Life Insurance Providers Industry Goes Digital For Survival In The New Market

The Business Research Company’s Life Insurance Providers Market Report - Opportunities And Strategies - Global Forecast To 2030

LONDON, GREATER LONDON, UK, March 18, 2021 /EINPresswire.com/ -- Our reports have been revised for market size, forecasts, and strategies to take on 2021 after the COVID-19 impact: https://www.thebusinessresearchcompany.com/global-market-reports

Life insurance providers understand that by going digital, they can ensure that their services are readily accessible for their customers and reduce the time taken to offer various services. The shift to digital has marked a shift towards paperless and penless processes for buying insurance and expecting virtual assistance during service requests. As per life insurance industry trends, digital processes are no longer a differentiator but a survival requirement. Customers of the life insurance providers market can now receive the required guidance through digital aids. The current situation has hastened customer migration towards a more virtual life where most interactions are driven by digital and social media. The COVID-19 crisis has only accelerated the need for digitization. For example, Bajaj Allianz Life Insurance aims at a complete transformation to becoming a totally digital business. Apart from developing their own mobile application, Bajaj also aims at investing heavily in analytics. It has developed a model for predictive analysis for renewals.

The global life insurance providers market is segmented by type into term life insurance, whole life insurance, variable life insurance, equity indexed life insurance, accidental death insurance, other life insurance and by application into agency, brokers, bancassurance, digital & direct channels.

Read More On The Global Life Insurance Providers Market Report:

https://www.thebusinessresearchcompany.com/report/life-insurance-providers-market

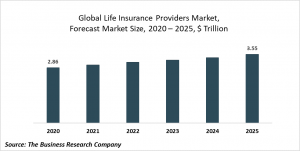

The global life insurance providers market reached a value of nearly $2.86 trillion in 2020, having increased at a compound annual growth rate (CAGR) of 1.8% since 2015. The life insurance providers market is expected to grow from $2.86 trillion in 2020 to $3.55 trillion in 2025 at a rate of 4.4%. The growth is mainly due to the growing awareness about investing in life insurance policies due to an increase in chronic illnesses. The life insurance market size is then expected to grow to $4.26 trillion in 2030 at a CAGR of 3.7%.

The insurance industry outlook shows the major players in the global life insurance providers market to be Ping An Insurance (Group) Company of China, Ltd., China Life Insurance Company Limited, Assicurazioni Generali S.p.A., China Pacific Insurance (Group) Co., Ltd., and Japan Post Insurance Co., Ltd.

Global Life Insurance Providers Market – Opportunities And Strategies – Global Forecast To 2030 is one of a series of new reports from The Business Research Company that provides life insurance providers market overview, forecast life insurance providers market size and growth for the whole market, life insurance providers market segments, and geographies, life insurance providers market trends, life insurance providers market drivers, restraints, leading competitors’ revenues, profiles, and market shares.

Request For A Sample Of The Global Life Insurance Providers Market Report:

https://www.thebusinessresearchcompany.com/sample.aspx?id=3935&type=smp

Here Is A List Of Similar Reports By The Business Research Company:

Term Life Insurance Market - By Type Of Insurance (Individual Level Term Life Insurance, Group Level Term Life Insurance, Decreasing Term Life Insurance), By Distribution Channel (Tied Agents And Branches, Brokers, Bancassurance), And By Region, Opportunities And Strategies – Global Forecast To 2030

https://www.thebusinessresearchcompany.com/report/term-life-insurance-market

Life Insurance Global Market Report 2021: COVID 19 Impact and Recovery to 2030

https://www.thebusinessresearchcompany.com/report/life-insurance-global-market-report

Insurance Agencies Global Market Report 2021: COVID 19 Impact and Recovery to 2030

https://www.thebusinessresearchcompany.com/report/insurance-agencies-global-market-report

Insurance Providers Global Market Report 2020-30: COVID 19 Impact and Recovery

https://www.thebusinessresearchcompany.com/report/insurance-providers-global-market-report-2020-30-covid-19-impact-and-recovery

Insurance Brokers Global Market Report 2021: COVID 19 Impact and Recovery to 2030

https://www.thebusinessresearchcompany.com/report/insurance-brokers-global-market-report

Interested to know more about The Business Research Company?

Read more about us at https://www.thebusinessresearchcompany.com/about-the-business-research-company.aspx

The Business Research Company is a market research and intelligence firm that excels in company, market, and consumer research. It has over 200 research professionals at its offices in India, the UK and the US, as well a network of trained researchers globally. It has specialist consultants in a wide range of industries including manufacturing, healthcare, financial services and technology. TBRC excels in company, market, and consumer research.

Call us now for personal assistance with your purchase:

Europe: +44 207 1930 708

Asia: +91 88972 63534

Americas: +1 315 623 0293

Oliver Guirdham

The Business Research Company

+44 20 7193 0708

info@tbrc.info

Visit us on social media:

Facebook

Twitter

LinkedIn

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.