Auto2x report-30 Carmaker Roadmaps to Self-Driving cars 2025

Learn about L2-4 technology roadmaps by Driving and Parking features coupled with penetration forecasts by level of autonomy to 2025 in EU, USA & China.

LONDON, UK, March 6, 2020 /EINPresswire.com/ -- "The democratization of ADAS accelerates fast to meet safety mandates but techno-economic deployment challenges of Level 3 still persist. The model availability of Level 2-Driving features in Europe, such as Traffic Jam Assist and Cruise Assist, reached 91 models in 2019 as Volume brands joined premium carmakers in model supply. We expect that aggregate sales of Level 3-Driving features in Europe, USA and China will grow from 0.31 million in 2019 to 7.19m in 2025" says Auto2x, a London-based automotive intelligence & consulting firm.

"Higher levels of vehicle automation will require augmented sensor set, new architecture and innovative validation methods among others. Auto2x estimates that in 2020 ADAS-Average-Content-per-Vehicle will amount to €489 for Level 2, with 17 sensors per car, and between €960 and €2,100 for Level 3 depending on the usage of lidar for further perception redundancy".

"Regulatory mandates, such as Europe's General Safety Regulation coming in effect in 2022, EuroNCAP requirements, and competition among carmakers, will fuel demand for ADAS sensors, supercomputers, AI, high precision maps. What's more, further collaboration between OEMs and Tier 1s-2s for the development of AD platforms will be crucial leading to disruption in ADAS rankings. As a result, Auto2x assesses that the combined ADAS revenue of the Top-11 Suppliers will rise by 21.5% between 2018 & 2020 to reach €13.87bn".

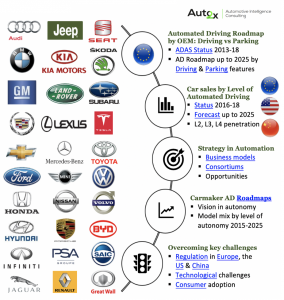

Auto2x's report "30 Carmaker Roadmaps to Self-Driving cars 2025" assesses leading car manufacturers’ ADAS&Automated Driving feature roadmaps, automation portfolio mix, deployment strategies and business models to transition towards full automation. Moreover, it examines the regulatory landscape, technical challenges and their implications on the deployment of a higher level of vehicle autonomy. This examination results in a technological roadmap for the introduction of L2-4 by leading OEM and penetration forecasts of different levels of autonomy until 2025 in the EU, USA, and China.

Chapters

1. The status of Automated Driving deployment by Level in 2016-19 ((21 pages)

2. Regulatory, engineering and other challenges for L3-5 deployment (17 pages)

3. OEM & Tier-1 strategies to commercialize Automated Driving (5 pages)

4. Level 2 to Level 4 carmaker roadmaps & car sales by AD Level to 2025 (27 pages)

4.1 Europe

4.2 USA

4.3 China

5. Carmaker’ profiles: ADAS & Automated Driving roadmap & outlook (29 pages)

5.1. Audi

5.2. Bentley

5.3. Porsche

5.4. Skoda

5.5. VW

5.6. BMW

5.7. Mini

5.8. Jaguar Land Rover

5.9. Mercedes-Benz

5.10. Tesla

5.11. Volvo

5.12. General Motors: Cadillac and Chevy-Cruise

5.13. Ford

5.14. Hyundai and Genesis

5.15. Nissan

5.16. Renault

5.17. Toyota and

5.18 Lexus

5.19. BAIC

5.20. BYD

5.21. CHANGAN

5.22. FCA:

5.23. Alfa Romeo &

5.24 Jeep

5.25. Geely

5.26. Great Wall

5.27. Honda

5.28 PSA

5.29. SAIC

5.30. Subaru

6. Appendix: Model availability by Level of Automation

Mariola Skoczynska

Auto2x LTD

+44 7825 686532

email us here

Visit us on social media:

LinkedIn

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.