2019 Year in Review & 2020 Outlook - Beacon Mergers & Acquisitions

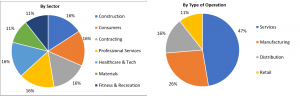

TORONTO, ONTARIO, CANADA, January 14, 2020 /EINPresswire.com/ -- Beacon Mergers & Acquisitions has finished its most successful year since 2010. In 2019, Beacon closed 19 transactions and advised businesses with combined revenue of over $100 million CAD. Beacon has an industry agnostic approach with experience across multiple sectors including diversified industrials, consumers, manufacturing, healthcare, technology, professional services, and more. In 2019, deal flow was well-diversified in terms of industry, with majority of transactions by volume coming from the service sector. Majority of the M&A activity originated from privately owned and managed businesses across Canada. Historically Beacon has seen strong activity in the diversified industrial sector, however, in 2019 Beacon saw considerable growth in demand from SaaS and Managed I.T. Service companies.

During 2019, Beacon streamlined its operations through automation and has been able to attract a diverse pool of sophisticated buyers through its marketing channels and industry network. Consequently, the company closed over 50% of its transactions within six months of initial engagement. Transacted companies’ selling price averaged 97.8% of the business assessment prepared by the Beacon valuation team at commencement of the mandate. In addition, companies that were marketed with an indicative asking price, sold on average within 10% of this mark.

In 2019, Beacon opened its first international affiliate office in Washington, D.C. to better serve clients with interest and operations in the U.S. market. Beacon also entered a strategic partnership with Prime Bank Investment Ltd., (“PBIL”) a leading South Asian investment bank. As part of this partnership, Beacon and PBIL will work together on M&A mandates and jointly serve clients across the Asian market. Both of these international expansion initiatives position Beacon as a truly global M&A advisory firm.

Canadian Lower Middle Market Outlook for 2020:

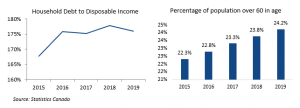

Canada has seen strong M&A activity in the lower middle market fueled by an aging population and early age retirement. Geo-political turbulence in the Middle East and the ongoing U.S. China trade war has diverted foreign direct investment to Canada. As a result, FDI in Canada hit $18.7 billion in the second quarter of 2019, its highest level in four years. This in combination with Canada’s transparent immigration policy continues to attract entrepreneurial professionals seeking to acquire mature businesses. These factors have created an optimal environment for a strong deal volume in the lower middle market in Canada. In 2019, 90% of the Canadian M&A activity by volume came from the lower middle market.

Beacon expects robust demand for M&A advisory services in 2020 as foreign direct investment continues to flow into Canada. In addition, a stable political environment and continued immigration will help sustain demand from new buyers. As Beacon continues to expand cross border activity in the United States and South Asia, the firm is well-positioned to attract various foreign buyers seeking to enter the Canadian market. As larger firms continue to consolidate in the wake of recessionary fears and a global economic slowdown, Beacon expects further consolidation and strategic acquisitions to be a key theme in 2020. A low-interest-rate environment and high dry powder reserve will generate additional tailwinds for the M&A industry. Despite this, Canada’s high debt to disposable income ratio and an increase in loan losses could lead to banks tightening lending and challenges in acquisition financing.

PR Department

Beacon Mergers & Acquisitions

+1 416-228-1200

email us here

Visit us on social media:

Facebook

Twitter

LinkedIn

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.