ESG ADDS UP (or DOWN)

UNITED STATES, November 30, 2020 /EINPresswire.com/ -- Appreciation of attention to ESG can add up to 10% to companies’ market cap over and above any direct gains according to a latest study from valuation firm, Reputation Dividend.

As investors become increasingly aware of reputational risks, they consider a host of reputational factors, including ‘Corporate Social Responsibility’ and ‘Environmental, Social and Governance’ (ESG) criteria. While not the most important driver of reputation impact, perceptions of ESG prowess can provide a tangible and material boost to market capitalization (market cap). Equally, a perceived lack of attention can cost shareholders dear by creating drains on companies’ reputation assets.

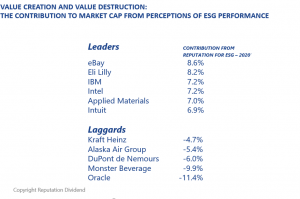

The study finds that overall, positive perceptions of companies’ prowess in the area of ESG are boosting investor confidence to account for close to 3.1% of the gross market cap, or $952 billion of shareholder value in the S&P 500. Within that, perceptions of especially high, or low, company performances in ESG can produce value impacts equating to up to 10% of the total market capitalization.

Top in the S&P for ESG are eBay, Eli Lilly, IBM, Intel, Applied Materials and Intuit. Kraft Heinz, Alaska Air Group, Dupont de Nemours, Monster Beverage and Oracle are on the ESG value destruction side.

According to Sandra Macleod from Reputation Dividend, “Investor perceptions of companies’ ESG performance create value when seen to be strategic and driving transformation. They can also actively destroy value when seen to expose the company to undue risk. And this is where investor activism has started to muscle in. No sector, no region is safe from that fundamental questioning of value-creation or value-destruction.”

“As volatility is set to increase, we see that corporate reputations underpin or drag valuations – markets are becoming more sophisticated in their assessments and more aware of both financial and non-financial risks. Understanding the drivers and contribution of reputations in the mind of in the investment community is now more important than ever,” according to Simon Cole, the firm’s founder.

The full 2021 Reputation Dividend Report will be freely available at www.reputationdividend.com in the new year.

REPUTATION VALUE ANALYSIS – EXPLAINED

Reputation value analysis reveals the economic impact of corporate reputation in order to help companies manage the assets more effectively. It quantifies the tangible financial impact of corporate reputation by making the direct link to market capitalization and share price performance. Analysis is a two-stage process. First, the factors that most influence the investment community, and thus the market capitalizations, of individual companies are prioritized using statistical regression analysis of hard financial metrics, including shareholder equity, return on assets, forecast and reported dividend, earnings, liquidity and company betas and reputation measures. From there, a combination of metrics are calculated, including the gross economic benefit shareholders derive from reputation assets, the location of value across the individual components of companies’ reputations, the extent to which investment in reputation building is likely to produce returns in value growth, and the relative value potential and risk of individual opportunities.

BACKGOUND

Founded by ex-Interbrand specialists and a team of analysts, Reputation Dividend produces the only recognized measure of the financial value of corporate reputation as a percentage of market capitalization. The firm’s annual Reputation Dividend Report spells out trends and developments in the investment community’s consumption of corporate reputation and how it impacts corporate values based on studies of more than 500 of the largest companies in the US and UK. Clients include AB-InBev, Aetna, Agilent, Airbus, Allstate, Amgen, ARM, Arrow, Bayer, Boston Scientific, eBay, GE, GKN, Hikma, Johnson & Johnson, MetLife, Phillips 66, Serco, Shire, Standard Life, Takeda, United Technologies, Zurich, Xerox.

FOR FURTHER INFORMATION:

Simon Cole

Founding Partner

+44 7956 423843

simon@reputationdividend.com

Sandra Macleod

Director

+44 7770 328724

sandra@reputationdividend.com

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.