Rong360 Big Data Institute: Mortgage Credit Availability Loosened at End-2020;National Mortgage Rates Drop 31BPs on Year

Jianpu Technology (NYSE:JT)

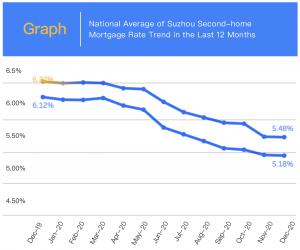

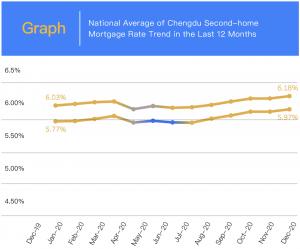

BEIJING, CHINA, January 8, 2021 /EINPresswire.com/ -- Cities: 38 Cities Recorded Mortgage Rate Decreases in 2020; Suzhou’s Mortgage Rate Dropped by Nearly 100BPs.According to surveillance data from Rong360 Jianpu Technology (NYSE: JT) Big Data Institute across the 41 cities for December 2020 (with data in statistics collected from November 20, 2020, to December 18, 2020), 11 cities recorded an MoM increase in mortgage rates, of which the rates in Chengdu and Dongguan each increased 4BPs MoM; 16 cities saw an MoM decrease in the rates, of which Changchun and Dalian suffered significant decreases of 16BPs and 9BPs, respectively. The remaining 14 cities maintained the same levels of rates as the previous month.

According to surveillance data from Rong360 Jianpu Technology (NYSE: JT) Big Data Institute across the 41 cities, 38 cities recorded mortgage rate decreases in 2020. At the end of 2020, the first-home mortgage rates decreased by more than 15BPs YoY in 37 cities, of which seven cities each saw a decrease of more than 50BPs in the rates and 16 cities each saw a drop of between 30BPs and 50BPs.

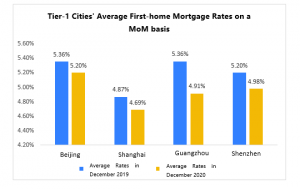

Among the tier-1 cities, mortgage rates in Beijing, Shanghai, and Shenzhen have stronger correlations with LPR, and their fluctuation ranges are also more similar to that of LPR. At the end of 2020, the YoY decreases in mortgage rates for first- and second-time homebuyers were all between 15BPs and 25BPs in these three cities. In Guangzhou, the mortgage rate for first-time homebuyers had a significant decrease of 45BPs YoY, while its second-home mortgage rate dropped by 37BPs.

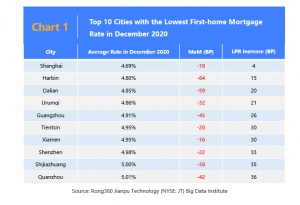

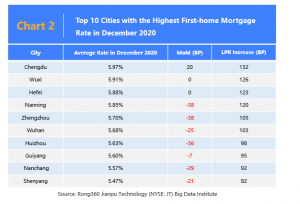

Ranking: The Rankings of Top 10 Cities with Lowest and Highest First-Home Mortgage Rates Changed Significantly

At the end of 2020, the rankings of the top 10 cities with the lowest and highest first-home mortgage rates changed significantly compared with those at the end of 2019. Harbin, Dalian, and Quanzhou were included in the list of top 10 cities with the lowest first-home mortgage rate, while Beijing, Haikou, and Hangzhou were knocked off. Huizhou, Guiyang, and Shenyang were included in the list of top 10 cities with the highest first-home mortgage rate, while Suzhou, Zhongshan, and Xi’an were knocked off.

Year-end Mortgage Credit Availability Increased Compared with Previous Years; Trend of “One City, One Strategy” Will Further Spread

In December 2020, the mortgage rates fluctuated slightly MoM, and there weren’t mortgage rate increases on a large scale nationwide near the end of the year. The availability of mortgage credit was not as tight as in previous years, and only a small amount of banks suspended extending home loans. Throughout the year 2020, the fluctuations of mortgage rates, either nationwide or citywide, were more significant than those of last year. Additionally, the changes in the home mortgage market were reflected not only in mortgage rates but also in policies. In particular, regions that introduced related policies successively in the second half actively sought to implement the core principle of “housing is for living in, not for speculation.” This led to tightened policies on housing provident fund loans and down payments.

Through attempts and practices in the fourth quarter of 2019 and full year of 2020, China used LPR as a lending reference rate for new mortgage loans, and a converted rate benchmark for existing home loans. We expect the trend of “One City, One Strategy” in mortgage rates to further spread in the future. Fluctuation ranges of mortgage rates in the regions with stable real estate markets will closely follow that of five-year LPR if the increase points on top of LPR remain unchanged. Other regions will provide guidance over the increased points of mortgage rates based on the popularity of local property markets and fluctuations of five-year LPR.

Media Contact

Jianpu Technology

+86 10 8262 5755

email us here

Visit us on social media:

Facebook

Twitter

LinkedIn

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.