The Challenger Bank Revolution is well underway... Our Soul Searching Thoughts at Payments2.0

The Rise of Challenger Banks

A New Banking Revolution is well underway... The Challenger Bank Revolution, Our Soul Searching Thoughts at Payments2.0

"Challenger banks have already made an impact in the market, transforming the banking landscape and creating new offerings to meet the evolving needs of customers, as customer-centricity is becoming the battle ground for new financial services" stated a KPMG report exploring the opportunities and challenges in 2019

The relationship between consumers and their banks is particularly of a complex type; it can be one of love and hate, and, on average, lasts longer than the relationship with a romantic partner. When it comes to matters of money, consumers have traditionally been loath to rock the boat – and though many will complain about their bank, few will make a change.

Unsurprisingly, banking gained a reputation as a closed industry, with established players holding dominance while start-ups struggled to gain a foothold.

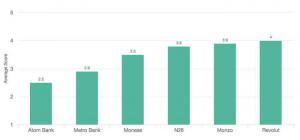

As the world enters the digital age, these days are over. The rise of UK banking start-ups such as Atom Bank, Monzo, Revolut, and Starling has reignited innovation within the sector.

The impact of these ‘challenger banks’ has forced real change within the sector. In the UK alone, the largest banks have closed over 1,700 branches in the last five years – all in response to the consumer behaviour change set in motion by the digital-first disruptors. And this is just the trailer of the full action movie yet to be released and witnessed by all.

Acknowledging the UK is at the forefront of the fintech revolution, the US firm Citigroup selected London as the site of its latest innovation lab network. Focusing on developing advanced technologies including data visualisation and high-tech computing, the decision will further bolster the city’s fintech expertise.

Following the lead of these trail-blazers, the established banking industry has invested heavily in developing their own digital capabilities, with the mobile channel now overwhelmingly the de facto method of money management – HSBC, for example, noted that more than 90% of its customer interactions came via digital channels, up from 80% in 2016. These are all real numbers!

Already considered as a global centre of excellence for financial services, the fin-tech revolution ensures that the UK will continue to be a hub for the best (unless some drastic Brexit actions takes away this privilege that the UK enjoys) and brightest organizations in the sector. With new providers emerging almost daily, the industry’s transformation is just getting started.

Fintech challengers have been slowly eroding banking relationships for years. Beyond the companies that are pure challenger banks — non-bank brands like PayPal, Venmo, Mint, and Rocket Mortgage offer customers easy ways to make payments, understand their finances, and get approved for a home loan. As companies known for mobile card processing and e-commerce seek approval for banking charters or partnerships, additional businesses outside the traditional banking realm make similar bids – opening the door to a new sector of businesses turned banks.

Beyond general banking offerings (of a deposit account, debit card, and payments), the revolutionizing sector will start to focus on customized features by specific target groups as listed below and even more with time:

* Freelancers — need additional support with tax calculations, withholding, and employee benefits;

* Immigrants — assist in quickly opening accounts online as a newcomer, and having access to savings & credit;

* Small Businesses — support needed in managing accounts receivable and payable, and expense monitoring;

* Minor / Kids — an education-based bank for learning how to effectively budget, save, and build credit;

* Elderly / ‘at-risk’ adults — customized support on access by power of attorney, custodianship, family trust, wealth preservation, retirement benefits, and insights on healthcare;

* Travelers — ability to use a global account and card without additional fees or challenges.

The outlook is rather bright and expansive for established challenger banks and even for the new arrivals offering a personalized experience for niche user segments.

Rohan Francis Britto

Rijndlpay Technologies Pvt. Ltd

+971 55 635 0635

email us here

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.