Mining expert Jay Taylor of Hard Money Advisors bullish on MacDonald Mines’ gold and silver project

Bulk Sampling has been initiated at property uniquely positioned proximal Argonaut's >6Moz Gold property and Richmont's >1Moz Gold Island Gold Mine.

MacDonald Mines Exploration Ltd. (TSX:BMK)

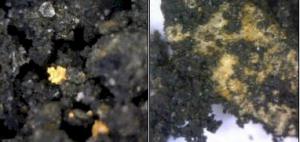

NEW YORK, NY, UNITED STATES, May 1, 2017 /EINPresswire.com/ -- Market Equities Research Group is responsible for the content of this release. MacDonald Mines Exploration Ltd. (TSX-V: BMK) (US Listing: MCDMF) (Frankfurt: 3M72) has commenced a bulk sampling program this Spring-2017 at its Wawa-Holdsworth Gold and Silver Project in Ontario. Market Equities Research Group projects ~80,000 oz Gold equivalent (non NI 43-101) in the Oxide Sands alone that can conceivably be tapped/mined to help cash-flow MacDonald Mines to prove up the bigger gold and silver picture on the property. The gold-bearing oxide sand zones now being quantified appear to offer a quick pathway to production (e.g. 3.45 g/t gold and 29.99 g/t silver ave. grade from a composite of 23 panels). Important to note is that neither aggregate licencing nor bulk sampling permissions will be required for the extraction of the oxide sands on the Wawa-Holdsworth Project. The aforementioned ‘bigger picture’ is exemplified in the lode gold in traditional quartz veins and showings already found on the property (e.g. the Soocana Vein system has revealed 16 g/t gold over 4.3 m, and 6.9 g/t gold over 15.8 m).

MacDonald Mines Exploration Ltd. is the subject of a report by Analyst Jay Taylor of Hard Money Advisors in which he initiated coverage. At BMK.V’s current trading price the Company’s market cap is minuscule compared to its potential. Mr. Taylor states: "If you are interested in exploration plays, with so many promising targets established in the past, it's difficult to not get excited about this company's prospects. Management bases its decisions on its strong scientific and technical competence and experience using in-house expertise in geophysical modeling tools. This is a real deal and one that virtually no one is aware of."

Excerpt of Jay Taylor's ‘The Bottom Line’ section of the advisory; “…For sure it's still early days for the company's Wawa-Holdsworth Project, but the good news is that it is a story not yet told. With some good news expected over the summer these shares should trade at much higher levels when the Bay Street boys and girls start to focus on this story. I view BMK as a very attractive speculation if purchased at its current price. While it is impossible to predict future share prices, with near-term positive news regarding a saleable gold-silver concentrate and various strong assay reports from both the sands and hard-rock targets over the summer, a move several fold above the current price of US$0.15 is certainly with the realm of possible outcomes."

Full copy of Mr. Taylor's advisory may be viewed at http://www.sectornewswire.com/bmk-JTaylor-20170421.pdf online.

The following additional research links have been identified for further DD on MacDonald Mines Exploration Ltd.:

MacDonald Mines' corporate website:

http://www.macdonaldmines.com

SEDAR Filings for MacDonald Mines:

http://sedar.com/DisplayProfile.do?lang=EN&issuerType=03&issuerNo=00004560

Recent Mining Journal review of MacDonald Mines: http://miningmarketwatch.net/bmk.htm

This release may contain forward-looking statements regarding future events that involve risk and uncertainties. Readers are cautioned that these forward-looking statements are only predictions and may differ materially from actual events or results. Articles, excerpts, commentary and reviews herein are for information purposes and are not solicitations to buy or sell any of the securities mentioned.

Fredrick William

Market Equities Research Group

8666209945

email us here

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.