Rondure Funds Celebrates 2-Year Anniversary and Good Performance; Blake Clayton promoted to PM

The Rondure New World Fund and the Rondure Overseas Fund recently passed their 2-year anniversary delivering good absolute and relative performance.

Rondure Global Advisors also announces the promotion of Blake Clayton to the role of Portfolio Manager on the Rondure Overseas Fund alongside current Portfolio Manager Laura Geritz, CFA. The corresponding separately managed accounts will continue to be managed by Ms. Geritz, who broke off from Wasatch Advisors in 2016 to found Rondure Global as a boutique investment firm focused on global equity investing.

Blake Clayton, MA, MPhil, DPhil, joined Rondure Global Advisors in 2017 as a research analyst after working as a senior equity analyst at Citigroup in New York. Dr. Clayton was a fellow at the Council on Foreign Relations, where he advised senior U.S. officials on a broad range of economic issues. He holds a doctorate from Oxford University and also holds dual master’s degrees from the Cambridge University and the University of Chicago. Dr. Clayton is the author of two books, Commodity Markets and the Global Economy and Market Madness: A Century of Oil Panics, Crises, and Crashes.

Reflecting on the past two years, CEO Laura Geritz shared, “High-Quality and Discipline are our hallmarks at Rondure. We launched into strong momentum markets where we tend to lag, but we had patience and discipline with our process, which is what our clients deserve, and are very pleased to see successful results. We are tremendously grateful to our clients who have invested alongside us and are excited about the future of the firm.” Regarding Blake’s promotion, Laura commented, “Blake has been an invaluable addition to the research team, demonstrating leadership and a keen ability to identify Quality Compounders that meet our CGP (Club, Glue, Platform) framework, which he helped formulate. We appreciate his great contribution and know he will continue to serve our clients well in this new role.”

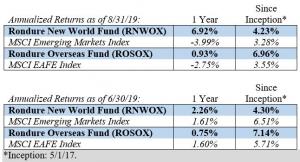

Annualized Returns as of 8/31/19. 1 Year & Since Inception*

Rondure New World Fund (RNWOX): 6.92% & 4.23%

MSCI Emerging Markets Index: -3.99% & 3.28%

Rondure Overseas Fund (ROSOX): 0.93% & 6.96%

MSCI EAFE Index: -2.75% & 3.55%

Annualized Returns as of 6/30/19. 1 Year & Since Inception*

Rondure New World Fund (RNWOX): 2.26% & 4.30%

MSCI Emerging Markets Index: 1.61% & 6.51%

Rondure Overseas Fund (ROSOX): 0.75% & 7.14%

MSCI EAFE Index: 1.60% & 5.71%

*Inception: 5/1/17

Performance data quoted represents past performance. Past performance is no guarantee of future results and investment returns and principal value of the Fund will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance quoted. For the most current month-end performance data please visit www.rondureglobal.com.

The Advisor has contractually agreed to waive and/or reimburse fees or expenses through at least August 31, 2020.

Rondure Funds will deduct a 2.00% redemption fee on Fund shares held 60 days or less. Performance data does not reflect the deduction of fees, including sales charges, or the taxes you would pay on fund distributions or the redemption of fund shares. Fees and taxes, if reflected, would reduce the performance quoted. For more complete information including charges, risks and expenses, read the prospectus carefully.

Diversification does not eliminate the risk of experiencing investment loss.

Total Gross Expense Ratios as of 8/31/19 are 1.76% Gross / 1.35% Net for RNWOX, 1.46% Gross / 1.10% Net for RNWIX, 2.04% Gross / 1.10% Net for ROSOX, and 1.72% Gross / 0.85% Net for ROSIX.

About Rondure Global Advisors:

Rondure Global Advisors® is a woman-owned investment adviser focused on High-Quality equity investing for the long-term. Rondure takes a bottom-up approach using disciplined global screening, rigorous “boots on the ground” company research, and close attention to valuation to find what we believe to be the best investment opportunities, anywhere in the world. Our global perspective is index-agnostic and our style is all-cap. Our investment philosophy is centered on investing in what we believe are very high-quality companies at good to great prices that we believe can provide sustainable growth over the long-term. We are deeply client-focused and actively cost-conscious because we are heavily invested alongside our clients for the long haul.

###

The objective of both the Rondure New World Fund and Rondure Overseas Fund is long-term growth of capital.

RISKS: Mutual fund investing involves risks and loss of principal is possible. Investing in foreign securities entails special risks, such as currency fluctuations and political uncertainties, which are described in more detail in the prospectus. Investments in emerging markets are subject to the same risks as other foreign securities and may be subject to greater risks than investments in foreign countries with more established economies and securities markets.

An investor should consider investment objectives, risks, charges, and expenses carefully before investing. To obtain a Rondure Funds prospectus, containing this and other information, visit www.rondureglobal.com or call 1-855-775-3337. Please read it carefully before investing.

Wasatch Advisors is not affiliated with Rondure Global Advisors or Grandeur Peak Global Advisors.

Rondure Global Advisors, Grandeur Peak Global Advisors, and Wasatch Advisors are not affiliated with ALPS Distributors, Inc.

Rondure Global Funds and Grandeur Peak Funds are distributed by ALPS Distributors, Inc. (“ADI”). Crystal Gourley is a registered representative of ADI.

RON000262 9/10/2020

Crystal Gourley

Rondure Global Advisors

+1 801-736-8555

email us here

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.