Digital Currencies - The Future of Payments ... Our Soul Searching Thoughts @ Payments2.0

Digital Currencies - The Future of Payments ... Our Soul Searching Thoughts @ Payments2.0

Today’s adoption rates could, and likely will, change. If the Chinese government, along with Google, Amazon, Facebook, or Apple (the so-called GAFA group), or a Chinese company like Tencent or ANT can overcome some of the barriers to cryptocurrencies, then cryptocurrencies could become more appealing. This will hasten their adoption and give them the potential to replace cash.

My personal conviction on the issue of stable coins is that we better be ahead of the curve. There is clearly demand out there that we have to respond to stated ECB President Christine Lagarde.

Our in-depth research shows the adoption rate of blockchain wallets as compared to the adoption rate of the Internet. At least for now, the curves are similar after adjusting for scale. If current trends continue, there could be two hundred billion blockchain wallet users by 2030. This is something for all of us to think about seriously!

Our twentieth-century payment system needs to be upgraded and digitised. Governments, particularly those in Western countries need to wake up before it is too late. That is because a private, loosely regulated digital currency is probably not the best response to the coming financial disruption.

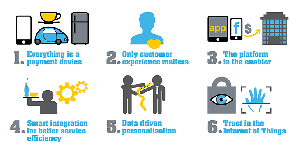

Now at Payments2.0 we have been striving at addressing the future of payments and developed a solution not just using cutting-edge technology but also practical usage to make it commercially viable for one and all the stakeholders involved including the Customer who is King now.

Our Payments2.0 platform versatile capabilities include

* PAYMENT PROCESSING

Our end to end payments processing solution improves efficiency simplifying operations

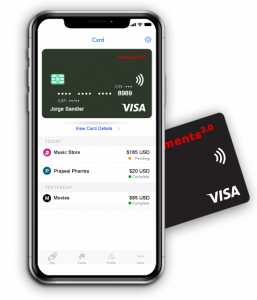

* DIGITAL WALLETS

Digital wallet solutions are about more than convenience, creating an alternate banking ecosystem

* DIGITAL CARDS

Take advantage of Digital payment cards to suit your needs – prepaid cards, multicurrency cards, Stored value cards, FX travel cards

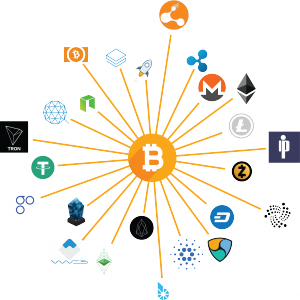

* BLOCK CHAIN

Crypto currency wallets linked with regular multicurrency wallets enabling faster and secure transfers

* MULTICURRENCY PLATFORM

Flexibility to store permissible multi currencies with freedom to convert and load between wallets to complete the transaction.

*REMITTANCES

Enabling faster cross border remittances using digital wallets and block chain technology.

* FIAT TO CRYPTO PAYMENTS

Global users can now pay with Crypto using their regular card linked to their multicurrency wallet.

* BUY CRYPTO WITH CREDIT CARD

Our card processing solution and seamless integration with Crypto exchanges facilitates global users to buy crypto coins using credit cards.

* A REWARDS MECHANISM

Our Rewards mechanism can be tailored not just for customers but even to keep staff loyal.

Brands that want to cater to a diverse market need to offer a variety of purchase options. For this reason, customised loyalty apps are popular at major chains. This type of payment system can easily be developed for any company by purchasing basic technology tools. For example, QR codes linked to digital wallets gaining popularity in emerging economies, where people are getting accustomed to this new lifestyle.

Applications can optimise business logistics, personalise customer experiences, and provide data needed for making decisions. For certain businesses, going cashless and adopting the newest technologies can significantly reduce operational overhead, increase productivity, and help with logistics. Software is available for business owners to access data in real-time from mobile devices and generate customisable reports.

Payments2.0 with it's Comprehensive Converged Payment Solutions Suite can provide you Anytime, Anywhere, Anyway, Any Currency!!!

Rohan Francis Britto

Rijndlpay Technologies Pvt. Ltd

+971 55 635 0635

email us here

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.