RentRedi Tenants Can Now Use One Of Their Largest Payments, Rent, to Boost Credit Score With Credit Bureau

Property management software RentRedi releases a new credit reporting feature to help tenants build credit by reporting rent payments to a credit bureau.

NEW YORK, NEW YORK, UNITED STATES, March 3, 2021 /EINPresswire.com/ -- RentRedi, the property management tech startup, today announced its release of a rent reporting feature that enables tenants to use their on-time rent payments to improve their credit score.

RentRedi landlords can now offer their tenants an incentive and reward on-time rent payments by offering the capability to build their credit score.

When CEO Ryan Baron started RentRedi in 2016, he wanted to ensure that both landlords and tenants could use the application to improve their renting experience. And the latest feature, to report rent payments, is no exception.

For landlords, rent reporting is an attractive incentive and reward for tenants who pay their rent on-time. According to TransUnion, 7 in 10 renters are more likely to make on-time rent payments if rent payments can be reported to a credit bureau.

Additionally, this feature can be an amenity offered to potential tenants. If a renter were choosing between two identical apartments, 67% said they would choose the apartment with rent payment reporting (TransUnion).

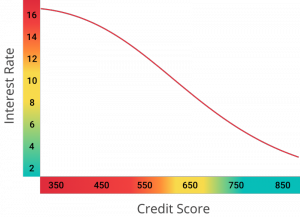

For tenants, rent reporting can boost their credit score by 26 points, and 60% of renters can even see improvements in just one month. Additionally, a high credit score can offer tenants lower interest rates for car, home & other loans, waived or reduced deposits to open utility or cell phone accounts, and increased credit limits.

What is the cost to report rent payments to TransUnion?

RentRedi offers 3 flexible payment options for tenants to report their on-time rent payments to TransUnion:

+ Entire Lease

+ 3-Months

+ Monthly

Says CEO Ryan Barone:

“The ability to be able to build credit just by paying your rent is a huge asset for both landlords and tenants! Not only do renters have an easy incentive and avenue to boost credit just by paying their rent, but rent payment reporting also offers landlords a competitive advantage in the residential real estate market.”

About RentRedi

RentRedi is a landlord-tenant software that empowers landlords to manage properties themselves, making stress-free renting affordable and accessible to everyone. For landlords, RentRedi provides an all-in-one dashboard that enables them to collect mobile rent payments, list properties, prequalify and screen tenants, plus electronically sign leases, export property-related reports, send in-app notifications to tenants, and manage maintenance with video. RentRedi has partnered with platforms including Realtor.com and Doorsteps, Latchel, TransUnion, Plaid and TSYS to create the best experience possible. For tenants, RentRedi’s mobile app allows them to prequalify, apply, pay rent, schedule rent, and submit maintenance requests, all from the palm of their hand. For more information visit RentRedi.com.

Lauren Hogan

RentRedi

+1 917-793-6068

email us here

Visit us on social media:

Facebook

Twitter

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.