Rong360 Jianpu Technology (NYSE:JT) Big Data Institute: Mortgage Rate for First-time Homebuyers Fell to 5.28% Nationwide

Jianpu Technology (NYSE:JT)

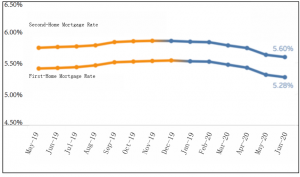

BEIJING, INTERNATIONAL, CHINA, July 2, 2020 /EINPresswire.com/ -- 1. Mortgage Rate: The Average First-home Mortgage Rate was 5.28% Nationwide, Posting a Decrease of 4 BPs on a Month-on-Month BasisAccording to the monitoring data released by Rong360 Jianpu Technology (NYSE: JT) Big Data Institute about 674 bank branches and sub-branches in 41 major cities, the nationwide average mortgage rate for first-time homebuyers was 5.28% in June 2020 (with data in statistics collected from May 20, 2020 to June 18, 2020), posting a decrease of 4 basis points (BPs) on a month-on-month (MoM) basis. For second-time homebuyers, the average mortgage rate was 5.60% nationwide, posting a decrease of 3BPs on a MoM basis.

Compared to the data in our preceding report, the nationwide average mortgage rate declined around 15BPs following the 5-year LPR decreased by 10BPs on April 20.

2. Cities: Tier-1 Cities’ Mortgage Rates Changed Slightly; Four Tier-2 Cities’ Rates Declined by More Than 10BPs

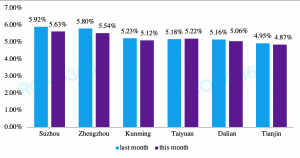

According to monitoring data from Rong360 Jianpu Technology (NYSE: JT) Big Data Institute across the 41 cities for June 2020 (with data in statistics collected from May 20, 2020 to June 18, 2020), the average mortgage rates for first homebuyers in 28 cities decreased sequentially. For second-time homebuyers, 30 cities saw the mortgage rate falling sequentially. Notably, the average mortgage rates for both first- and second-time homebuyers in Zhengzhou, Suzhou and Dalian decreased by over 10BPs this month. Taiyuan and Huizhou saw slight bounce-back from a 10BPs decrease in the last month.

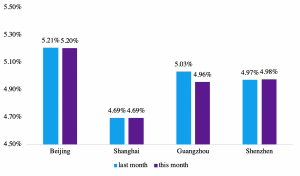

In general, among tier-1 cities, key banks in Beijing and Shenzhen executed similar mortgage rate levels. But in Shanghai and Guangzhou, different banks’ rates varied largely.

In June 2020 (with data in statistics collected from May 20, 2020 to June 18, 2020), the average mortgage rates for first- and second-time homebuyers decreased by 1BP on a MoM basis in Beijing. The rates remained the same level as the prior month in Shanghai. In Guangzhou, the mortgage rate decreased by 7BPs on a MoM basis for the first-time homebuyers and 5BPs for the second-time homebuyers.

In June 2020 (with data in statistics collected from May 20, 2020 to June 18, 2020), a number of cities further lowered the mortgage rates level. In Suzhou and Zhengzhou, where the first-home average mortgage rate has once dropped below 6% respectively, the rates further decreased by more than 20BPs, posting a cumulative decrease of more than 30BPs since April 20. Kunming and Dalian also saw a decrease of more than 10BPs in the latest monitoring period, and Dalian saw a decrease of close to 30BPs for two consecutive periods. The first-home average mortgage rate in Taiyuan was lowered by 19BPs in the prior month while bouncing back 4BPs for this month, posting a cumulative decrease of 15 BPs over the past two consecutive reporting months.

Di Wang

Jianpu Technology

+86 10 8262 5755

email us here

Visit us on social media:

Twitter

LinkedIn

Facebook

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.