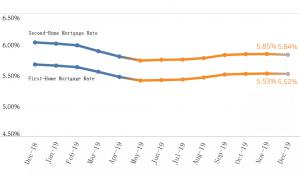

Mortgage Rate Stopped Increasing for Six Consecutive Months and Declined Slightly by 1 BP in December

Jianpu Technology (NYSE:JT)

BEIJING, CHINA, January 7, 2020 /EINPresswire.com/ -- On November 20, the five-year LPR, which is the reference for new mortgage interest, was declined for the first time, leading to a slight decrease of the mortgage rate nationwide after increasing for six consecutive months. The monitoring data released by Rong360 Jianpu Technology Inc. (NYSE:JT) Big Data Research Institute shows that the average mortgage rate for first-time homebuyers in 35 cities under monitoring was 5.52% in December 2019 (Data collected from November 20, 2019 to December 19, 2019), posting a decrease of 1 basis points (BP) on a month-on-month (MoM) basis. Specifically, 72 BP have been added above the five-year LPR. Additionally, the average mortgage rate for second-time homebuyers was 5.84% in December 2019, posting a decrease of 1BP's on a MoM basis. Specifically, 104 BP have been added above the five-year LPR.The average mortgage rate nationwide declined and then rose in the year of 2019. However, as shown in the graph above, the change in the second half of the year was significantly slighter than that in the first half of the year, which reflects that the recent operation of real estate regulatory policies and real estate market are both relatively stable.

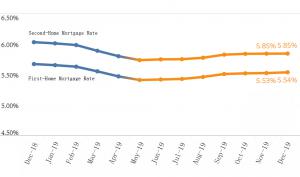

In order to reflect the nationwide mortgage rate more objectively, Rong360 Jianpu Technology Inc. (NYSE:JT) Big Data Research Institute includes Zhongshan city of Guangzhou province in key monitoring cities since December 2019. The number of joint-stock Banks in some monitoring cities are also increased and the sample size changed from 533 bank branches (sub-branches) in 35 cities to 613 bank branches (sub-branches) in 36 cities.

According to the monitoring data of the 613 bank branches (sub-branches), in December 2019, the average mortgage rate for first-time homebuyers was 5.54%. Specifically, 74 BP have been added above the five-year LPR. Additionally, the average mortgage rate for second-time homebuyers was 5.85%. Specifically, 105 BP have been added above the five-year LPR. This is mainly because the mortgage rate in the newly added Zhongshan city was relatively high and pulled up the national level on the whole.

Di Wang

Jianpu Technology

+86 10 8262 5755

email us here

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.