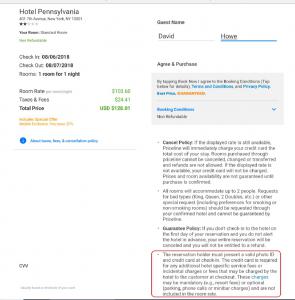

US Credit Czar David Howe Reports Priceline and Hotel Pennsylvania to Federal Government

Federal UDAAP violation conspicuous at New York City landmark hotel following Priceline booking

The undisclosed and predatory fee is considered by the United States Federal Trade Commission as an ‘UDAAP’ because it is patently ‘unfair and deceptive’ in nature when not conspicuously disclosed at the point of sale.

See UDAAP: https://www.cfpaguide.com/portalresource/Exam%20Manual%20v%202%20-%20UDAAP.pdf

“It’s remarkable that we live in a society that tolerates what I call ‘sanctioned theft’,” remarked David Howe, USA Credit Czar, America’s child identity guardian, and founder of SubscriberWise. “The idea that the Hotel Pennsylvania, and hotels anywhere in the USA for that matter, can so brazenly misrepresent the price of a room is an outrage in a world where computer technology could easily itemize these otherwise hidden and predatory fees.

“But concealing the full price is exactly – and literally – what the hotel industry is banking on,” conceded Howe.

“In other words, there’s simply no reason that US and state regulators turn a blind eye to these unfair and deceptive practices. The notion that a 3rd party offering a hotel property to its members is somehow unable to disclose a complete and accurate accounting of daily mandatory hotels fees is wholly ridiculous.

“As for Priceline’s role in these predatory money schemes, it appears that the organization is not directly responsible when the hotel fails to display the true cost of a room. However, it’s my strong position that Priceline -- and other 3rd-party aggregators -- should immediately and permanently remove any hotel from its list of published properties if the fees are not fully and conspicuously itemized.

Related Washington Post Story: https://www.washingtonpost.com/lifestyle/travel/hotel-resort-fees-hidden-charges-bemoaned-by-travelers-are-climbing-higher-than-ever/2017/07/20/a56256d0-68b1-11e7-a1d7-9a32c91c6f40_story.html?noredirect=on&utm_term=.f6b1b1752fae

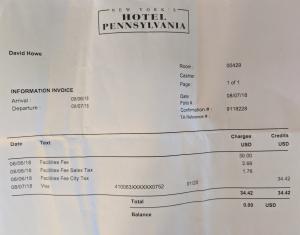

“For the record, I spoke with ‘Dave’ in the accounting department at the Hotel Pennsylvania today. I also spoke to ‘Iris’ at Priceline. Each told me the same thing. They both said I’d need to dispute with the other party. And I did exactly that and accomplished nothing but excuses for this obvious predatory practice of deceiving consumers.

“The only advice that was consistent from each: READ THE FINE PRINT,” Howe quipped.

“In fact, Dave told me it was my responsibility to read the fine print,” continued Howe. “Iris justified the fee by reading Priceline's fine print, which was apparently contained on the final booking page – where, of course, the actual fee and total amount was not: ‘Hotel charges may be mandatory (e.g., resort fees) or optional (parking, phone calls or minibar charges) and are not included in the room rate’. My question to both: ‘What if the fee happened to be $500.00 or $5000.00 per day! Shouldn’t a customer know this information…?’

“Apparently, since neither could answer my question, it’s okay if the heist is something more modest, for example $50.00 or less,” Howe added. “My guess is once the hidden fee reaches the $100.00 mark, then consumers – and no doubt complicit lawmakers – will finally demand an end to this shameful business scam.

“Yes, it’s just another way that consumers are fleeced by dishonest and predatory businesses engaged in ‘DRIP’ pricing and federal ‘UDAAP’ violations,” the Credit Czar concluded. “I sincerely hope one day consumers will wise up to the harms of deregulation. I sincerely hope one day consumers will respond to these predatory practices with a unified voice at the ballot box.”

About SubscriberWise

By incorporating years of communications performance data and decision models, including FICO's latest analytic technology (FICO 9 Score), SubscriberWise® delivers unprecedented predictive power with a fully compliant, score driven decision management system. SubscriberWise is a risk management preferred-solutions provider for the National Cable Television Cooperative (www.nctconline.org). The NCTC helps nearly 1000 members nationwide.

SubscriberWise is a U.S.A. federally registered trademark of the SubscriberWise Limited Liability Co.

Media Relations

SubscriberWise

330-880-4848 x137

email us here

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.