Rong360 Jianpu Technology(NYSE:JT)Big Data Institute: Mortgage Rates End Decline of 9 Consecutive Months Within The Year

Jianpu Technology (NYSE:JT)

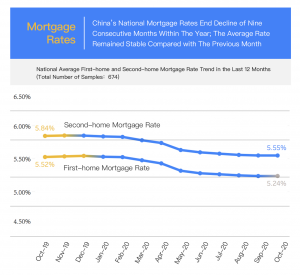

BEIJING, 中国, October 30, 2020 /EINPresswire.com/ -- 1. Mortgage Rates: China's National Mortgage Rates End Decline of Nine Consecutive Months Within The Year; The Average Rate Remained Stable Compared with The Previous MonthAccording to surveillance data from Rong360 Big Data Research Institute across 674 bank branches and sub-branches in 41 major cities, in October 2020 (with data in statistics collected from September 20, 2020 to October 18, 2020), the national average mortgage rates for first-time homebuyers and second-time homebuyers were 5.24% and 5.55% respectively, the same as a month earlier. The national mortgage rates ended a decline of nine consecutive months within the year, with an inflection point appearing.

2. Cities: 32% of Cities Increased Mortgage Rates in October from The Previous Month; 5 Cities Saw an Increase of over 5BPs on Month in Mortgage Rates

According to surveillance data from Rong360 Jianpu Technology (NYSE: JT) Big Data Institute across the 41 cities for October 2020 (with data in statistics collected from September 20, 2020 to October 18, 2020), 13 cities recorded a month-on-month (MoM) increase in mortgage rates, accounting for 31.7% of all monitored cities; 14 cities saw a decrease in the rates, while the remaining 14 cities maintained the same levels compared to the prior month.

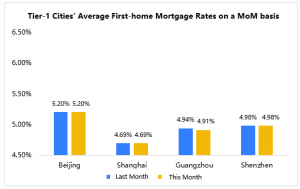

In October 2020 (with data in statistics collected from September 20, 2020 to October 18, 2020), the mortgage rates in tier-1 cities including Beijing, Shanghai and Shenzhen remained the same as the previous month; In Guangzhou, four banks lowered mortgage rates for first-time homebuyers, which led to a reduction again as a whole, down 3BPs on a MoM basis, while its second-home mortgage rate was unchanged.

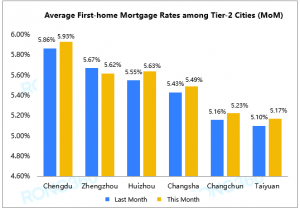

In October 2020 (with data in statistics collected from September 20, 2020 to October 18, 2020), the average mortgage rates dropped in 14 cities, with Zhengzhou seeing the largest decrease of 5BPs on a MoM basis. Among the cities recording a MoM rise in mortgage rates, Huizhou, Taiyuan, Changchun, Chengdu and Changsha all saw an increase of more than 5BPs.

Media Contact

Jianpu Technology

+86 10 8262 5755

email us here

Visit us on social media:

Facebook

Twitter

LinkedIn

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.