US Data Center Construction Market - Industry Analysis, Trends, Market Size, Major Vendors & Forecast 2023 | Arizton

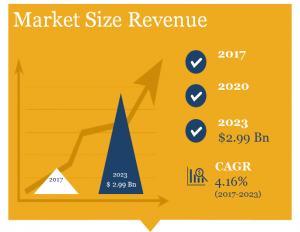

The data center construction market in US is projected to generate revenues of approx $3 billion by 2023.

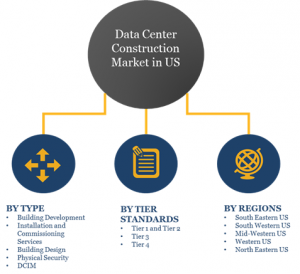

CHICAGO, IL, UNITED STATES, March 6, 2018 /EINPresswire.com/ -- Arizton’s recent market research report on the data center construction market in US identifies Turner Construction, Holder Construction, DPR Construction, Jacobs Engineering Group, Corgan, AECOM, Syska Hennessy Group, ABB, Assa Abloy, Bosch Security Systems (Robert Bosch), Honeywell International, Nlyte Software, Schneider Electric, Siemens, SimplexGrinnell (Tyco International), Sunbird Software, and Vertiv as the leading vendors that are likely to dominate the market during the forecast period. This research report provides detailed analysis of market segmentation by type (building development, installation and commissioning services, building design, physical security, and DCIM), by tier standards (Tier 1 and Tier 2, Tier 3, and Tier 4), by regions (South Eastern US, South Western US, Mid-Western US, Western US, and North Eastern US).

The data center construction market in US is expected to reach values of around $3 billion by 2023 and is projected to grow at a CAGR of more than 4% during the forecast period.

Request for free sample for more information.

The increasing demand for the facilities at the edge is augmenting the development of the data center construction market in US. The exponential growth of connected devices across business and consumer segments and demand high bandwidth internet across rural areas promote the development of edge data centers in the US market. The initiation of smart cities that require facilities close to customer locations will create lucrative opportunities for local and global vendors in the US market. Players such as vXchnge, EdgeConneX, and 365 Data Centers are some of the key edge-developers in the market. Furthermore, the rapid deployment of modular, containerized, performance optimized data center (POD) facilities will gain predominance in the US market over the next few years.

Data Center Construction Market in US – By Type

Greenfield data center developments spanning acres in land space will aid in the growth of the market during the forecast period

The data center construction market in US by type is classified into building development, installation and commissioning services, building design, physical security, and DCIM. Building development dominated the majority of the market share in 2017 and is anticipated to grow at a CAGR of approximately 3% during the forecast period. Building development in the construction market is categorized into greenfield and brownfield development. The establishment of modern facilities that are built to withstand earthquakes and floods is boosting the growth of this segment in the US market. The installation of renewable energy sources such as wind and solar energy for partial or complete power operations in greenfield data center development will revolutionize the data center construction market in the US.

Data Center Construction Market in US – By Tier Standards

LEED and the Uptime Institute certification to help operators attract new consumers in the data center construction market in US

The tier standards segment in the data center construction market is divided into Tier 1 and Tier 2, Tier 3, and Tier 4. Tier 3 standard dominated the market share in 2017 and is expected to grow at a CAGR of more than 5% during the forecast period. The growing requirement for sustainable designs to reduce power consumption and carbon emission of facilities is boosting the demand in this market segment in the US. The data center operators are focusing on obtaining certification from Uptime Institute, LEED and BICSI to attract new consumers and gain a larger market share. . Vendors are also focusing on adding flexibility and reducing complexity in the installation and commissioning services process to aid data center operators to react quickly to the growing demand for their services in the US market.

Data Center Construction Market in US – By Regions

South Eastern and South Western region will continue to add more revenue to the data center construction market in US

The data center construction market in US by region is segmented into South Eastern US, South Western US, Mid-Western US, Western US, and North Eastern US. South Eastern US region to dominate the market share in 2017 and is projected to grow at a CAGR of over 4% during the forecast period. Major investment projects by key vendors such as Facebook, Carolina, Digital Realty, CyrusOne and RangingWire in Virginia will propel the expansion of the data center market in the region. The availability of cheap power, strong fiber connectivity, low taxes, and tax incentives are some of the factors propelling the growth of the market in US. The growing demand for edge data center facilities in secondary data center market such as North Carolina, South Carolina, and Tennessee will also augment the growth of this region in the US market during the forecast period.

For detailed market insights, order a report now.

Key Vendor Analysis

The data center construction market in US is highly competitive, and the leading vendors are focusing on launching innovative solutions to sustain the competition in the market. The new development projects will offer lucrative revenue opportunities for local construction contractors, sub-contracts, installation and commissioning service providers, and architectural firms in the US market. The DCIM software will help operators reduce power consumption and carbon emissions to attract new consumers and gain a larger market share in the US. The deployment of modular data centers and brownfield construction will help players expand in untapped regions in the US market.

The major vendors in the data center construction market in US are:

Construction Contractors

Turner Construction

Holder Construction

DPR Construction

Jacobs Engineering Group

Corgan

AECOM

Syska Hennessy Group

Physical Security and DCIM Providers

ABB

Assa Abloy

Bosch Security Systems (Robert Bosch)

Honeywell International

Nlyte Software

Schneider Electric

Siemens

SimplexGrinnell (Tyco International)

Sunbird Software

Vertiv

Other prominent vendors include Clune Construction, Fluor Corp., FM Engineering, Fortis Construction, Gensler, Gilabne Building Co., HDR, Hensel Phelps, HITT Contracting, Hoffman Construction, JE Dunn Construction, Morrison Hershfield, Mortenson Construction, Structure Tone, Whiting-Turner Contracting Co., Allegion, Axis Communication, Cisco, Cormant, Digitus-Biometrics, Eaton, EMKA Group, FNT, Geist: Environet, Hangzhou Hikvision Digital Technology, Intel DCM, Modius, Optimum Path: Visual Data Center, Panduit, Rackwise, and Vigilent.

For more details click here:https://www.arizton.com/market-reports/data-center-construction-market-us

Jessica Shirley

Arizton Advisory and Inteligence

+1-312-465-7864

email us here

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.