Fiscal Year (FY) 2019 Medicare Fee-For-Service Improper Payment Rate is Lowest Since 2010 while data points to concerns with Medicaid eligibility

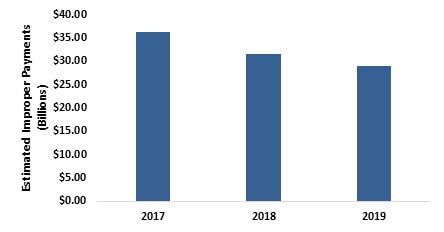

The Centers for Medicare & Medicaid Services (CMS) announced today that the Medicare Fee-For-Service (FFS) improper payment rate has fallen yet again, and is at its lowest level since FY 2010. Today’s announcement reinforces the Trump Administration and CMS’ commitment to strengthening Medicare and ensuring that tax dollars are spent appropriately. CMS’ aggressive program integrity measures lowered the estimated amount of Medicare fee-for-service (FFS) improper payments$7 billion from FY 2017-2019 to a total of $28.9 billion.

Medicare Fee-for-Service Estimated Improper Payments (in Billions) 2017-2019

In October, President Trump announced an Executive Order instructing CMS to undertake all appropriate efforts to detect and prevent fraud, waste and abuse and more aggressively ensure the integrity of the federal health care programs. Improper payments represent payments that don’t meet program requirements – intentional or otherwise –and contribute to inaccurate spending of Americans’ tax dollars.

“At a time when Medicare’s ballooning costs are threating the long-term sustainability of the program, President Trump is taking action to protect the program,” said Administrator Seema Verma. “Every dollar spent inappropriately is one that should have been used to benefit patients. Under President Trump’s leadership CMS is pulling every lever at its disposal to safeguard precious resources and direct them to those who truly need them – both today and in the future.”

Taxpayer Savings

The reduction in improper payments represent considerable savings for the American public. The Medicare FFS estimated improper payment rate decreased to 7.25 percent in FY 2019, from 8.12 percent in FY 2018, the third consecutive year the Medicare FFS improper payment rate has been below the 10 percent threshold for compliance established in the Improper Payments Elimination and Recovery Act of 2010. This year’s decrease was driven largely by progress in a number of important areas:

- Home health claims corrective actions, including policy clarification and Targeted Probe and Educate for home health agencies, resulted in a significant $5.32 billion decrease in estimated improper payments from FY 2016 to FY 2019.

- Other Medicare Part B services (e.g., physician office visits, ambulance services, lab tests, etc.) saw a $1.82 billion reduction in estimated improper payments in the last year due to clarification and simplification of documentation requirements for billing Medicare under our Patients Over Paperwork initiative.

- Durable Medical Equipment, Prosthetics, Orthotics, and Supplies improper payments decreased an estimated $1.29 billion from FY 2016 to FY 2019 due to various corrective actions implemented over the years.

Healthcare costs are skyrocketing; by 2026, one out of every five tax dollars will be spent on healthcare. To constrain costs, we have to ensure that payments are made according to the rules. Improper payments are not necessarily a measure of fraud. The term refers to government payments that do not meet statutory, regulatory, administrative, or other legally applicable requirements. Improper payments might be overpayments or underpayments, and may not necessarily represent expenses that should not have occurred at all.

CMS has developed a five-pillar program integrity strategy to modernize the Agency’s approach to reducing the improper payment rate while protecting its programs for future generations:

- Stop Bad Actors. We work with law enforcement agencies to crack down on “bad actors” who have defrauded federal health programs.

- Prevent Fraud. Rather than the expensive and inefficient “pay & chase” model, we are focused on preventing and eliminating fraud, waste and abuse on the front end and proactively strengthening vulnerabilities before they are exploited.

- Mitigate Emerging Programmatic Risks. We are exploring ways to identify and reduce program integrity risks related to value-based payment programs by looking to experts in the healthcare community for lessons learned and best practices.

- Reduce Provider Burden. We want to assist rather than punish providers who make good faith claim errors. To that end, we are we are reducing burden on providers by making coverage and payment rules more easily accessible to them, educating them in our programs, and reducing documentation requirements that are duplicative or unnecessary.

- Leverage New Technology. We are working to modernize our program integrity efforts by exploring innovative technologies like artificial intelligence and machine learning, which could allow the Medicare program to review compliance on more claims with less burden on providers and less cost to taxpayers.

“Our progress on improper payments is historic, but there’s more work to be done,” Administrator Verma said. “CMS has taken a multifaceted approach that includes provider enrollment and screening standards to keep bad actors out of the program, enforcement against bad actors, provider education on our rules and requirements, and advanced data analytics to stop improper payments before they happen. These initiatives strike an important balance between preventing improper payments and reducing the administrative burden on legitimate providers and suppliers.”

Results of First Cycle of States to Undergo New PERM Eligibility Component

As states were implementing new rules under the Affordable Care Act for determining eligibility for many beneficiaries — including using the Modified Adjusted Gross Income — the previous administration paused Payment Error Rate Measurement (PERM) eligibility reviews from FY 2014 to FY 2018. In 2017, the Trump administration took steps to restart these reviews so that beginning in FY 2019, CMS reintegrated the measurement of the eligibility component of the Medicaid and Children’s Health Insurance Program (CHIP) improper payment rates in the PERM program. Even prior to the completion of this review, CMS began conducting eligibility audits of state beneficiary eligibility determinations in states identified as high risk by previous OIG and state audit findings (beginning in California, New York, Kentucky, and Louisiana). These efforts will allow consistent insight into the accuracy of Medicaid and CHIP eligibility determinations and will shed light on vulnerabilities and the effectiveness of the agency’s work with the states on this issue.

The national improper payment estimates reported in FY 2019 are 14.9 percent, or $57.36 billion for Medicaid and 15.8 percent, or $2.74 billion for CHIP. The FY 2019 Medicaid and CHIP improper payment measurement includes the first of three cycles of 17 states (Cycle 1) reporting for the updated eligibility component. CMS expects to see a steady increase in eligibility vulnerabilities identified over the next two years once all three PERM cycles are measured under the updated eligibility component.

The increase in the PERM rates are driven by high levels of observed eligibility errors. Some of the most consistent findings included states maintaining insufficient documentation to substantiate that income and other information was appropriately verified, failures to conduct timely and appropriate annual redeterminations, and claiming beneficiaries under incorrect eligibility categories that provide a higher federal matching rate than was appropriate. Eligibility errors of this nature are particularly concerning as it can indicate that individuals are allowed to remain enrolled in the program during times in which they do not qualify, potentially diverting limited resources that could otherwise be invested in better serving vulnerable populations.

The agency is not waiting to take action. CMS is taking steps to ensure that states are working with their eligibility systems vendors to guarantee that every person on the program meets eligibility requirements and states maintain appropriate documentation of their verification process. This will continue work that began over a year ago as CMS initiated efforts to implement an aggressive Medicaid program integrity strategy designed to safeguard taxpayer dollars and ensure the sustainability of this critical program. These actions have included a recently proposed rule to enhance transparency and oversight of Medicaid spending and supplemental payments.

In addition, CMS has already released guidance on expectations for state eligibility practices, particularly for populations covered at enhanced federal match rates.

Furthermore, in remarks to the National Association of Medicaid Directors, Administrator Verma recently announced plans to overhaul eligibility rules to tighten the standards for eligibility verification and ensure that CMS and states have appropriate safeguards in place to ensure finite resources are going to those who need it most. CMS will propose new rules to tighten the standards for eligibility verification and ensure that CMS and states have appropriate safeguards in place.

For more information on the agency’s improper payments for Medicare, Medicaid and the Children’s Health Insurance Program (CHIP) can be found at CMS FACT SHEET.

To view the HHS Agency Financial Report, visit https://www.hhs.gov/about/agencies/asfr/finance/financial-policy-library/agency-financial-reports/index.html

For a copy of Administrator Verma’s recent comments on Medicaid program integrity efforts, please see https://www.cms.gov/blog/medicaid-program-integrity-shared-and-urgent-responsibility

For the Administrator’s November 12, 2019 speech at the National Association of Medicaid Directors conference, click here:https://www.cms.gov/newsroom/press-releases/cms-administrator-seema-vermas-speech-national-association-medicaid-directors-washington-dc

### Get CMS news at cms.gov/newsroom, sign up for CMS news via email and follow CMS on Twitter CMS Administrator @SeemaCMS, @CMSgov, and @CMSgovPress.

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.