China Is Accelerating Phosphate Production, TBRC Report Shows

LONDON, GREATER LONDON, UK, February 6, 2019 /EINPresswire.com/ -- There has been a rapid increase in the production and export of phosphates from China, Chemical Fertilizers Global Market Opportunities And Strategies To 2022 from The Business Research Company shows. In the past, there was a limited supply of phosphate rock due to limited production capacity and monopolistic pricing in most countries, but there has been a rapid increase in phosphate production in China. For example, in 2014, the world trade in diammonium phosphate and monoammonium phosphate was estimated to be around 24 million metric tonnes, of which China provided 8 million tonnes. This is significant given that ten years ago, Chinese exports were close to zero. In 2016, China produced 17,295.7 thousand metric tonnes of phosphate fertilizer, and the consumption was 11,857.6 thousand metric tonnes. The imports of phosphate fertilizers into China were 198.6 thousand metric tonnes, and the exports from China were 4,714.2 thousand metric tonnes.

Download a sample of the report at https://www.thebusinessresearchcompany.com/sample.aspx?id=1826&type=smp

China has large amounts of reserves of the three main components for fertilizers manufacturing: phosphate, natural gas and potash. China has a significant capacity for producing nitrogen and phosphate fertilizers. The country is self-sufficient in these two fertilizers; it also exports them to other countries. As of 2017, China’s phosphate reserves were estimated at 3.1 billion metric tonnes.

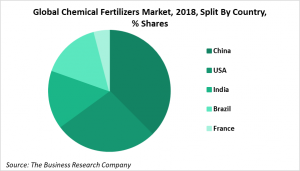

China was the largest consuming country in the global chemical fertilizers market in 2018, accounting for over 22% of the market, followed by the USA at around 16% of the global total. The market in China is mainly supported by the high average application rate of fertilizers per hectare, 368.5 kg larger than the global average, the high level of food production in the country (being the largest in the world, especially for tea and rice), and wide cultivation of fibers such as cotton for exports.

Chemical fertilizers are a segment of the chemicals market. The chemical fertilizers market can be further segmented by nutrient into nitrogenous fertilizers, phosphate fertilizers and potash fertilizers. Phosphate fertilizers manufacturers produce phosphate fertilizers materials and other phosphate materials and mix them into fertilizers. Ammonium phosphate, defluorinated phosphate, and di-ammonium phosphate are examples of the phosphate fertilizers segment. The global phosphate fertilizers market is expected to grow at a compound annual growth rate (CAGR) of more than 3.5% in 2022.

Chemical Fertilizers Global Market Opportunities And Strategies To 2022 is one of a series of new reports from The Business Research Company that identify opportunities and explain strategies, provide a market overview, analyse and forecast market size and growth, market trends, drivers, restraints, and leading competitors’ revenues, profiles and market shares in over 300 industry reports, covering over 2400 market segments and 56 geographies. The market reports draw on 150,000 datasets, extensive secondary research, exclusive insights and quotations from interviews with industry leaders. Market analysis and forecasts are provided by a highly experienced and expert team of analysts and modellers.

Where To Learn More

Read the Chemical Fertilizers Global Market Opportunities And Strategies To 2022 from The Business Research Company for information on the following:

Markets Covered: Global chemicals market, fertilizer market; nitrogenous fertilizers market, phosphate fertilizers, potash fertilizers market; cereals fertilizers, oilseeds fertilizers, fruits fertilizers, vegetables fertilizers market; broadcasting fertilizers, drop spreading/placement fertilizers, fertigation fertilizers, foliar spray fertilizers market.

Fertilizer Companies Covered: Nutrien Ltd, Yara International, The Mosaic Company, CF Industries Holdings Inc., Israel Chemicals Ltd.

Regions: North America, Asia Pacific, Western Europe, South America, Eastern Europe, Middle East, Africa.

Countries: USA, China, Japan, Germany, Brazil, France, Italy, UK, Australia, India, Spain, Russia.

Time Series: Five years historic (2014-18) and forecast (2018-22).

Data: Global chemical fertilizers market size and growth, 7 regions and 12 countries; global chemical fertilizers market historic and forecast growth rates, segmentation by type of nutrient, 2014 – 2018, volume (thousand tonnes), fertilizers use by crop category, 2014 – 2018, volume (thousand tonnes), fertilizers use by method of application, 2014 – 2018, volume (thousand tonnes); company profiles and financial performance 2013-21 for Nutrien Ltd, Yara International, The Mosaic Company, CF Industries Holdings Inc., Israel Chemicals Ltd.

Global chemicals market size and growth rates 2013-17 and 2017-21.

Other Information: Global chemical fertilizers market regional and country analysis, customer information, market comparison with macro-economic factors, chemical fertilizers market size as a percentage of GDP, per capita average chemical fertilizers expenditure, global and by country; market opportunity assessment, PESTEL analysis, drivers and restraints, trends, opportunities and strategies, key mergers and acquisitions, fertilizer market by country covering regulatory bodies, associations, investments, and competitive landscape.

Strategies For Fertilizer Producers: The report identifies over 22 strategies for fertilizer producers including those being pursued by companies in the fertilizer market and those suggested by trends in the market. Strategies described include EuroChem Inc.’s strategy of expanding its distribution network to gain access to important markets by acquisitions such as that of its purchase of a 100% interest in Agricola Bulgaria, Bulgaria’s leading fertilizer Distribution Company, and Yara International’s strategy of strengthening its R&D department to improve its product offerings.

Key Opportunities In the Fertilizer Market: The report reveals where the global chemical fertilizer industry will put on most $ sales up to 2022.

Sourcing and Referencing: Data and analysis throughout the report are sourced using end notes.

Number of Figures: 91

Number of Tables: 155

Interested to know more? Here is a list of reports from The Business Research Company similar to Chemical Fertilizers Global Market Opportunities And Strategies To 2022(https://www.thebusinessresearchcompany.com/report/chemical-fertilizers-market):

Chemicals By End Use Global Market Report 2019(https://www.thebusinessresearchcompany.com/report/chemicals-by-end-use-global-market-report)

Global Industrial Gas Market, Opportunities And Strategies To 2021(https://www.thebusinessresearchcompany.com/report/industrial-gas-global-market-opportunities-and-strategies-to-2021)

Oliver Guirdham

The Business Research Company

+44 20 7193 0708

email us here

Visit us on social media:

Facebook

Twitter

LinkedIn

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.