Bioplastic Packaging -The Presence of Strict Regulations in Europe and North Americas is Boosting the Demand | Arizton

The Global Bioplastic Packaging Market to Reach Revenues of over $9.9 billion by 2024

CHICAGO, IL, UNITED STATES, October 31, 2019 /EINPresswire.com/ --

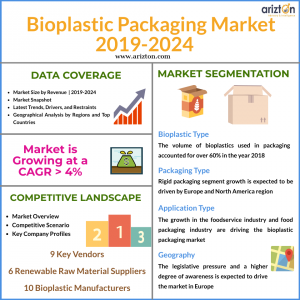

According to Arizton’s recent research report, Bioplastic Packaging Market - Global Outlook and Forecast 2019–2024 is expected to grow at a CAGR of over 4% during the forecast period.

Dwindling reserves of fossil resources, increase in rules and regulations, bioplastic for bulk packaging, and focus on sustainable packaging are the factors that are likely to contribute to the growth of the bioplastic packaging market during the forecast period.

The bioplastic packaging market growth is expected to be steady, with the supply side parameters affecting the industry cost structure more than the demand side. Europe is leading the market with the consumption of bioplastic being the highest in the region. The market is expected to be volume-driven, mainly on account of high range of products in the F&B sector, with each requiring a different packaging based on its contents and processing nature. In term of types, biobased and non-biodegradable bioplastic is expected to witness significant growth. The study considers the present scenario of the bioplastic packaging market and its market dynamics for the period 2018−2024. It covers a detailed overview of several market growth enablers, restraints, and trends.

Key Highlights Offered in the Report:

1. The decline in the availability of crude oil on account of high rates is expected to lead to a resource shortage situation for conventional plastics. Consequently, natural polymers and polymers from renewable resources stand out as an alternative to fossil fuel-based plastics.

2. Biodegradable plastic packaging requires efficient industrial composting facilities that are currently lacking across the regions. Hence, the impact of bioplastic packaging on litter reduction is minimal.

3. Starch-based bioplastics are expected to play a major role in the usage of bioplastic for bulk packaging. Since bulk packaging is used for many cycles until they are discarded or recycled, the price-performance ratio is comparatively better for bioplastic bulk packaging than bioplastic consumer packaging.

4. From the cost perspective, a Bio-PET bottle is more than 45% costlier than petroleum-based PET bottles. Also, the current preference among vendors is for non-food bio-based bioplastic suppliers rather than food-based feedstock suppliers as the cost difference between the two is over 30%.

5. The price of Bio-PET is more in the APAC region due to limited production capacities in the region, especially in China. Hence, there is a higher dependence on imports, which are priced at premium. The cost in Europe is comparatively lower, hence the procurement and the final product cost are low in the European region. (In 2017, the price of Bio-PET was less than €3/kg in Europe, while it was over $3/kg in APAC).

Key Offerings:

• Market Size & Forecast by Revenue | 2018−2024

• Market Dynamics – Leading trends, growth drivers, restraints, and investment opportunities

• Market Segmentation – A detailed analysis by packaging, type, application, and geography.

• Competitive Landscape – Profile of 9 vendors

Bioplastic Packaging Market: Segmentation

The biobased and non-biodegradable packaging segment has grown at a steady rate driven by the use of three types of polymers: Bio-polyethylene terephthalate, Bio-polyethylene, and Bio-polyamide. The demand for bio-polyamides is expected to increase during the forecast period as they are environment-friendly and provide a high barrier resistance to oxygen, carbon dioxide, and other similar gases. The price of Bio-polyethylene terephthalate is higher in the APAC region on account of limited production capacities in the region, especially China. Biodegradable bioplastic has a wide application in Europe than in other regions. The development of new materials such as polylactide, polyhydroxyalkanoates, and cellulose or starch-based material offers robust functionalities such as barrier properties, composability, and biodegradability. Hence, the production capacity of the biodegradable segment is expected to increase during the forecast period. However, the market is inhibited by the lack of scope for economies of scale.

With increased emphasis on the circular economy, the market is exploring several eco-friendly alternatives, both flexible and rigid types. The rise in beverage manufacturers is offering a major impetus to the application of bioplastic in rigid form. Europe and North America are the major markets on account of strict legislative emphasis. Currently, APAC is the regional leader in the conventional rigid plastic packing.

The F&B industry dominated the flexible packaging market in North America. The increase in quick-service restaurants and retail sectors has boosted the consumption of food items, thereby driving the sector. The US, along with China and India, is expected to drive the global flexible packaging market demand by the food industry during the forecast period. The growth of several F&B outlets such as QSR, coffee shops, ice cream shops, and full-service restaurants has provided new impetus to the industry.

The food industry is growing across the world. The industry has a wide variety of products that requires sustainable and health-friendly packaging – fresh food, dairy, meat, poultry, seafood, bakery to processed, and RTE food. All these types require different packing (monolayer, multi-layer, multi-material, foil-based, and paper-based). Hence, the rise in the food and beverage industry is a major factor responsible for the growth of the market. The personal care industry is growing rapidly, with a major focus on rigid packaging. The bioplastic demand for bottle and container-based personal care products is growing in the premium category of personal care products as customers can afford this type of packaging.

Other application areas include pharmaceuticals and foodservice. Films used in plastic packaging can be a combination of various film materials. The exploration of biobased and nonbiodegradable films in the pharmaceutical sector is a major driver for the growth of the segment. Bioplastic pouches are also expected to gain traction as they are largely single-use plastics.

Market Segmentation by Packaging

• Flexible

• Rigid

Market Segmentation by Type

• Biobased and Non-biodegradable

• Biodegradable

Market Segmentation by Application

• Food and Beverages

• Personal Care

• Other Application

Bioplastic Packaging Market by Geography

The packaging demand in Europe is expected to grow on account of EU directives and the changing industry and customer perception. The growth of stringent regulations and legislation is likely to push the procurement of bioplastic during the forecast period. However, one of the major drivers is the growing awareness of the use and purchase of sustainable practices to reduce harmful effects on the environment. Sustainable business emphasis is expected to have a major impact on the plastic industry as they are the latest stakeholders.

In North America, the shift to sustainable packaging due to the low recycling rate of plastic packaging is expected to gain traction during the forecast period as the commercial aspect of bioplastic is fine-tuned with disruptions in supply chain rectified. The market in the US is having a steady growth rate on account of ample support from government agencies and a robust supply chain of bioplastic. Fierce competition in the F&B and personal care industry has put more pressure on brands for differentiation, aiding the demand for sustainable packing.

The growing demand for environment-friendly products, increasing packaging volumes, and plastic waste control rules are expected to aid the growth in APAC. China is the largest market for bioplastic. China and Japan exhibit strong growth potential for bioplastic packaging polymers. The increased consumption of food and beverages is increasing the demand in the APAC region. However, the availability of low-cost alternatives in the form of fossil fuel-based plastics is a hindrance for the growth of the market in APAC.

Market Segmentation by Geography

• North America

o US

o Canada

• APAC

o Japan

o South Korea

o India

o China

o Australia

• Europe

o UK

o France

o Spain

o Germany

o Italy

• Latin America

o Chile

o Mexico

o Argentina

o Brazil

• MEA

o Turkey

o Saudi Arabia

o UAE

o Israel

Looking for more information? Order a sample here.

Key Vendors Analysis

A majority of vendors are small and medium-sized enterprises. The demand is not uniform, hence regional level vendors are higher in number than global vendors. Since bioplastic is the premium raw material, the cost often passes on to consumers. The scaling up options is also limited. The demand is not steady and is mostly infrequent, hence, the challenge for the vendors is to manage resources accordingly. The market is characterized by established conventional plastic vendors, providing packaging as a service. Many vendors are shifting to sustainable and biodegradable practices. Adherence to regulations limits the use of single-use plastics, thereby driving vendors to shift toward eco-friendly and sustainable methods. Vendors have launched bioplastic products in the flexible packaging sector, followed by the rigid segment. The trade issues between the US and China are expected to adversely affect the economy of APAC, leading to a negative impact on the bioplastic packaging market.

Key Vendors

• Amcor

• Clondalkin

• Coopbox Air

• Futamura

• Huhtamaki

• Sealed Air

• Sonoco

• Sphere

• Tagleef Industries

Renewable Raw Material Suppliers

• Cargill

• Corbion

• Reverdia

• Roquette

• Tereos

• Total

Bioplastic Manufacturers

• BASF

• Biotec

• Braskem

• DowDuPont

• Eastman Chemical Company

• Greendot

• Koninklijke DSM N.V

• NatureWorks

• Novamont

• Perstorp

Jessica

Arizton Advisory & Intelligence

+1 3122352040

email us here

Visit us on social media:

Facebook

Twitter

LinkedIn

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.