RC Drilling Results, Taranis Copper-Silver Project, Namibia. White Metal Resources has completed the necessary drilling to take the historical mineral resources of its Tarnis (Okohongo) Copper-Silver Deposit in Namibia to NI 43-101 compliance. Situated within the Kaoko Belt of northwest Namibia about 700 km northwest of Windhoek, is hosted by metasedimentary stratigraphy and is considered to be analogous with the stratiform sediment-hosted Central African Copperbelt (CAC) deposits of Zambia and the Democratic Republic of the Congo. White Metal's Okohongo deposit contains historical Inferred Mineral Resources of 10.2 million tonnes grading 1.12% Cu and 17.75 g/t Ag, using a 0.3% Cu cut-off (INV Metals Inc. NI 43-101 Technical Report, Effective Date March 31, 2011). The new resource is expected this Q2-2021, and will add significant tangible value.

See the most recent news release regarding the Tarnis Copper-Silver Project:

https://www.whitemetalres.com/2021/may-18-2021-white-metal-reports-230-metres-of-231-cu-463-gt-ag-including-40-metres-of-474-cu-651-gt-ag-from-final-rc-drilling-results-taranis-copper-silver-project-namibia

WHM.V currently has a nominal market cap of ~C$14M (126,724,750 shares trading at ~C$0.11). The share price of WHM.V is apt to appreciate from the current trading price as continued news flow occurs, and as the significance of what White Metal possesses is better appreciated by the market, reflecting the significant growing intrinsic value on its many projects. The Company has a lot of moving parts as it also retains a vast portfolio of quality projects from its approach as a project generator. As is often the case with project generators, the sum of the parts is greater than the whole until market awareness kicks-in -- over time if management makes the right moves, cyclical markets cooperate, and geological/exploration success prevails, astute investors can be handsomely rewarded, WHM.V is certainly now approaching an inflection point.

For further DD on White Metal Resources Corp. the following URLs have been identified:

Company website: https://www.whitemetalres.com

Recent Mining MarketWatch Journal review: https://miningmarketwatch.net/whm.htm

Content found herein above is for information purposes and is not a solicitation to buy or sell any of the securities mentioned. Market Equities Research Group is responsible for the content of this watch list information release.

Fredrick William

Market Equities Research Group

+1 866-620-9945

email us here

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.