Breathe New Life into The Card For The New Normal Digital-First World ... Our Soul Searching Thoughts at Payments2.0

Cards are the most frequent touchpoint any financial institution have with consumers, its time for us to Breathe New Life into The Card for the Digital World

Part of the New Normal is that’s become particularly true in the pandemic era, when a rising wave of online shopping has combined with a U.S. coin shortage and a general prudishness with regards to handling cash. What does this exactly mean? Simply, Financial Institutions need to double up on improving their card products to meet present customers' emerging needs - Get out of the traditional past and serve the needs of today - Evolve with the present times!

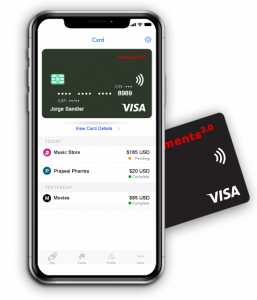

Evolution in the Fin-tech industry does not simply mean continue from where we left it before the pandemic, rather start right from scratch with upgrading the on-boarding process to include instant digital card issuance to a customer’s chosen mobile wallet. “With digital issuance, you now have the ability to accelerate the entire process,” quipped Eli Hazan, Country Director at Payments2.0. “The customer can get the card activated immediately on the digital side into the wallet so they can spend using their mobile device while they're waiting for the physical plastic, if that is ever going to be needed in these times?” he further added.

That’s a win-win-win for all stakeholders - Customers are delighted because they aren’t waiting for a card, while issuers don’t lose consumer spend while the person waits for a piece of plastic to arrive in the mail - This is what the New Normal is and will look like to which the financial institutions must be prepared.

We must not forget the importance of getting a slot in a consumer’s digital wallet which is critical in today’s era of changing payment preferences. After years of incredibly slumberous adoption, many consumers are suddenly drawn to contactless payments due to COVID-19.

Many industry research figures show that 76 percent of consumers who’ve made the switch to contactless intend to continue using it even after the pandemic has passed. “So, consumers can adjust habits and change those card usage reflexes very quickly if the right motivation and incentives are provided to them, and as they realize that using a phone to pay is so much quicker than digging through a wallet or purse to find a card.”

A very important trend we have observed is that customers aren’t going to wait for Financial Institutions to catch up with their needs. If necessary, they’ll just switch to competitors who already meet them. so there is the where we must all "Its a wake up call for all of us in the Payments domain knowing that Our Complacency will not reward us rather lead to a comatose mode eventually for those who don't adapt" said Rohan F. Britto at Payments2.0

Banks, Corporates and even Regulators must now recognize the imperative to modernize not just digitize, the infrastructure and workflow that moves money and data between businesses locally and cross border must be at the fort-front of this revolution.

We conclude out thoughts by reminding all our colleagues that for all of the challenges the pandemic has created for financial services, it also presents an incredible opportunity to build closer, more connected relationships with customers — if financial institutions are willing to do so.

Watch Out for The New Generation of Challenger Banks!!!

Rohan Francis Britto

Rijndlpay Technologies Pvt. Ltd

+971 55 635 0635

email us here

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.